The failure to diversify can have negative consequences in investing but also in life. Take for example monocropping, the practice of growing a single crop year after year on the same land. While it allows for the specialization of equipment and better yields, the dominance of a few genetic lineages of crops has made the agricultural system more susceptible to pests or diseases. With only a single resistance strategy, an entire crop can be quickly wiped out. An example is the potato blight in Europe in the mid 19th century; another is the deadly fungus that is currently devastating banana plantations.

Food scarcity is the danger of monocropping whereas unrewarded risk is the danger of portfolio concentration. Diversification is said to be the only “free lunch” in finance, an idea in fact coined by Nobel Prize winner Harry Markowitz in 1952, one of the grandfathers of modern portfolio theory. The MPT says that by diversifying, an investor gets a benefit (reduced risk) at no loss in returns over the long term.

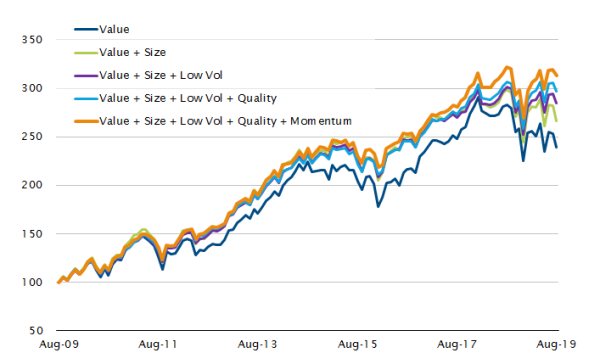

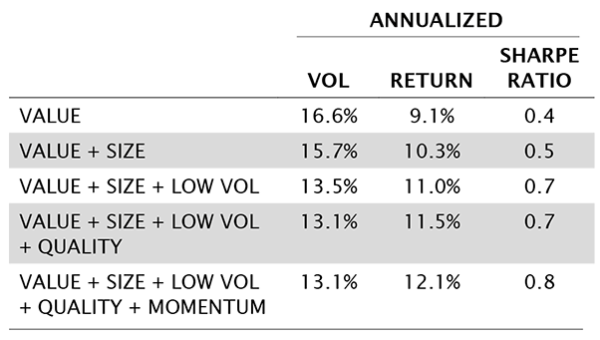

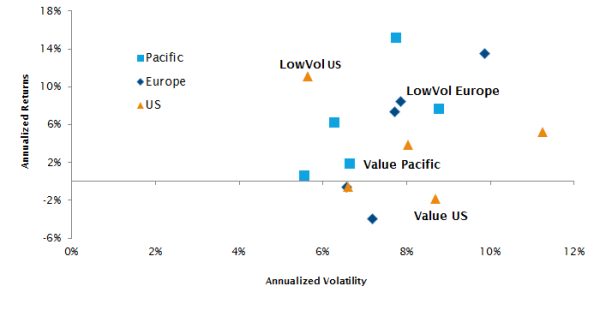

To avoid disaster scenarios and also profit from the diversification free lunch, investors may consider global multi-factor quantitative strategies which source diversification from:

1) Stocks

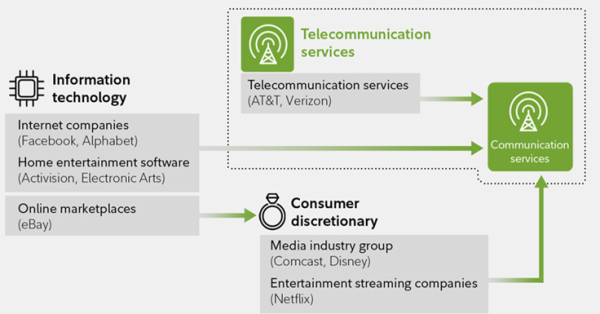

2) Sectors

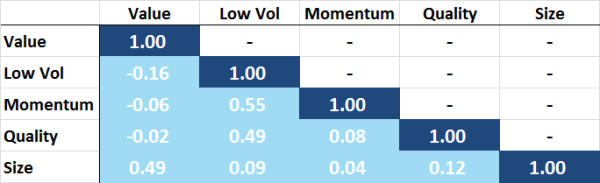

3) Factors

4) and Regions.