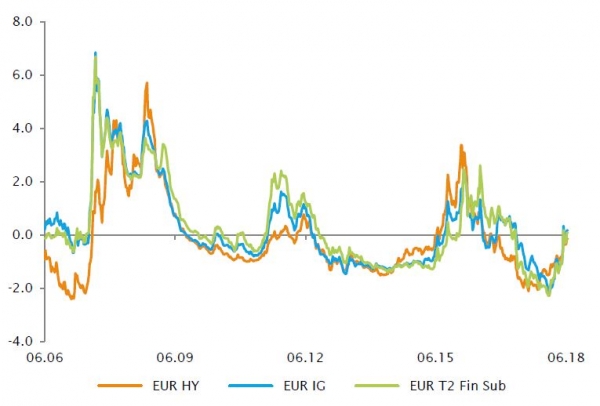

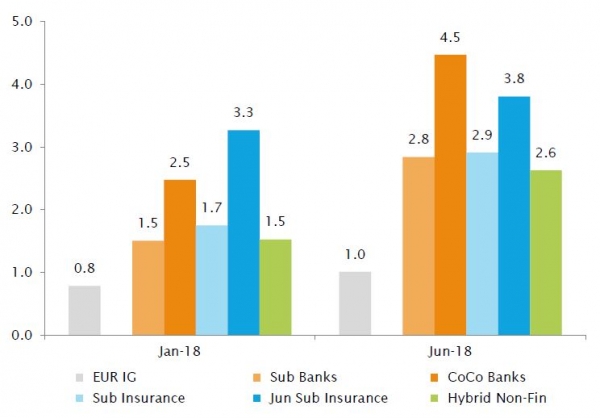

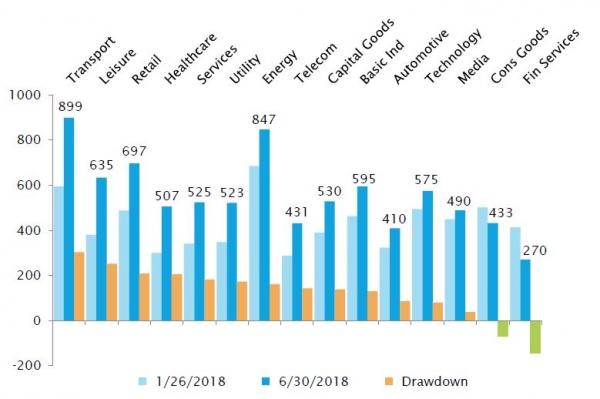

After an impressive start of the year, with spreads reaching multi-years lows on all market segments, credit markets have been impacted by a shift in monetary policy expectations. Indeed, strong economic performances led markets to expect tighter monetary policies from both the Fed and the ECB. The rise in rates impacted all risky assets, but the tight valuations of the credit markets accelerated sales on the asset class, especially on high beta segments like High Yield and Subordinated instruments.

As of today the risk of unexpected hawkish shocks is very low, as the Fed hiking cycle is already priced in and Draghi’s led ECB reaffirmed its very cautious and supportive stance. Risk free rates may rise, but this should just be a reversal of the flight to quality experienced so far, and with limited impact on risky assets valuations. Indeed, both spreads level and short-term volatility are now above their three years averages and compared with the past, the magnitude of this year widening is in line with post-2008 episodes of market corrections. We believe that valuations have certainly improved, even though not yet on cheap territory, and the risk of a disordered market reaction has dramatically diminished which creates a more attractive European credit market environment.