- 1. US - The Fed performs unprecedented U-turn

- 2. Eurozone – German 10Y yields go negative again, with the ECB’s consent

- 3. UK – They keep debating, while the economy is stalling

- 4. China – Long-expected encouraging signs of growth pickup

- 5. Germany – Finally a positive reading from the German Ifo Business Climate Index

US - The Fed performs unprecedented U-turn

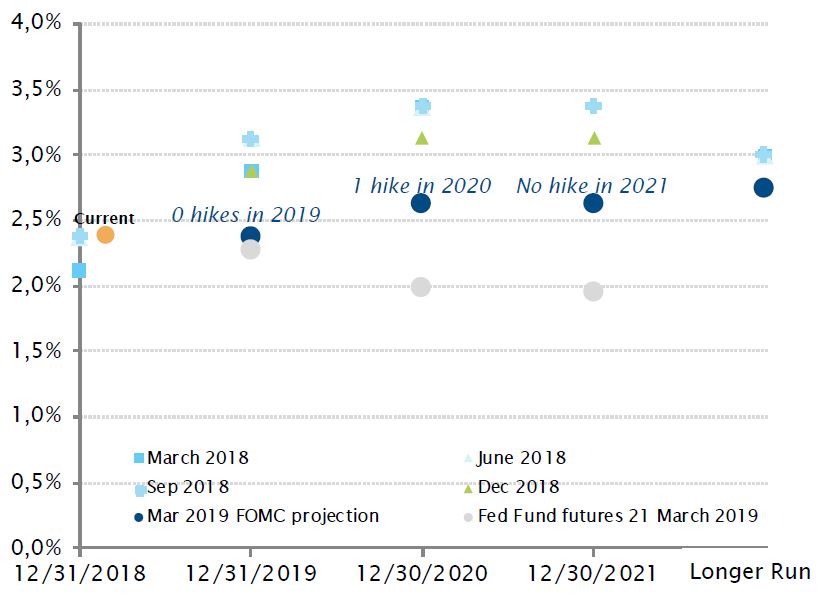

The U-turn performed by the US Federal Reserve in a matter of six months is quite spectacular and possibly unprecedented.

In early October 2018, the Fed had just raised its key rate for the seventh time in two years. FOMC members were expecting to hike three times in 2019 and once more in 2020, after the hike which was due in December 2018. Fed President, Jerome Powell, was stating the Fed Fund rate was still ‘a long way from neutral’ and was about to put the Fed’s ongoing balance-sheet reduction process on ‘autopilot’.

But in March 2019, after a flurry of speeches hinting at a more accommodative stance, the Fed hammered the final nail in the coffin for further monetary policy tightening. Not only did FOMC members signal they now barely expect to raise short-term rates in the next three years, they also said the current Fed Fund rate has almost reached its neutral long-term level. On top of this, the Fed announced it will have finished decreasing the size of its balance sheet by September.

As such, monetary policy tools are now fully on standby and the Fed’s stance is truly neutral – with no bias in one direction or the other – and ready to be adjusted, however may be needed. In a context where global growth concerns still prevail, futures markets have not taken long to start pricing in a rate cut this year or next.

The Fed is done with rate hikes. Markets now pricing in rate cuts

Sources: Federal Reserve, Boomberg. Data as at: 05.04.2019

German 10-year rates are back in negative territory

Sources: Bloomberg, SYZ Asset Management. Data as at: 05.04.2019

Eurozone – German 10Y yields go negative again, with the ECB’s consent

It was never meant to happen in the first place. And it was certainly not meant to happen a second time. But it did: German 10-year rates fell into negative territory in March.

The cocktail of factors was powerful: continuously weaker activity across the continent, the ECB revising growth and inflation projections lower ahead of lower-than-expected inflation data, a surprisingly dovish Fed pushing global rates lower, and talks of the ECB tiering bank deposits to mitigate the impact of negative short-term rates on profitability – perceived as a sign the ECB has given up on the prospect of raising rates.

In this context, the flattening of the EUR curve, measuring the difference between long-term and short-term rates, does not seem odd, especially as medium-term inflation expectations have also fallen back towards 2016 lows. Europe’s ‘Japanisation’ is underway.

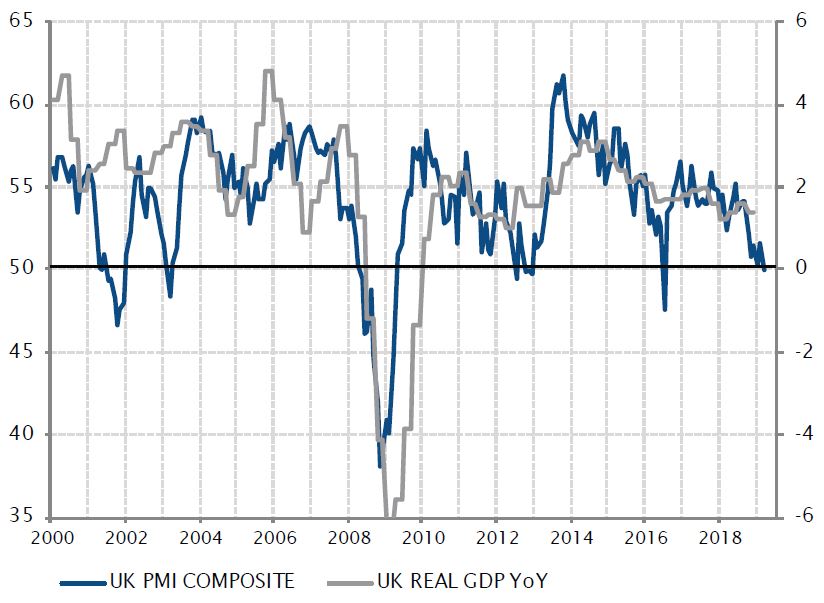

UK – They keep debating, while the economy is stalling

The United Kingdom and the European Union are playing in overtime, after postponing the 29 March initial deadline for Brexit twice.

In March, the rising risk of an exit without a deal and its potential impact for business activity on both sides of the Channel – and of the Irish border – were increasingly being felt. According to March activity data, the economy stalled, with activity in the service sector contracting and manufacturing activity only spurred on by stockpiling ahead of potential supply chain disruptions.

There seems to be no time limit to political posturing, subtle strategies and power struggles in Parliament. But the economic impact of lingering uncertainty around the UK’s terms of trade and relationship with the EU might rapidly force politicians’ hands. Otherwise, the dreaded scenario of a Brexit-related recession might well materialise… even if Brexit has not effectively occurred.

The UK economy has stalled, faced with Brexit uncertainties

Sources: Factset, SYZ Asset Management. Data as at: 05.04.2019

Chinese pickup in manufacturing activity follows significant credit and fiscal support

Sources: Factset, SYZ Asset Management. Data as at: 05.04.2019

China – Long-expected encouraging signs of growth pickup

The Chinese economy appears to have regained its footing in 2019, and this is eminently good news as far as the global growth outlook is concerned. While the US is losing momentum, as fiscal support wanes, and Europe is stuck in the doldrums, an encouraging sign from the world’s second-largest economy was badly needed after it experienced a year-long pronounced slowdown.

The pickup in Chinese industrial activity in March, back in expansion and at its highest level since last spring, is therefore welcome evidence the compounded monetary and fiscal policy easing implemented over the past few quarters is gradually having its intended effects. Firstly, offsetting the excessive tightening in credit condition implemented in 2017, which weighed on credit growth last year. Second, ensuring the domestic side of the economy was stabilised in time for when the full impact of the US tariffs was to be felt at the beginning of 2019.

US-China trade talks appear to be constructive and might result in some form of a deal. But seeing a pickup in Chinese final demand will be key to ensuring global growth does not bow under the pressure of European headwinds and weakening US tailwinds.

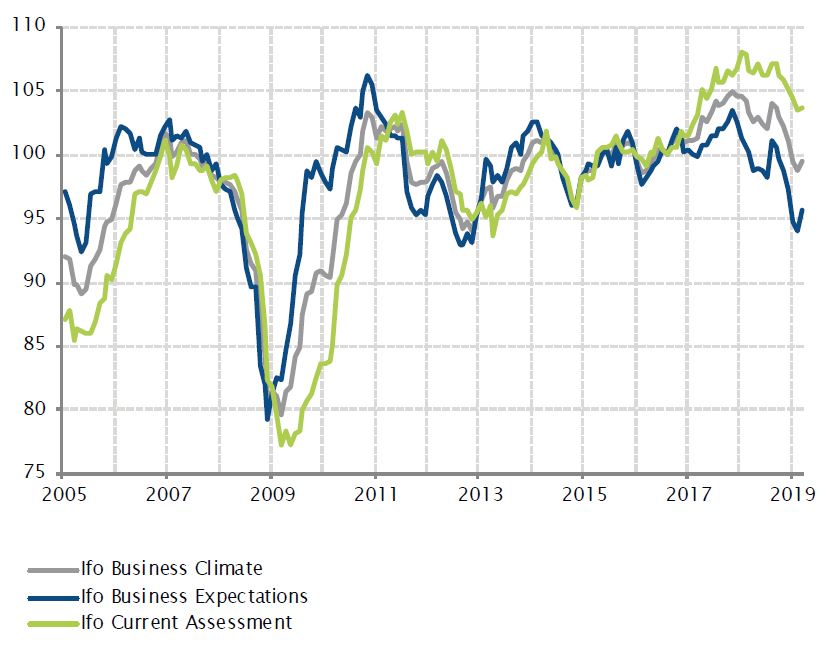

Germany – Finally a positive reading from the German Ifo Business Climate Index

After six months of continuous decline, the German Ifo Business Climate Index recovered in March. Despite consensus, which expected the data to remain unchanged, and weak flash PMI figures released earlier in the month, the Index increased from 98.7 to 99.6. The main diver was an increase in business expectations, which gained 1.6pts to reach 95.6. This suggests the German economy could stabilise in H2. In term of sectors, services displayed a strong recovery – up 4.7pts – while manufacturing remained a drag – down 2.5pts. This weak data echoes the manufacturing PMI, which reached its lowest level since 2012 at 44.7.

While these surveys indicate a negative trend is still at play in the manufacturing sector, the encouraging data on the domestic front – suggested by the Ifo – could offer some brighter perspectives for the second half of the year.

German Ifo business survey

Sources : Bloomberg, SYZ Asset Management. Data as at: 31.03.2019

Norges Bank hiked interest rates

Sources: Bloomberg, SYZ Asset Management. Data as at: 29.03.2018

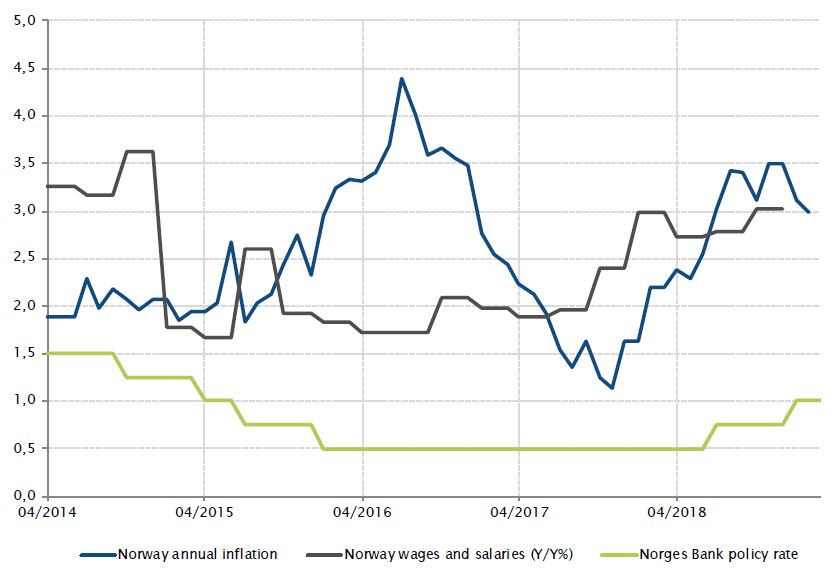

Norway – Norges Bank just hikes it

In a world of poor economic growth, anaemic inflation and low rates for longer, Norway stands out among major developed economies. On 21 March, Norges Bank hiked its key policy rate by 25bps to 1.0%.

The Norwegian economy is growing at a solid pace, up 0.9% in Q4 and with an increase of 2.7% expected this year. Meanwhile, the PMI has remained above 55 since last August and inflation has been higher than expected – at 3.0% and 2.6% for headline and core inflation, respectively, in February, compared to a 2.0% target. As a result, Governor Olsen noted: "The outlook and the balance of risks suggest that the policy rate will most likely be increased further in the course of the next half-year."

Concerned about keeping the policy rate too low for too long, Norges Bank is thus facing issues other major central banks would currently dream of.

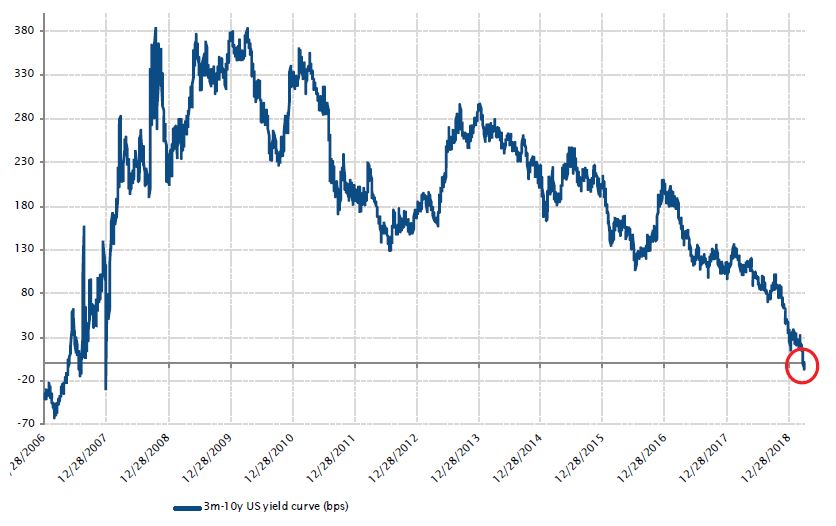

Rates – Temporary inversion of the 3M-10Y US yield curve?

In March, the US 3M-10Y yield curve inverted. However, this was not the case for the 2Y-10Y yield curve, which is more reliable for predicting a looming recession and stands at 15bps. The inversion of the former came mostly on the back of a more dovish Fed, coupled with some disappointing manufacturing figures in Europe. This prompted a flight to quality, with the US 10Y treasury yield decreasing by 31bps last month.

Usually a yield curve inversion acts as a leading indicator for the US economy and tends to predict a recession in the next 12 to 18 months, but this has not always been the case. Market participants are well aware the US economy is approaching the end of the cycle and a recession will occur sometime in the future. But timing is something more difficult to predict on the back of a yield curve inversion. Moreover, markets will have to see whether the yield curve inversion lasts, drops further into negative territory, and spreads to the 2Y-10Y curve. Looking at the past, there are some periods when the yield curve briefly inverted without a recession following.

Last but not least, unprecedented and prolonged ultra-accommodative monetary policies have naturally flattened the yield curve and it could be hazardous to attempt historical comparisons.

3M-10Y US yield curve (bps)

Sources: Bloomberg, SYZ Asset Management. Data as at: 08.04.2019

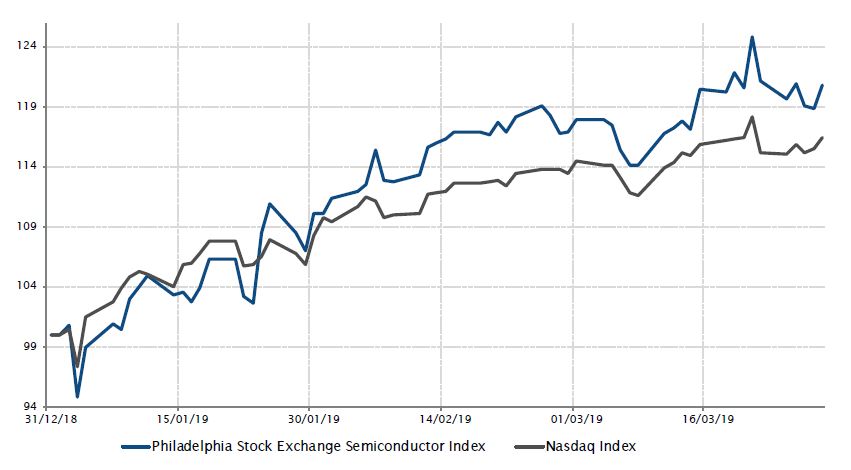

Philadelphia Stock Exchange Semiconductor and Nasdaq indices YTD performance (rebased at 100)

Sources: Bloomberg, SYZ Asset Management. Data as at: 09.04.2019

Equities – Semiconductor performance reaches record levels

The Philadelphia Stock Exchange Semiconductor Index (SOX) tracks the performance of thirty companies involved in the design, distribution, manufacture and sale of semiconductors. In the first quarter, the Index rallied 21.4%, outperforming the Nasdaq by 4.6%.

Q4 2018 was very weak for semiconductors, mainly due to weaker-than-expected demand for chips. But since the beginning of this year, the main industry actors have called a trough around Q2 and are expecting a strong rebound in the demand for semiconductors in H2. Moreover, since the Federal Reserve initiated its monetary policy U-turn in January, and as US-China trade tensions seem to stabilise, the technology sector (i.e. growth stocks) ranks as one of the best performers so far in 2019.

Recently, the SOX reached new all time highs and recovered the sharp loss of last year’s fourth quarter, where it was down 15.0%.

As we enter the Q1 earnings season, it will be interesting to see whether the tone remains positive for the second half of the year. Any sign of doubt and we could see a correction on some names.

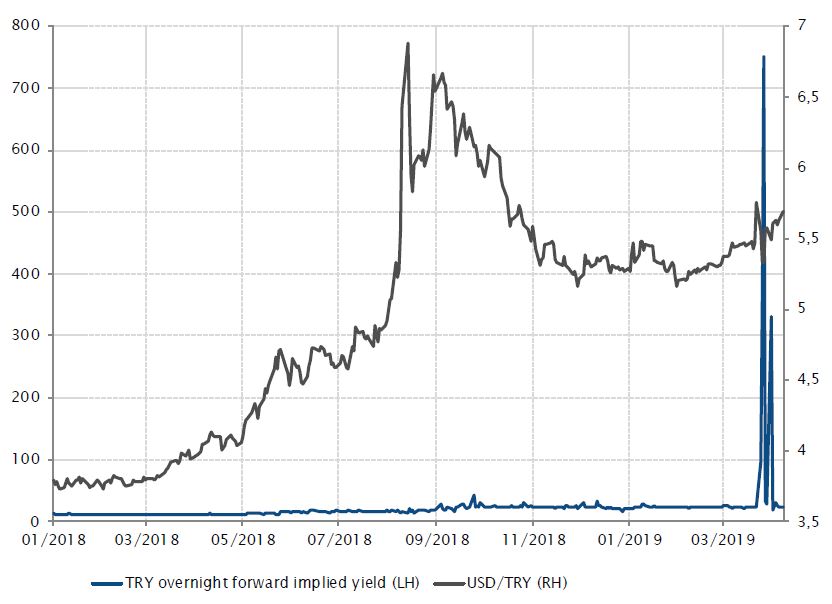

Turkey – Major squeeze on lira liquidity

The Turkish overnight forward implied yield soared by more than 700% – reaching 1300% – due to the fact domestic banks stopped lending lira in the offshore market. Following a heavy plunge in the lira, which lost 5% in one day, it appears Turkish officials tried to stabilise the currency ahead of municipal elections by preventing investors from shorting it. This resulted in squeezing some foreign banks that were unable to close out their FX swap positions. The overnight rate returned close to normal levels in the following days. However, this event once again damaged investor confidence in Turkish assets and might affect liquidity of the offshore market going forward. Investor concerns were for example reflected in the surge of Turkey’s CDS, which increased by 134bps over the month.

Turkish lira offshore rates went through the roof

Sources: Bloomberg, SYZ Asset Management. Data as at: 08.04.2019

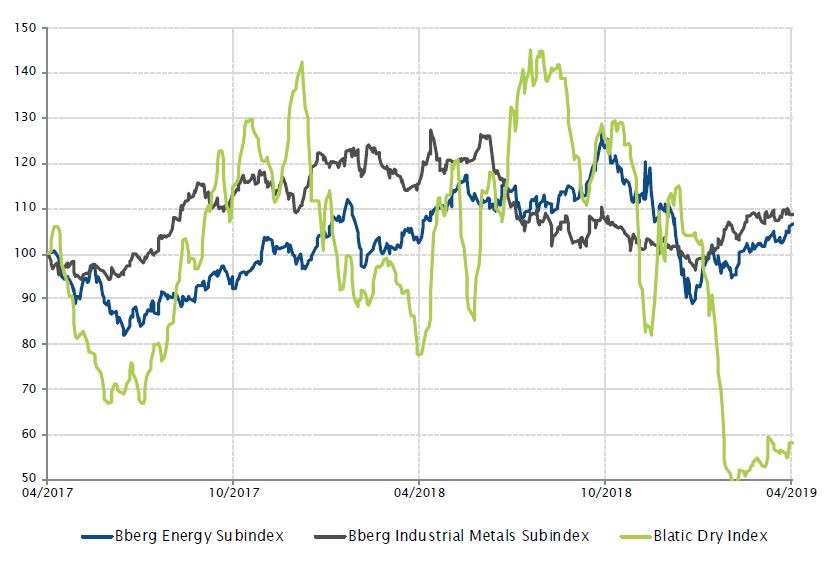

2019: a good start for oil prices

Sources: Bloomberg, SYZ Asset Management. Data as at: 08.04.2019

Commodities – Oil redux?

While equity markets posted an impressive and somewhat unexpected V-shape rebound in Q1 – the best quarterly returns since Q2-2009 for the S&P 500 – the rebound in energy prices has been equally, if not more spectacular, with a strong gain of 5.1% and 3.6% for the US WTI and Brent Oil in March. As a result, oil is up 30% YTD, posting its best start to the year since 2002. This is due to efforts by OPEC to cut supplies, supply issues in Venezuela, as well as dovish central banks attempting to ease fears of a global recession.

As far as demand is concerned, there is still no tangible sign of significant improvement, but the sentiment towards global growth and trade prospects has bottomed out since the end of last year, industrial metals have also rebounded and the Baltic Dry Index has finally stabilised. However, there is still a long way to go before claiming ‘reco-victory’.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)