Last December, Technicolor’s management announced that they were in advanced negotiations to sell their patents business. While we are still waiting to see if any agreement is reached and under what conditions, if a deal goes through it could be a key catalyst for the stock to move higher. The Technology activity is often seen as a black box due to the low visibility of its earnings. Putting a price on it would stop the debate on the value of this business and refocus attention on the Connected Home business and most importantly on Production Services.

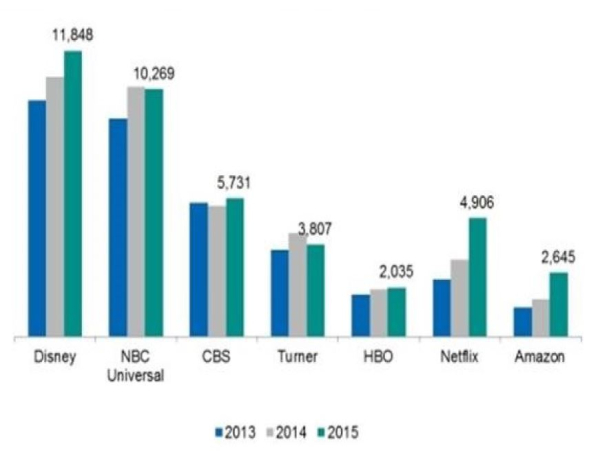

The rise of streaming service providers over the last couple of years has changed considerably our viewing habits, but also, more generally speaking, the TV landscape. While the number of streaming platforms has surged, the competition for subscribers has intensified and the need for exclusive quality content has become strategically crucial. As a result, the global distributions platforms such as Netflix and Amazon Studio are substantially increasing each year their programming budget. For example, Netflix already announced that it will spend between USD 7 and 8 billion on content (original and licensed) in 2018, up from USD 6bn in 2017!

And if the over-the-top actors are spending in order to feed their aggressive growth strategy and trying to reach a critical scale as fast as possible, the traditional broadcasters have to increase their programming costs to remain relevant and to defend their market share.

These trends are very positive for the produc

tion services industry and Technicolor is a consolidator in this very fragmented market. As a market leader, Technicolor is already

working with most of the top content production companies and has won many awards for its work thanks to its best in class visual effects services, for example.

The Production Services activity is therefore expected to deliver strong growth over the coming years driven by this increasing need for premium video content as the competition to attract viewers is intensifying.

Technicolor is also the number two manufacturer of set-top boxes and gateway streaming through its Connect Home division. This hardware is often overlooked, but remains critical in the delivery of accurate content quality to customers. Technicolor is well positioned to help create and deliver high-end content for any type of production company and to deliver it on most sort of platform.