This may not be the “Blue Wave” that some had expected, and the Republicans may retain control of the Senate while Democrats hold onto the House of Representative. In what is likely to be a “split congress” result, Mr Biden and his new administration would struggle to pass their full agenda as the Senate would likely block many of their most significant reforms, even if the economy can look forward to some additional fiscal support.

In the meantime, markets may react with some heightened volatility as legal challenges to the various results play out.

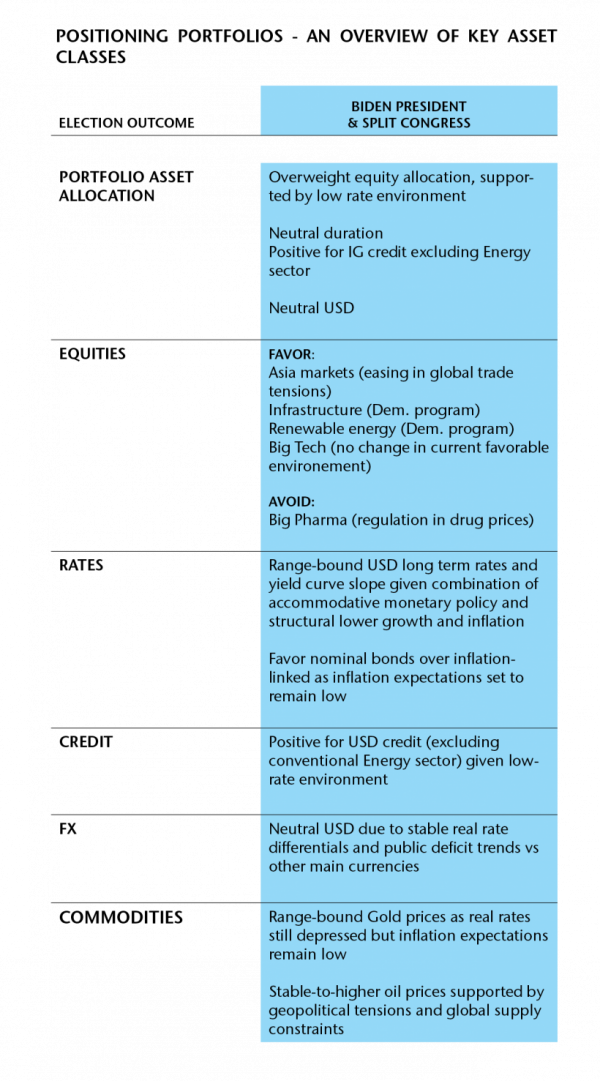

In the short run, we expect this situation to have the following impact on assets:

- A neutral-to-negative impact on the dollar, as some expansionary fiscal and monetary policies could be implemented, but without going beyond the programs seen in other large developed economies.

- A positive outcome for equity markets

- with a still-favorable environment for US Big Technames,

- some outperformance in Asian markets as the unpredictability of trade tensions between the US and China diminish

- infrastructure and renewable energy may outperform if the Democrats manage to push their agenda

- lower probability for a rotation in favor of value sectors

- Range-bound long-term dollar interest rates as the structural trends of slow growth and inflation remain in place, along with very accommodative monetary policy from the Federal Reserve

- Support for credit and emerging market debt, given the ample liquidity and very low yields available in government rates

- Range-bound gold prices as real interest rates have little potential to fall further.

As we wait for the outcome to be confirmed, we believe that our clients’ portfolios remain well positioned to ride out any short-term volatility.