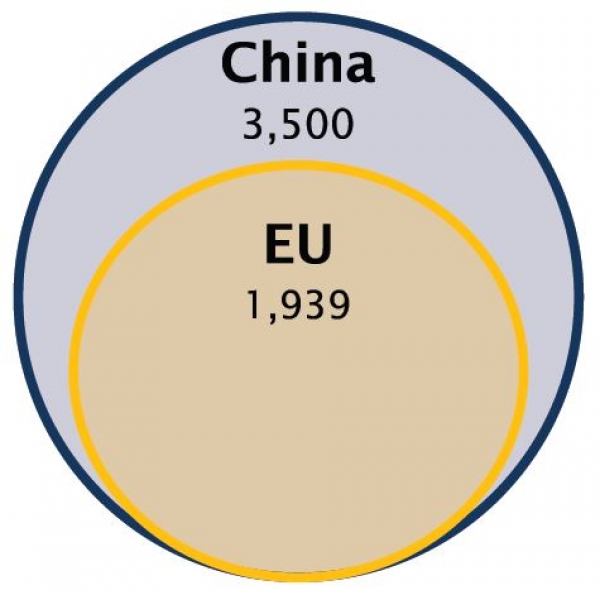

A clear illustration of this dynamic is China. The country may not be the first name that comes to mind when thinking of environmental virtues. Images of heavily polluted mega cities are frequently shared on social media, as are the feelings of anger and frustration of their inhabitants. But the Communist Party is taking the threat seriously: it is estimated that 40% of all factories in the country have been closed at least temporarily over the recent years to be inspected which led to 80,000 factories being prosecuted or fined by the environmental bureau (Forbes, China Shuts Down Tens of Thousands of Factories in Widespread Pollution Crackdown, 24.10.2017). Yet, the most promising achievement so far has been a government pledge to cut its emissions of hazardous particles by 25% by 2035 compared to 2016 and the creation of an Emission Trading System (ETS) for companies in the power sector.

ESG, no more a question of “IF” or “WHEN”, but “HOW”

Friday, 04/27/2018Carbon is a particularly important indicator in the global Environmental, Social and Governmental (ESG) framework: it is a widely scrutinized indicator by regulators and appears to be linked to performance in many industries. In addition, it can be reliably estimated and is not prone to manipulation unlike many other ESG factors. Scrutinizing a company’s carbon footprints before initiating a position may therefore not only be worthy for ‘mother earth’, but also sound from a performance and risk point of view.

“As both society and regulators have become increasingly sensitive to ESG issues, many investors feel or indeed are compelled to increase their scrutiny of these issues. From a pure investment standpoint, we would also argue that it is not a matter of conscience anymore, but a need to preserve the value of investments in the face of rapidly rising potential liabilities linked to ESG matters.”

China is thus a good example of the tectonic change under way: in just a few years, pollution went from being seen as an accepted by-product of growth and economic development to a major problem that must be tackled urgently.

Mitigating the ESG Risk

The last decade was filed with company controversies regarding ESG concerns. Volkswagen is a well-known example which embraces both environmental and governmental issues, but it was dwarfed by BP’s Gulf of Mexico disaster in 2010, which cost the company a record amount of $65bn in compensations alone.

The potential pitfalls faced by companies are diverse depending on the type of business. An obvious intangible risk lies with governance, as fraud can lead a company to bankruptcy, or at least to a transitory loss in confidence. Enron was an extreme example, with executives hiding billions of dollars of debt by purposely cooking the books and finally pushing the company into bankruptcy.

Whatever the nature of the risk, both society and regulators have become increasingly sensitive to ESG issues, forcing investors into increasing their awareness irrespective of their own beliefs. It is not a matter of conscience anymore, but a need to preserve the value of investments in the face of rapidly rising potential liabilities.

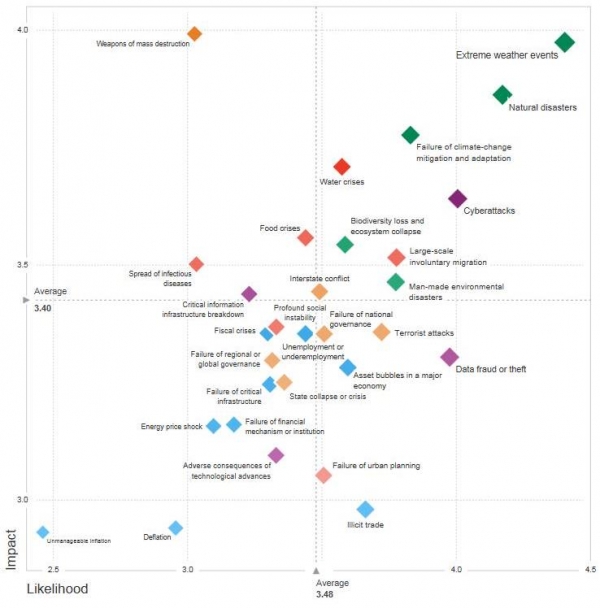

Here is where carbon comes to the forefront. As highlighted by a survey of more than seven hundred specialists sponsored by the World Economic Forum (WEF), extreme weather events and natural disasters were both ranked as top 5 risks in terms of both likelihood and impact on businesses (World Economic Forum, The Global Risk Report 2018, 2018).

In the case of pollution and of carbon in particular, the costs are twofold: they can be direct – linked to regulation for example, or indirect due to a loss in value of assets. The ETS mechanism falls in the first category, as it tries to capture the cost of carbon externalities and to let market forces assessing a fair price. It is based on the "cap and trade" principle: an overall volume of Greenhouse Gas (GHG) is defined and companies can trade emission allowances based on their own emissions. Typically companies have to submit one emission permit per metric ton of carbon discharged or pay a fine (European Commission, The EU Emissions Trading Systems (EU ETS), 2016). Cape Town’s current drought belongs to the second category. The city’s reservoirs are nearly empty which has a direct impact on the wine production, a relatively important part of the country export industry, which is down by 20% (CNBC, Cape Town is running out of water, and no one knows what economic impact that will have, March 2018). Michael Bloomberg, the UN special Envoy for Climate Action, cautioned that this event should act as a wake-up call on climate change.

The importance of carbon emissions

ESG criteria may be a key to capture business sustainability, but their inclusion into an investment process is not as straightforward as it may sound. Despite the increasing disclosure by companies of non-financial data, there is still a large part of the universe where information remains barely available. To make things worse, even when the information is available, its quality is often low and prone to management’s subjectivity, if not manipulation.

A further problem is the distinction between qualitative and quantitative data. The inclination toward greenwashing (i.e. promoting an ESG friendly vision of a company via amplified marketing without implementing actual practices) is especially high at large companies as they are able to produce a hefty amount of policies and objectives regardless of their real efforts. An evidence of the greenwashing phenomenon can be found in the data reported: according to Goldman Sachs, the companies in the MSCI ACWI disclose on average more binary data related to policies than performance data related to policies (54.9% vs. 11.6%) (Goldman Sachs, The PM’s Guide to the ESG Revolution, 2017).

This can lead to facetious situations where a company may achieve a very good overall ESG score while being exposed to severe controversy. For instance, Marathon Petroleum scores highly on most ESG ratings (Conser ESG Consensus®), but is subject to a high level of controversy. As a matter of fact, as underlined by Norway’s largest life insurance company, KLP, Marathon owns 9.2% of the Dakota Access Pipeline. The controversy around the project has focused on the question of tribal sovereignty and the risk of water contamination. KLP has taken the decision to exclude the company based on "unacceptable risk of contributing to serious or systematic human rights violations" (KLP, Decision to exclude Energy Transfer Partners, Phillips 66, Enbridge Inc., and Marathon Petroleum Corporation, March 2017).

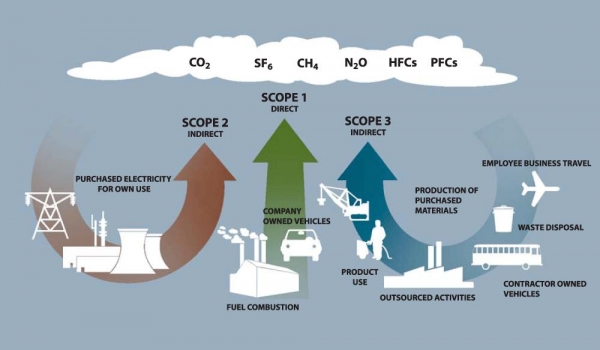

For all the above reasons, taking GHG emissions into account brings a double advantage. First, they are difficult to manipulate since they are either reported by the companies through the audited Carbon Disclosure Project (CDP) framework or estimated by experts such as Trucost, a Standard & Poors subsidiary. Secondly, analysing the full carbon footprint also tackles the issue of free riders and "fabless" companies by taking into account not only the company’s own emissions but also those of their whole supply chain (Called Scope 1, 2 and 3 (Scope 1 covers a company’s own asset emissions, Scope 2 covers company use of electricity, heat etc. and Scope 3 embraces the company’s whole supply chain from suppliers to clients)).

Where opportunities lie

The demand for investments embracing ESG factors is gaining traction across Europe with individuals and institutional investors increasingly abiding either by conviction… or by obligation. An example of the latter lies in the French article 173, as it requires institutional investors to disclose how ESG criteria and carbon-related concerns are taken into account in their investment policies.

From an investor’s point of view, opportunities linked to carbon avoidance exist, as various companies engage in the provision of clean energy or address environment linked issues. But limiting your scope to those companies dramatically shrinks your investment universe and thus not only reduces the potential for performance but also increases concentration and thematic risks. A better starting point would be to keep an investment universe as wide as possible by initially excluding only the worst offenders, and then pick the best available companies in each industry. Take the example of Excel Energy, an US electricity producer that is fast transforming itself from a fossil fuel generation toward a renewable one. The company would probably be excluded within a strict carbon avoidance process, but it is actually a virtuous player with strong potential for earnings growth.

Furthermore, a very important question remains to be answered with ESG in general: can it create performance? While many contradictory studies highlight the difficulty of assessing the impact of "soft" data, the Carbon Discloser Project finds a direct link between engaging in emission reductions and performance in a study led by PWC (PWC, CDP Global 500 Report 2011, Accelerating Low Carbon Growth, 2011). Over a period ranging from 2005 to 2011, it was found that companies which fully integrated climate change into their strategy substantially outperformed the broader market. Goldman Sachs, in a 2017 note regarding the use of ESG data by PMs, analysed various metrics to determine which one could be a reliable source of alpha generation (Goldman Sachs, The PM’s Guide to the ESG Revolution, 2017). One of their key findings was that low carbon emitters tended to outperform, particularly among oil producers, refiners, chemicals, infrastructure and utilities. The results were also consistent in less obvious sectors consuming large amounts of electricity, notably gaming.

As a conclusion, empirical evidence points to an increasing impact of ESG factors on stock performances. GHG analysis offers the double advantage of being objectively measurable and having sizeable environmental and social consequences. Reducing the overall carbon footprint of a portfolio should thus reduce its risk, while also helping the planet and the investor’s consciences. Talk of a win-win strategy!

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)