By creating a virtual ledger of diamond sales, the technology seeks to ensure that all registered diamonds are neither conflict free (so called ‘blood diamonds’ used to finance war and terror) nor are they synthetics that are passed off as real ones. With the acquisition of Clara, Lucara appears to be one step ahead of its competitors in this undertaking.

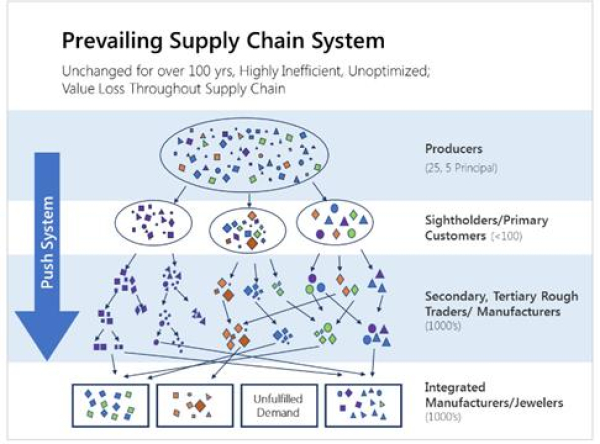

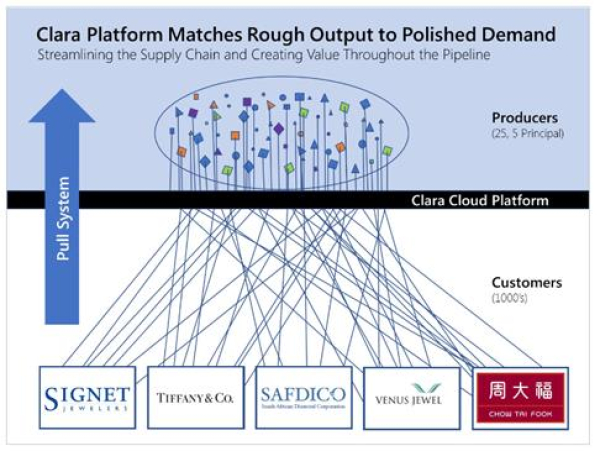

Clara is a commercially scalable, digital platform that applies computing algorithms to match rough diamond production to specific polished manufacturing demand on a stone by stone basis. The blockchain technology improves the dollars per carat ($/ct) for producers whilst making inventory and financing more efficient for manufacturing. Manufacturers are currently all set up differently and specialise in a shape, cut or quality. Producers have to create ‘parcels’ of diverse diamonds in order to sell them all, thus during tendors, manufacturers have to bid for parcels that may not suit or meet their requirements and crucially may not generate a profit for them. Clara allows for matching stone production with polished orders requirements in real time, thus unlocking the best value for every stone.

For Lucara, the benefits are 3-fold - Clara provides an affordable, yet highly valuable near-term growth platform for the company, it expands Lucara’s customer base by engaging new participants in the supply chain and it also provides stable, continuous cash flow that is not tied to the fixed sales tendor cycles.

Lucara has an opportunity to lead a change in the diamond industry gaining a strong first mover advantage with the establishment of the first true blockchain in the space. Providing authencity and traceability to consumers throughout the supply chain stands to benefit all participants and should allow diamonds to shake off its opaque reputation towards a brighter, more sparkling future.