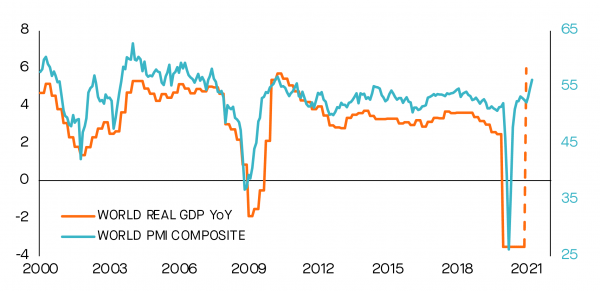

The strongest global recovery in four decades is reassuring investors that with efficient vaccination programs, major developed economies are accelerating from the stop-start lockdowns of 2020. Eventually this pace of rapid recovery will inevitably slow. Until then, attention has shifted to anticipating a change of direction in monetary policy as central banks turn to tapering their stimulus and raising interest rates in response to increasing consumption and inflation. This has created periods of volatility as sovereign bond markets reflected questions of how quickly economies might recover and when monetary policy and inflation return to normal.

For the second half of the year, we are watching for confirmation that the pre-pandemic paradigm is still in place, despite spikes in inflation that translate into temporarily higher yields.

The re-opening of economies is unleashing massive economic and consumer demand, which has been frustrated for more than a year. We have seen this first in China, then the US, and now European economies are poised to experience the same. In the short run, this booming demand will meet with shortages as supply chains experience delays in everything from computer chips to building materials and labor. This inevitably increases prices and drives inflation higher. However, our central scenario is that as the global recovery progresses, these inflationary pressures will prove shortlived.

Macro Introduction: Positioned for inflationary blips

That will therefore not translate into a fundamental change in the world’s growth outlook, as longer term we remain stuck in a structural “Japanification” rut of low inflation and low growth.

Nevertheless, central banks, led by the US Federal Reserve, are keen to avoid the mistakes that followed the great financial crisis a decade ago by removing stimulus too quickly. In particular, central bankers will try to avoid repeating the experiences of 2013 and 2018 when tapering disrupted markets, especially fixed income. As a result, they have reassured markets that there is still a long way to go in terms of improving employment. The Fed, in particular, has switched to assessing average inflation over time, rather than a fixed target. Emerging economies are in a different phase. With many vaccination campaigns running behind schedule, and economic recoveries therefore lagging, they are struggling with increasing Covid cases along with rising inflation.

In terms of timing, investors should be aware of a possible catalyst in the form of early signs that the Federal Reserve will taper monetary stimulus. This could come as early as the Jackson Hole meeting of central bankers at the end of August. Nevertheless, barring an inflation surprise, we do not expect the Fed to break with its stated intention of leaving interest rates untouched through the end of 2022.

Tapering will change the supply/demand dynamic in bond markets. There has been enormous liquidity supply from central banks to maintain low yields and to compensate any lack of demand. As current debt levels are historically high, a path to tapering stimulus is even narrower than in 2018. Consequently, rates volatility should remain elevated.

Our portfolios remain positioned for the reflation trade: higher exposure to cyclical sectors on the equity side, even if we have started to take some profits, coupled with a low duration on the fixed income side.

Moreover, we have kept equity protections in place in order to prepare for any increase in volatility as the uncertainties discussed above play out.

Equities: Seizing recovery opportunities

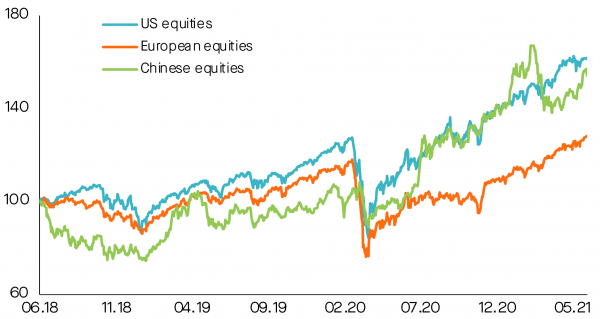

The global recovery is especially beneficial for stock markets, which are supported by the combination of positive economic momentum and still low interest rates. As a result, equities remain the most attractive asset class.

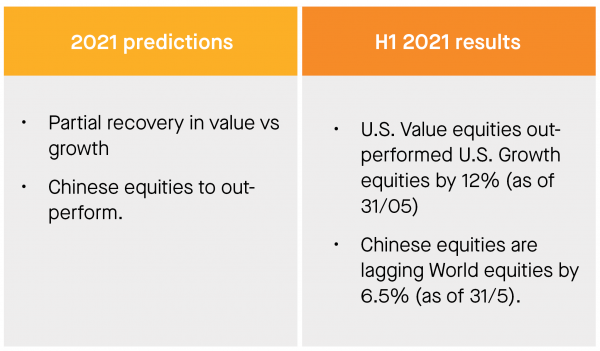

At the start of the year we anticipated positive returns for equity markets as the economic recovery was still in its initial phase. The first quarter delivered earnings that beat market expectations, and we have already seen a partial recovery of value versus growth stocks.

In many respects, the most remarkable thing about equity markets in the first half of the year was that the economic recovery transcended specific events, such as the GameStop and Archegos periods of volatility. Historically, either of these might have tripped the equity market into a downturn, but the momentum of pandemic rebound was so strong their neither knocked the market from its trajectory. We have been positioned to take advantage tactically of this reflation environment with exposure to cyclical and value stocks, where many sectors such as financials and materials are benefiting from the US’s economic recovery and infrastructure plans. European equity markets have also lagged the US in 2020, and we expect that they should close the gap in the second half of 2021.

The latter part of the year will see much investor focus on the US, as the Biden administration’s proposed corporate tax increases move through the political process. Although the eventual compromise may result in a lower tax rate, multinationals may find themselves under pressure to repatriate reserves held outside the US.

In the second half we also expect that Chinese equities will continue to be volatile because of the changing regulatory environment and pressure on technology firms. We remain positioned in this market despite the short-term uncertainties as we believe China’s economic strength merits a structural exposure in portfolios.

Another important theme for equity investors will be inflation and its impact on interest rates. If interest rates were to substantially increase, we could expect a negative impact on equity markets. Also, not all sectors would impacted the same way as some companies are less impacted by inflation.

Overall, while we will certainly see some profit taking, we remain optimistic as there is still plenty of potential value in stocks. The pandemic’s themes of work from home and digitalisation looked, at the start of the year, to have created some small bubbles in some sectors. However, rather than bursting, other sectors have caught up.

As the year progresses, we expect earnings to remain important but macro data and inflation in particular could generate volatility.

Fixed Income: Actively seeking value

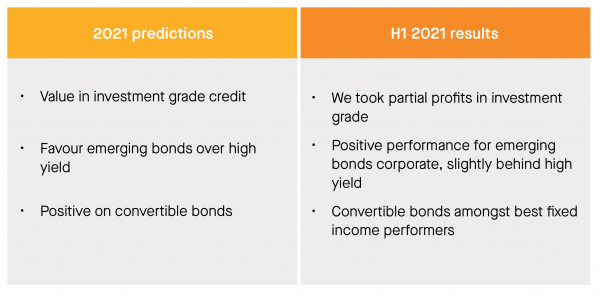

Compared with six months ago, many of the uncertainties in the world economy have dissipated. Still, longer-term low growth and inflation mean that the environment remains difficult for fixed income investments with narrow spreads. Slowly, the share of negative-yielding bonds on the market is diminishing, falling by around one-third over the first half of 2020.

The fixed income market remains an environment demanding a highly active approach to identify returns. There are opportunities for yield, such as subordinated bonds or emerging market debt in hard currency, along with some corporate credit, compared with sovereign debt yields. However, we do not yet think it time to sharply increase our exposure to fixed income assets. If we see interest rates in the developed world rising, it will offer an opportunity to start to progressively add duration in our portfolios. Once the 10-year US Treasury note rises closer to 2%, we think it will be time to start building longer duration positions.

Recently, we have redeployed a small portion of the cash to unconstrained bond instruments with short duration features. Sensitivity to rates remains low, but higher yields are captured by investing in segments like subordinated debt or asset-backed securities.

In terms of valuation, convertible bonds remain attractively valued. That’s even more obvious since mid-February, as they underperform due to a higher exposure to long-duration stocks, mainly information technology or recently-created companies.

Private Markets: Opportunities ahead

The economy is set for high growth in 2021 as it catches-up and pent-up demand gets released. While impressive, will it be sustainable? Valuations have largely anticipated such recovery despite the many risks we cannot ignore. The sectoral dichotomy created by the pandemic creates opportunities across private market strategies, from growth investing to corporate carve-outs, from distressed investing to legal assets, from management buyout to secondaries.

In uncertain times, asset allocators may look for high and uncorrelated return streams that alternative investment strategies such as litigation funding can offer. After successfully financing claimants on single cases, across commercial litigation and arbitration, we are leveraging the expertise we built in the asset class into law firm lending, a private debt strategy that offers similarly compelling uncorrelated returns in an even more defensive way.

The deep dislocations created within exposed industries and capital structures also provide a fertile ground for value-driven strategies, such as distressed investing, secondary transactions, or turnarounds. By remaining attentive and ready to transact at the right price, investors can find opportunities that provide significant downside protection and upside scenarios.

In terms of growth investing, we believe that the key is to stick to simple strategies:

1) Support high growth technology companies or tech-enabled business services, which more often than not accelerated their growth trajectories since the start of the pandemic,

2) Back successful management teams in their journey to consolidate a fragmented niche market through various M&A initiatives around a solid core platform, with objective to create an industry leader, and

3) Benefit from long term growth trends such as sustainable agriculture with the help of technology that can help solve several health and climate issues we face as a global community. Specifically, ag-tech and food-tech provide a very large addressable opportunity and high impact, especially on the larger farmer communities located in Africa and Asia.

The inclusion of uncorrelated and countercyclical strategies in a portfolio continue to provide diversification benefits in these uncertain times.

Hedge Funds: Paradigm shifts

Well-structured hedge funds continue to generate performance in this environment, and we see an institutional shift into alternative strategies and a window of opportunity in event-driven strategies, in particular in Japan.

Many institutional clients reduced their fixed income exposures and cash to reinvest in hedge funds this year. This trend to increase exposure to alternatives represents something of a paradigm shift. With equity markets at new highs, low rates and the increased correlation between equities and bonds, institutional investors are attracted by hedge funds as a means to reduce equity portfolio risk. Event-driven strategies are especially benefitting from narrowing spreads as vaccination campaigns and the US elections, together with persistently low interest rates have reduced uncertainty over the past six or so months. Moreover, the accumulation of cash by companies during the 2020 crisis, in some sectors reaching record levels, in addition to margin pressures due to the accelerating disruptions of technology, will all create an exceptional year for corporate activity.

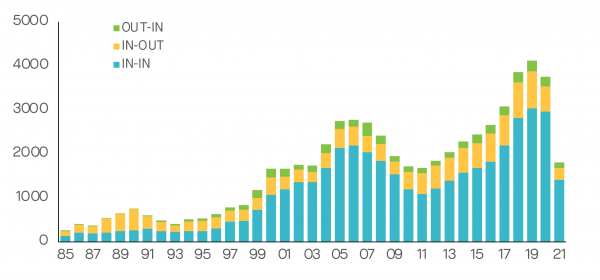

In addition, we think that Japan offers increasingly interesting investment opportunities for corporate event-related strategies, where activity has more than doubled over the last ten years to record levels. For many years, the Japanese market has been undervalued as it was difficult to generate outperformance. That has changed rapidly, driven by the corporate governance reforms set in motion by former Prime Minister Shinzo Abe. Designed to improve profitability and the shareholder visibility in much corporate activity, the reforms are also improving returns on investment as well as investor protections. Simply put, the changes are putting corporate boards and managements under pressure to perform, which can only be beneficial for foreign investors. A recent new draft of the corporate governance code will certainly amplify this pressure.

Finally, we continue to be positive on convertible arbitrage. New issuance often came from high quality growth companies with high volatility at the stock level, for example Twitter or Peloton, which are ideal characteristics for this strategy. After a strong start to the year, we have recently seen a repricing due to excessive levels of new issuance and a reduction in volatility. That offers a perfect entry point to benefit from this uncorrelated strategy.

Trading: Retail therapy?

Investor euphoria prevailed in the first months of the year – a trend which was particularly visible on the retail trading front. While private investors did not take an active role in the bull market which followed the financial crisis of 2008, they are now back with a vengeance. This has been facilitated by the “democratization” of investing through the launch of low-cost and user-friendly trading applications as well as easier access to investment information and education.

The pandemic accelerated this trend as ‘stay-at-home’ drifted into ‘trade-at-home’ habits. One of the key events of the first part of 2021 was the rise of social media forums discussing financial trading, letting retail traders share ideas, target specific stocks and ‘gang up’ against professional investors such as hedge funds. That created rapid market moves and heavy trading volumes concentrated in a few stocks such as GameStop or AMC Entertainment, particularly early in the year.

Another sign of market euphoria has been the boom of SPACs (Special Purpose Acquisition Companies), which enable private companies to go public without going through an Initial Public Offering process. The ongoing surge in these ‘blank check’ acquisition transactions has heightened scrutiny from the US regulator.

Besides equity markets, the most spectacular development of 2021’s first half was cryptocurrencies, exemplified by Bitcoin. While the ‘digital gold’s’ performance has been impressive, others such as Ethereum or ‘altcoins’ did even better. Blockchain-based technologies are creating many new applications, fueling platforms and attracting much investment interest. Still, as with any evolution, few will survive and eventually proliferate. Cryptocurrencies remain highly volatile and risky assets which demand that investors are selective, avoid too much leverage and allocate only a very small part of their wealth.

The question for markets is whether the end of the pandemic will signal the end of this retail trading therapy? Some have suggested that private investors will return to betting on sports once economies re-open. The evidence suggests otherwise. While many of these traders may not have first-hand experience of previous market crashes, it seems that the digitalization of finance has lured new demographic groups into the investment world. However, their patience and risk-management skills may soon be tested. Market volatility, as measured by the VIX index, has stayed on the low side over the last 12 months. This may signal too much investor complacency. The middle of the year and northern hemisphere summer is usually characterized by lower volumes and unexpected events which can create volatility spikes. Uncertainties about inflation and Federal Reserve policy could trigger some market pullbacks in the months to come.

Finally, we should mention another change in trading noticed through the pandemic. Working-from-home habits have generated increasing demand from institutional and external asset managers for access to trading services outside the working day. Along with quicker account opening, professional investment clients increasingly want more fluid relationships that let them trade whenever they want and access advisory services, sometimes varying between asset classes and geographies, depending on their individual expertise.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)