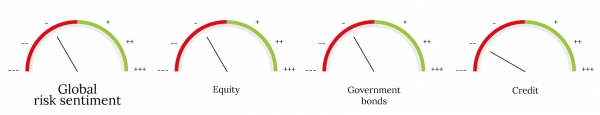

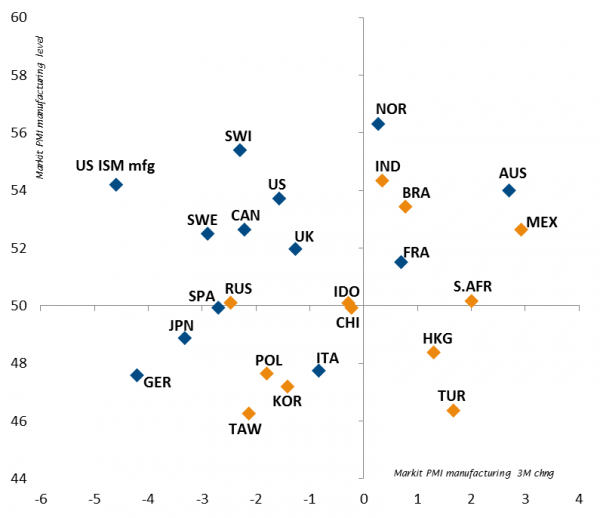

Thanks to a new dose of monetary policy accommodation, central banks in developed markets should be able to extend the business cycle – although somewhat artificially, as they refuse to normalise rates in order to properly flush out the system. There is still too much debt, following a decade of financial repression, and not enough nominal growth, despite a decade of ultra-loose monetary policy. Economic growth in developed economies is now expected to bottom out around the end of the first quarter, before nearing potential economic growth further down the line. While this is not ideal, it will not be enough to trigger inflation concerns. So we are back in a kind of goldilocks scenario with no recession, low inflation and no interest rate hikes. The extra liquidity has annihilated volatility, reflated asset valuations and triggered a new run-to-carry. However, as the influence of monetary stimulus will soon fade, and valuations are not overly appealing, it is now too late to blindly chase the rally.

As a result, we did not alter our allocation very much this month. We continue to look for carry, growth stories, relatively cheap valuations and diversification. In this context, we favour hard currency emerging market (EM) debt and subordinated debt for their carry and relatively cheap valuations. Meanwhile, we are warming up to EM local currency debt because of the Federal Reserve’s very patient dovish attitude, which should cap both US rates and dollar strength. On the equities side, we are keeping our overweight to the US as a source of growth, to China and the UK for valuations purposes, and are underweight in Europe and Japan, which lacks any near-term growth sparks, as well as in EMs ex-Asia, where valuations are less appealing. As far as diversification is concerned, we are relying on duration, gold and an exposure to the Japanese yen.

Where are the risks? On the political side, the trade war is far from being resolved; we will not witness a return to the good old days of a ‘flat’ globalisation world; and the never-ending Brexit saga is heading into overtime. But these are well-known unknowns – perhaps not yet priced in, but clearly flagged. More worryingly, I wonder how much of the goldilocks scenario is priced in, how solid it is, and thus how long it could last. I am not convinced of its resilience, as very soon economic data will either confirm a bottoming out of nominal growth, with rate hike expectations quickly resurfacing, or it will point to an increased risk of recession. The current scenario appears to be more of a ‘silverlocks’ than a goldilocks situation. Complacency over low inflation, the absence of rate hikes and no recession is the key risk for this year.

_Fabrizio Quirighetti