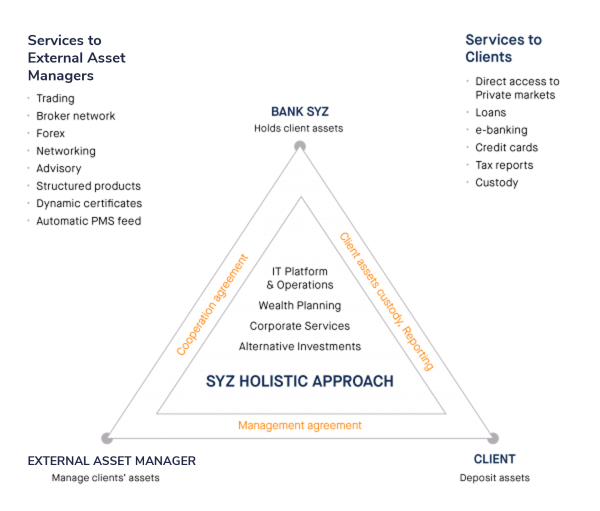

A personalised approach to serving you

Every external asset manager has a designated client relationship manager as their single-entry point, enabling them to take full advantage of the Syz Group's wide-ranging expertise, including research, advisory, trading and operational management.

Process, personalised

We make it easy to access our services, taking a partnership-based approach, so you can focus on what matters most to you and your clients. Thanks to our robust approach and efficient decision-making, we can meet all your needs and add value at every stage of the process.