As widely discussed before the election, the mail-in votes yet to be counted may eventually flip the lead to give Joe Biden the presidency. But of course we can expect Mr Trump to challenge those postal votes at a state and even federal level through the Supreme Court. This could prove pivotal since Mr Trump has appointed three of the nine justices over the course of his 4-year term.

The US is now entering a period of political uncertainty, and possibly social instability that could last weeks or longer.

States now have until 8 December to fix any controversies over registered voters or the validity of mailed-in ballots, and the Electoral College then has to ratify its allocation of seats to each party on 14 December, handing the presidency to Mr Trump or Mr Biden. This majority should then, ordinarily, be rubber-stamped by Congress at its first session on 6 January, ahead of the inauguration on 20 January.

The period of uncertainty ahead of us has the potential to unsettle financial markets, especially just as the Covid pandemic is again forcing many countries to resume social distancing and disrupt economies.

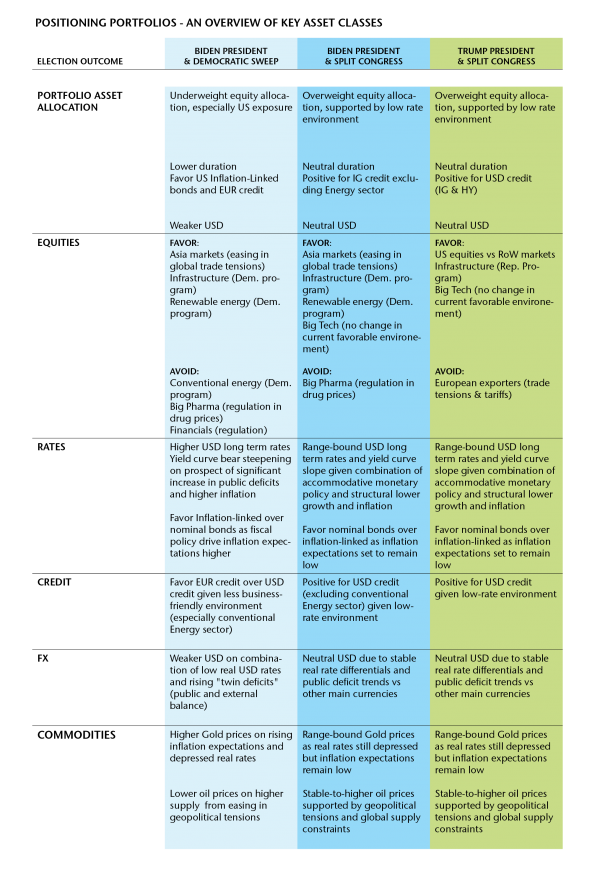

If Mr Trump were eventually confirmed for another four-year term and re-elected with a split Congress, we may see equity markets resume their positive trend, but we think this is unlikely as long as uncertainties and the possibility of social unrest remains. Since we have already reduced our market exposure in client portfolios over the past two months, we are not in a rush to cut exposure further.

Although the USD could strengthen during the period of political uncertainty, we expect to see range-bound long-term dollar interest rates as the structural trends of slow growth and inflation remain in place, along with very accommodative monetary policy from the Federal Reserve. We have a number of positions in place to contain the impact of any significant short-term equity market volatility, as well as defensive assets such as high quality bonds and gold, all of which should play a defensive role. Such volatility will also provide opportunities to add exposure as this low interest rate environment is here to stay and will ultimately supporting yielding assets.

US ELECTIONS: MANAGING SHORT-TERM VOLATILITY

Wednesday, 11/04/2020This was an unthinkable scenario for many, yet here we are: while the result of the election remains far from certain, the initial results credit Donald Trump with a lead in several key states, providing a margin for the incumbent president to claim victory.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)