Despite significant strides in prevention and survivorship rates, cancer remains a leading cause of death across Europe. With nearly 200 variations of cancer, the complexity of navigating treatments and optimising resources is at the forefront of healthcare companies’ agendas.

The data illustrating the accelerating prevalence of cancer makes for grim reading. By 2030 there will be over 22 million new cases a year, up from 14 million in 2012. This surge is being underpinned by an ageing population worldwide; cancer rates rise dramatically in +55yrs old. To tackle this problem, the oncology market is set to keep growing as companies continue to find ways to treat the disease.

Moreover, the recent surge in ethical investing, particularly among millennials, is shining a spotlight on investments which can secure financial returns while positively contributing to society. Pioneering developments in oncology deliver in both areas: progress in fighting the second leading cause of death globally and access to leading-edge healthcare innovators with growth potential.

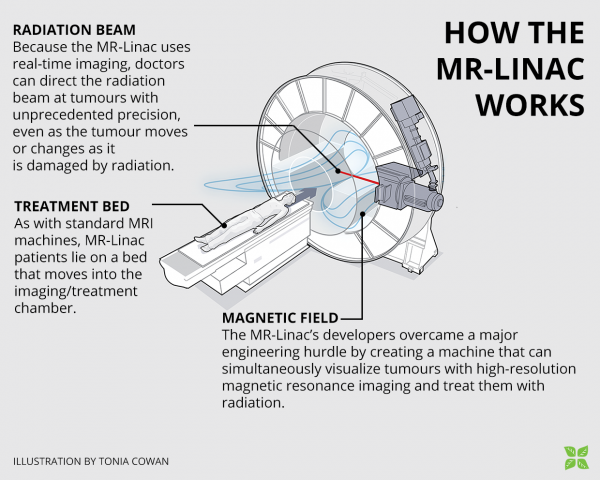

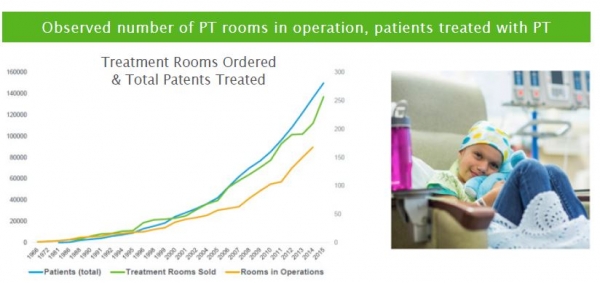

Our fund is invested in two companies leading the way in pioneering treatments within radiation therapy. Elekta offers the world’s first MRI-guided radiotherapy and Ion Beam Applications is the leading global player in proton therapy.