Volatility has generally been subdued this year and the Vix index recently hit lows not seen since early 2007. It is not clear why volatility has been so low in recent months – given the noise surrounding President Trump’s first few months in office combined with European elections, most investors would be forgiven for expecting 2017 to be a year of heightened volatility. So why is it so subdued? Benign macro-economic conditions, the dampening effects of central bank policy, or simply investor complacency? It is probably a combination of all of these and other factors, but we fear complacency could be playing a big part. Despite the market rally, there are signs of investor caution. Cash levels are reasonably high and many investors worry that valuations are beginning to look quite stretched, especially in the US. Low readings of volatility gauges like the Vix or the VStoxx could be another sign of imminent risk. Days after the Vix dipped below 10 in early May, US markets lurched downwards recording their worst day in 8 months. The two other occasions when the Vix also fell below 10 preceded a bond market sell off in 1994 and the global financial crisis beginning in 2007. In a market where we are finding many stock valuations quite demanding, finding exposure to volatility seems to be an interesting contrarian theme.

Contrarian opportunities in low volatility environment

Tuesday, 06/20/20172017 has started strongly for equity markets. The MSCI World index, a gauge of global stocks, recently touched all time highs. Global risk appetite is solid, political risks seem to be diminishing and macro indicators and corporate earnings are encouraging. With optimism so widespread, it certainly makes finding new ideas more difficult for contrarian stock pickers such as ourselves.

The market’s steady rise upwards may be opening up one contrarian opportunity in particular – volatility, or lack of it.

How to play volatility?

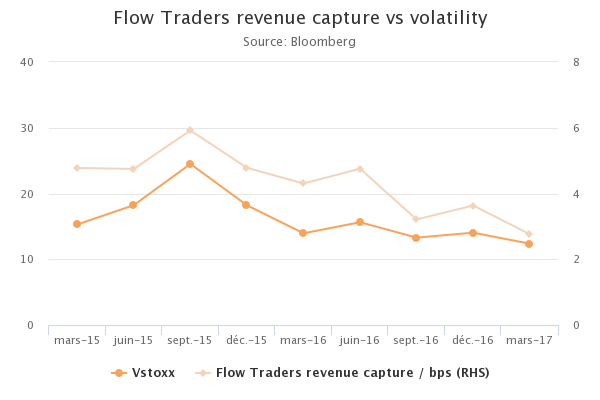

Within financials, there are a number of companies that rely on volatility to drive trading volumes. The investment banks have recently enjoyed a flurry of activity on the back of the ‘Trump bump’. However, these companies generally do not meet our quality criteria. There are simply too many balance sheet risks including high levels of leverage and opaque hard to value balance sheets. In times of stress and volatile markets, we feel these would be particularly risky investments. Pure trading businesses like exchanges, market makers and inter-dealer brokers are attractive as they combine strong returns, high levels of cash generation with exposure to volatility-driven trading activity. IG Group, the leading provider in spread betting and CFD products, is generally geared to volatility in the short term. While regulation is a key risk, IG is best positioned to adapt to the changing environment at the expense of smaller players. Flow Traders is another interesting play on volatility. It is a leading ETF market maker with c20% of market share in Europe. Over the longer term, it is benefitting from the structural growth in ETFs, but in the short term its revenues are largely influenced by volatility. When this is subdued, low trading volumes and tight spreads weigh on revenues. However in times of stress or market dislocation, volatility provides a kicker to its structural revenue growth. The business model delivers superior returns and cash, it is well positioned for the structural growth in ETFs but earnings are currently depressed because of the lack of volatility. The shares have been weak as a result, but we believe there could be significant upside if volatility returns to more normal levels. We believe Flow Trader’s valuation is reflecting the unlikely scenario that the current low levels of volatility will continue for years to come.

The calm before the storm

Being contrarian investors, we are be more cautious when markets are grinding up. In his book, The Black Swan: The Impact of the Highly Improbable, Nassim Nicholas Taleb points out that "the feeling of the safety reaches its maximum when risk is at its highest". While we have little or no visibility as to when volatility will pick up, we feel that over our long term time horizon it will normalise to the benefit of companies like Flow Traders or IG Group. For this reason, we have been searching for other out-of-favour businesses which are exposed to similar themes while also trimming positions in our asset manager holdings which may suffer in choppy markets. We are used to finding ideas in out of favour themes in anticipation of a rebound.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)