- 6. Markets - Impact of Hurricanes Harvey and Irma

- 7. Equities - Rising euro impacts negatively European equities

- 8. Commodities - Gold is shining

- 9. Forex - Rate differential cannot explain US dollar weakness

- 10. Markets - Historically low volatility endure despite political and geopolitical uncertainty

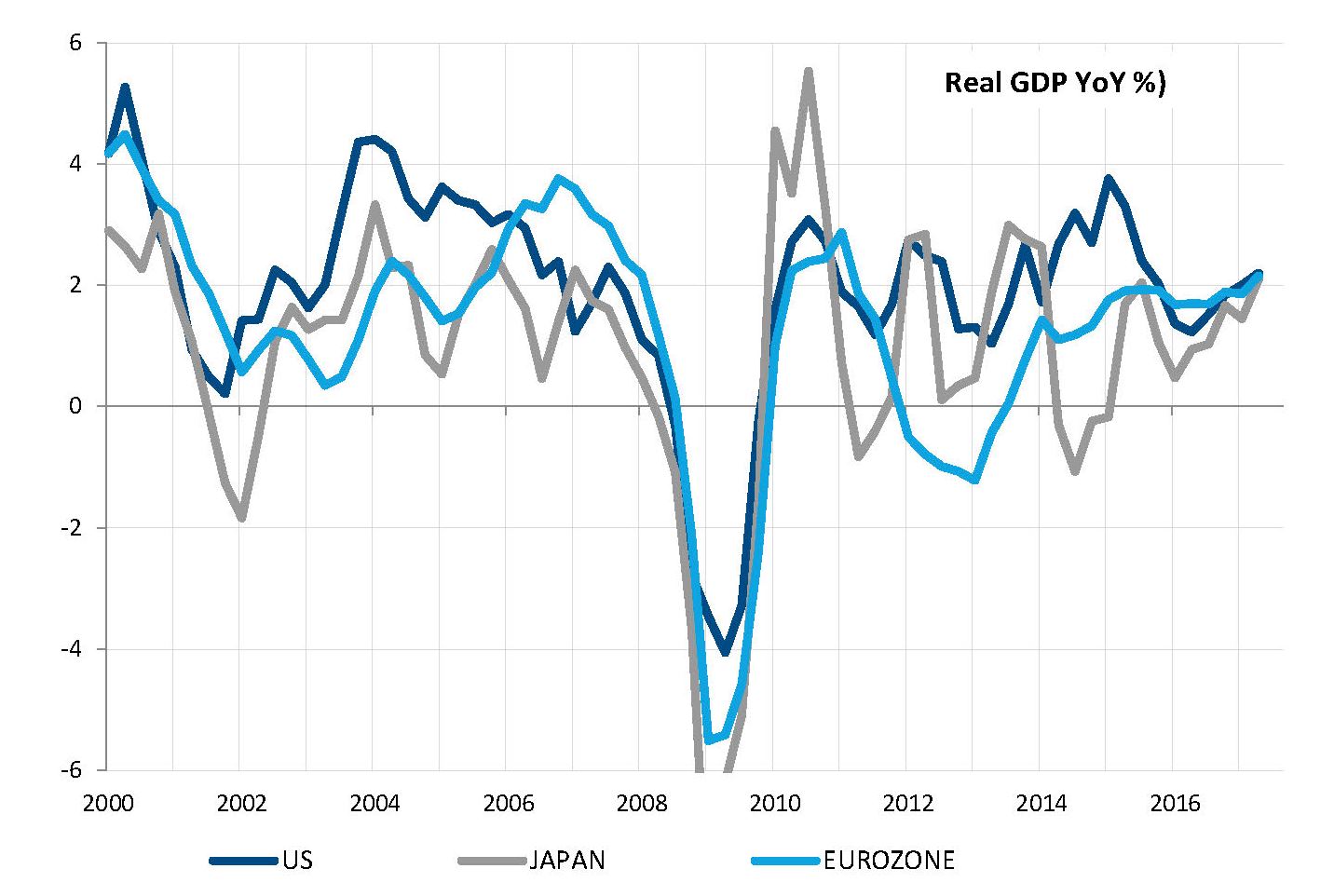

World economy - Synchronized global growth at last

In the current environment, there are many reasons for investors to be worried. However, for the first time since the 2008 financial crisis, economic growth is not one of them. The world’s largest economies are still expanding, with growth rates at or above potential. Q2 GDP data has confirmed the strength of the Eurozone and Japan (+0.6% QoQ each), the rebound of the US economy after a weak Q1 (+0.75% QoQ in Q2), and the stability of Chinese growth at a pace conform with its government’s target (+1.7% QoQ).

For the first time since 2008, global growth is synchronized and Q2 yearly GDP growth rates are similar in the US, the Eurozone and Japan.

Synchronized global growth for the first time since 2009

Source: Factset, SYZ Asset Management. Data as of: 31 August 2017

Balanced US growth fuelled by final consumption and business investment

Source: Factset, SYZ Asset Management. Data as of: 31 August 2017

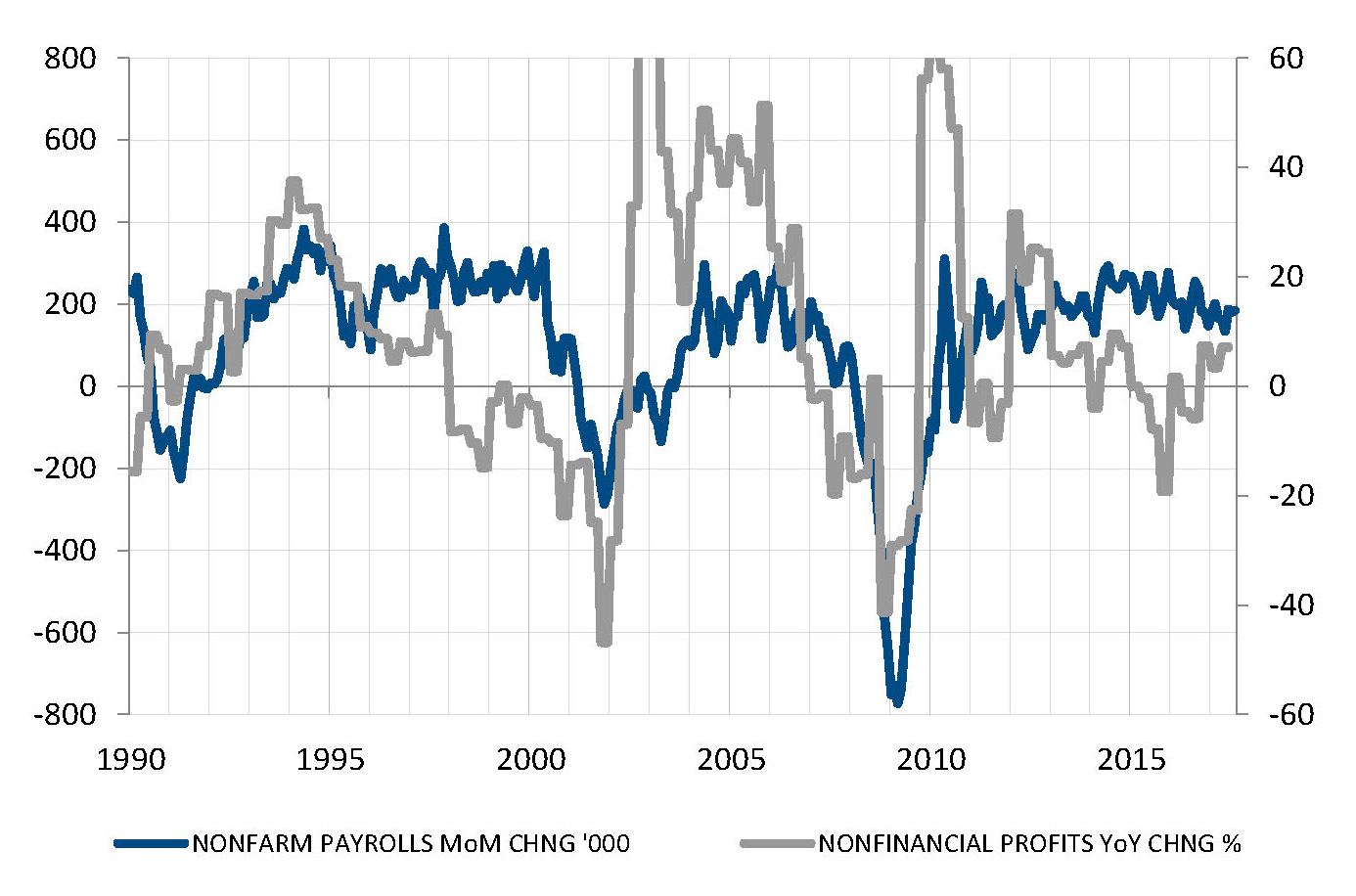

United States - Back to balanced economic growth

Following the negative impact of falling oil prices on the US economy and investment environment for two years in a row, the US economy has finally resumed a more balanced growth pattern. While the absolute GDP growth rate is not exceptional, it now runs on two legs instead of being reliant solely on consumer spending.

The recovery in non-financial profits, up 5.4% in Q2 and 7.1% from last year, has propelled business investment. Moreover, continuous job creation -despite low unemployment rates- has also helped fuel household spending. Nevertheless, the tighter labour market has so far failed to trigger upward wage pressures.

This rebalancing of US growth drivers makes the current expansion more resilient to external shocks. Indeed, the impact of the recent hurricanes on GDP will remain mild and temporary.

China - Economy stabilized ahead of the National Congress

As the 19th National Congress of the Communist Party opens on October 18th, Xi Jinping will be able to highlight the success of his first term in office with the soft landing of China’s economic growth. Over the past year, GDP growth in China has stabilized between 6.5% and 7%, as a result of targeted fiscal and monetary policy. The yuan has reversed its 2016 losses against the US dollar and is now up 7% against the greenback.

These are welcome improvements compared to early 2016, when fears of a Chinese hard landing were weighing on global growth prospects and causing the Fed to postpone its rate normalization.

The latest data points to a continuation of this positive trend, with PMI in the manufacturing and service sectors on an upward trajectory. While it cannot eclipse issues of private indebtedness and rapid credit growth, in the short-term there is no visible cloud on the Chinese economic horizon.

GDP growth has stabilized and PMI indices are reassuring

Source: Factset, SYZ Asset Management. Data as of: 31 August 2017

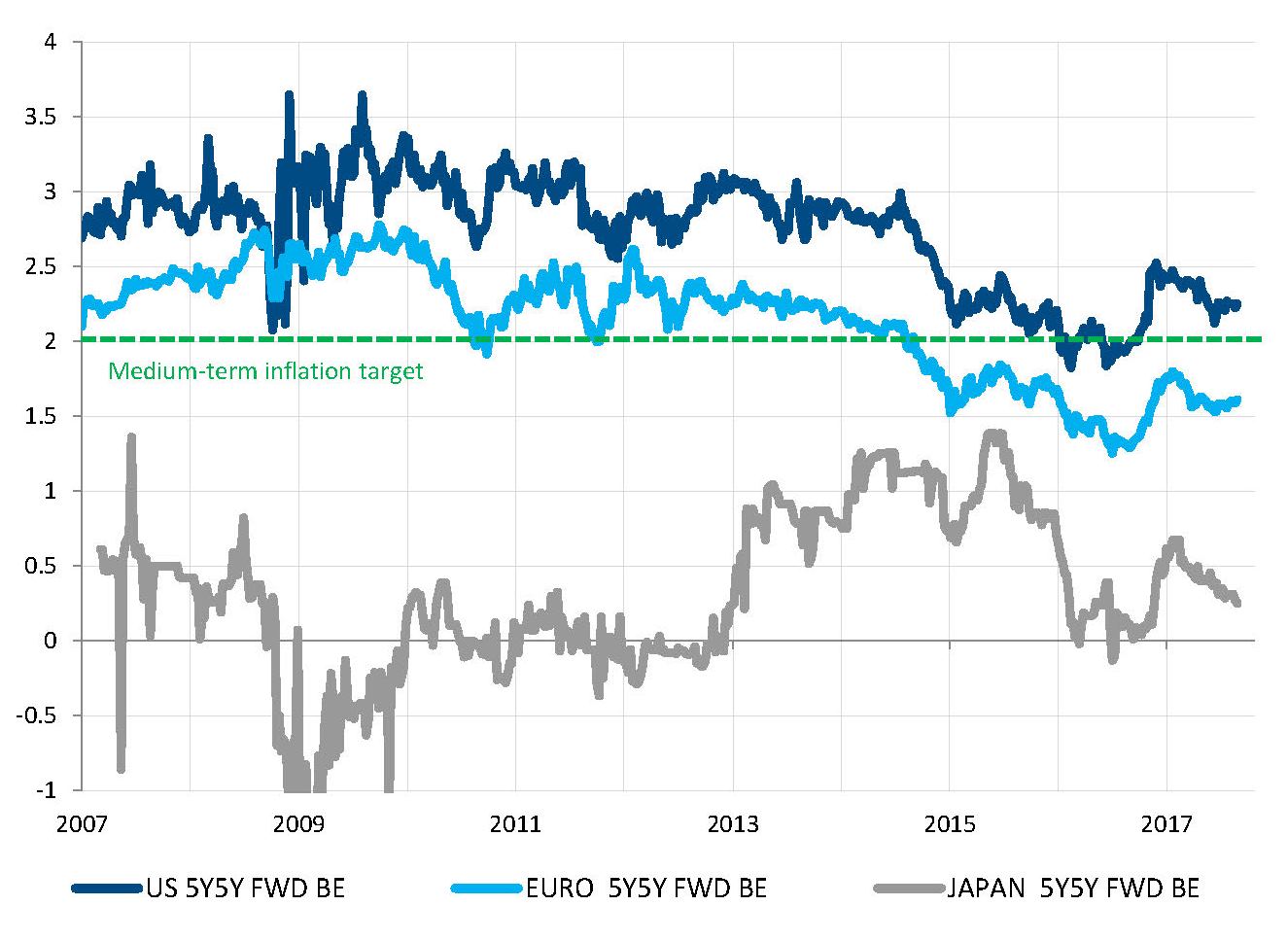

No improvement in medium-term inflationary trends

Source: Bloomberg, SYZ Asset Management. Data as of: 31 August 2017

Inflation - No upward pressure in developed economies

Despite a broadly positive global economic environment, improving labour markets and commodity prices on the rise, inflation remains muted.

Looking at medium-term inflation expectations over five years, the improvement is hardly visible. In the US, they are returning to last year’s lows following the Trump-bump. In the Eurozone, they remain below the ECB target. In Japan, they are nearing zero, thereby highlighting the failure of Abenomics to reinitiate inflationary dynamics in the Archipelago.

The evolution of overall inflation is key to understanding the behaviour of the Fed, the ECB and the BoJ. Although they are erring toward normalization, the lack of inflation so far prevents them from moving too boldly. This might change if there is a pickup in any of these indices.

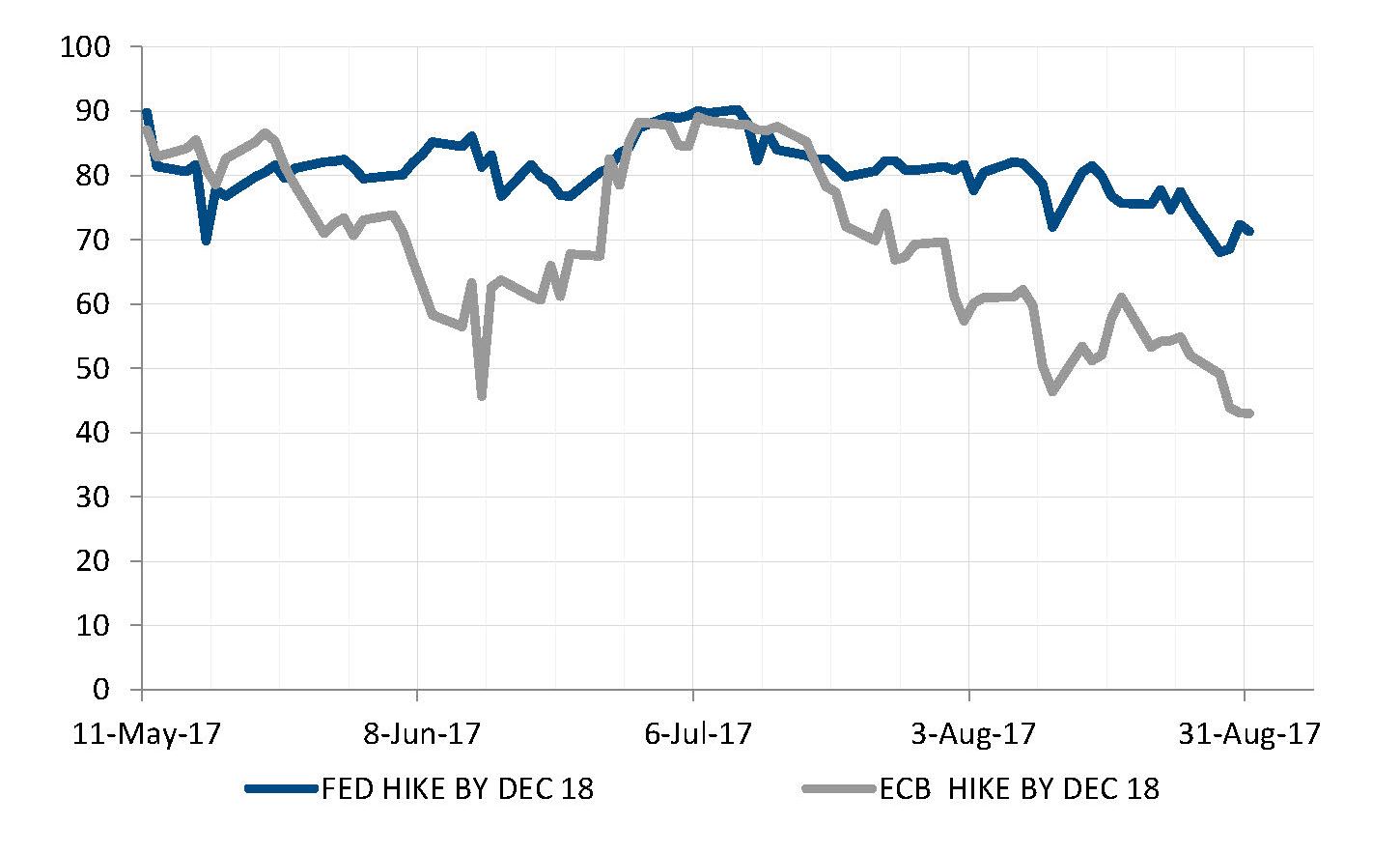

Central Banks - Declining rate hike expectations

Something peculiar has happened over the summer concerning market-based expectations of monetary policy in the US and Europe. While both the ECB and the Fed are increasingly hinting at normalization of their monetary policy, the probability of a rate hike in the next 18 months keeps sliding lower.

At the end of June, the probability of a 25bp rate hike was close to 100%. This was based on future contracts, Fed hikes and M. Draghi’s "Sintra speech" that acknowledged decreased risks in the Eurozone.

Since then, the probability of a rate hike has significantly decreased. Continuously low inflation is certainly part of the explanation. Central banks’ focus on balance sheet management (QE tapering in Europe, balance sheet unwinding in the US) has also played a part. However, this trend might also reflect the growing perception that in a high-debt and low-inflation environment, the ability of central banks to tighten financing conditions is structurally limited regardless of the growth and employment backdrop.

Market-based probability of rate hikes slid during the summer

Source: Bloomberg, SYZ Asset Management. Data as of: 31 August 2017

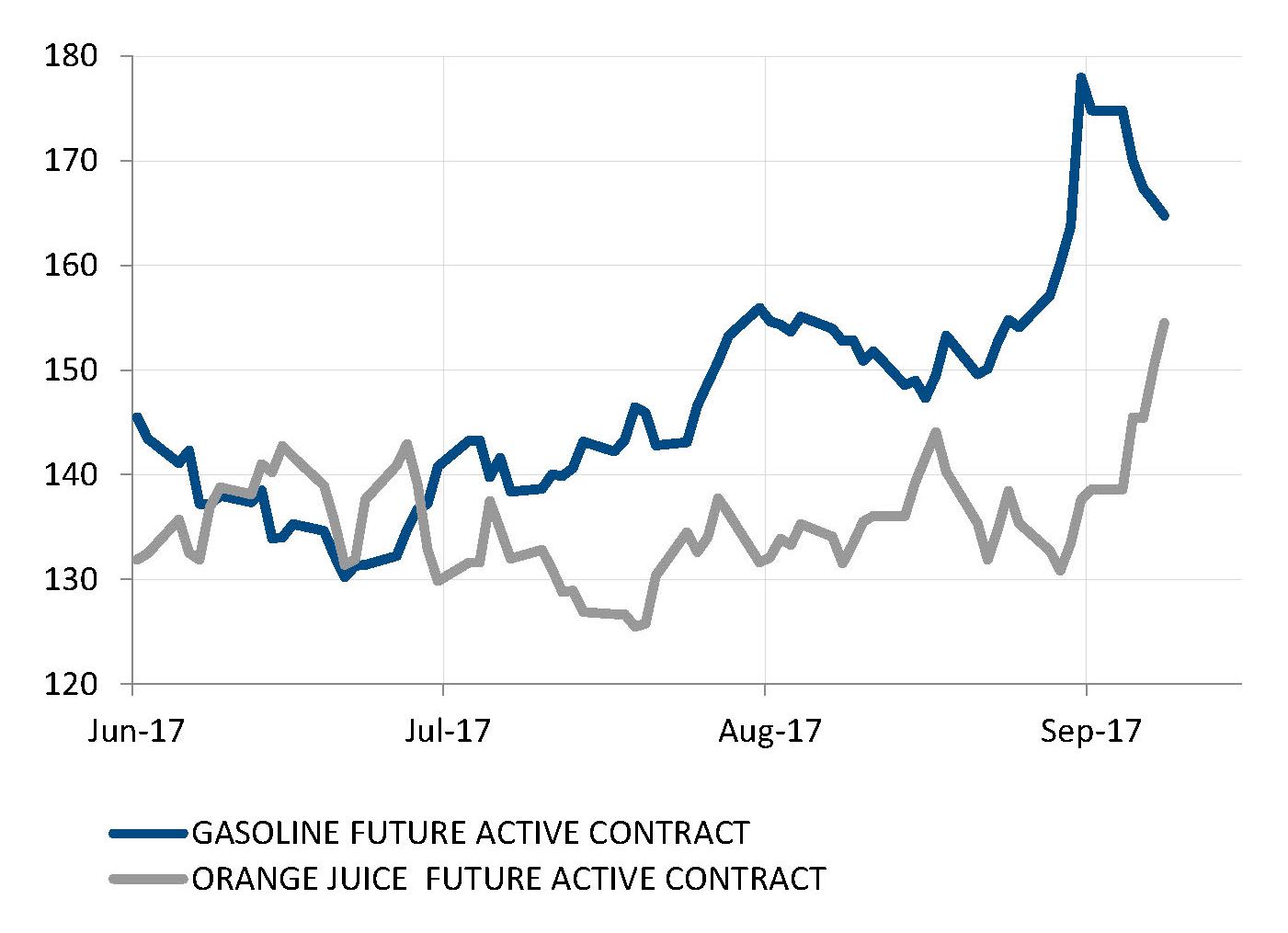

Hurricanes have prompted a surge in some commodity prices

Source: Bloomberg, SYZ Asset Management. Data as of: 8 September 2017

Markets - Impact of Hurricanes Harvey and Irma

In the Gulf of Mexico, hurricanes Harvey and Irma have inflicted heavy damages in southern Texas, Florida and the West Indies. Nevertheless, they have had a limited impact on financial markets, and appear unlikely to unsettle the current favourable growth backdrop. Indeed, the US Congress eluded a government shutdown as it allocated 15bn USD and a 3-month increase of the debt ceiling to disaster relief.

Still, the hurricanes have had a pronounced impact on specific sectors such as reinsurance (the S&P500’s worst performing sector since mid-August). Prices of gasoline have also jumped 20% after large refineries on the Texas coast shut were shut down. Orange juice prices posted a similar increase as the threat of Hurricane Irma

became tangible.

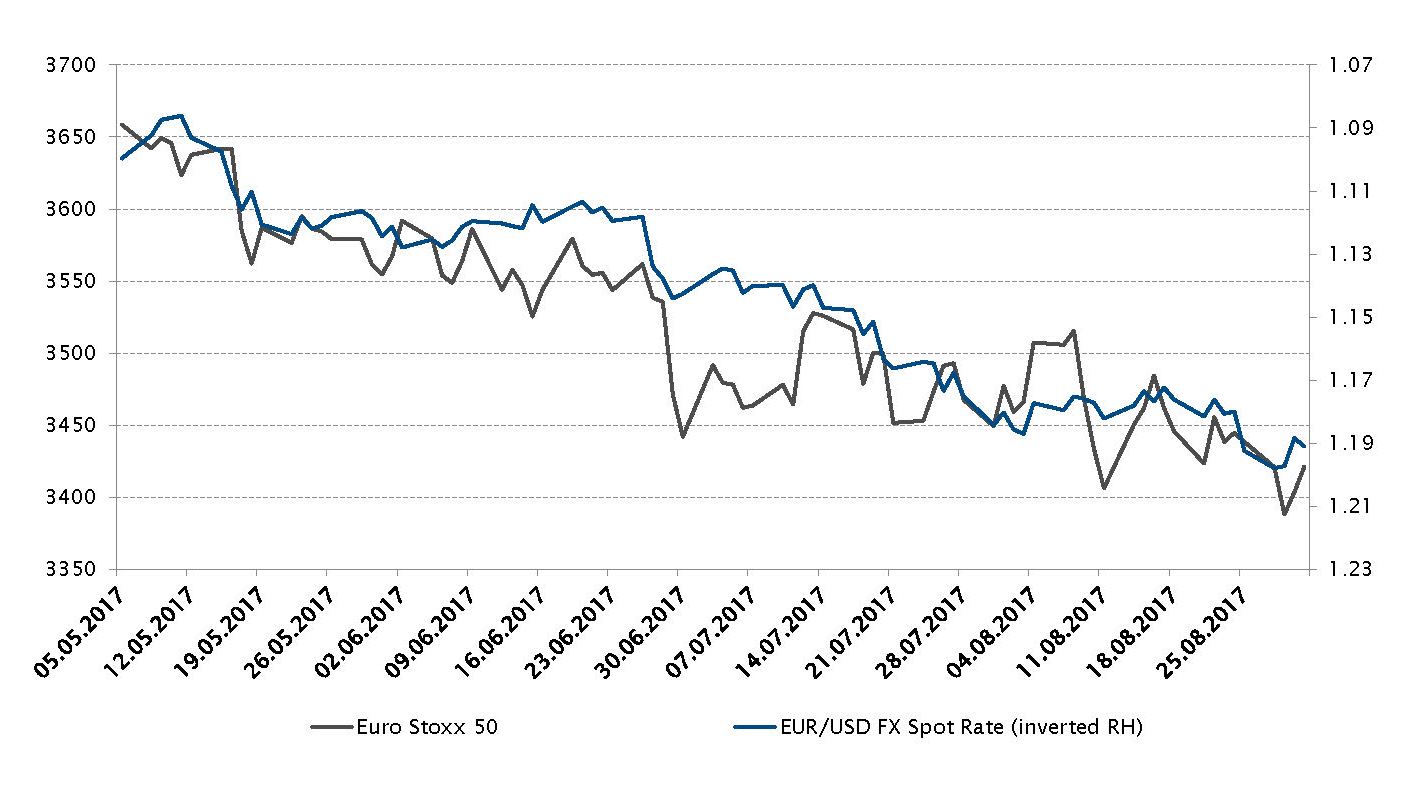

Equities - Rising euro impacts negatively European equities

Since the French Presidential election in May, European equities which were investors’ most crowded trade have been under pressure mainly due to the strength of the euro.

European equities have been attracting a lot of inflows following Emmanuel Macron’s victory, as the general landscape in Europe was evolving in the right direction. This is off the back of reduced political risk (in the US the "Trump trade" is fading away), a positive and improving economic momentum in many European countries, coupled with appealing valuations (compared to other equity markets of the developed world) were the main reasons why market participants favoured this asset class.

At the same time, the beginning of the summer saw some ECB statements turn more hawkish (leaving the door open to a possible roll back on their support this autumn), triggering a stronger euro that negatively impacted European companies, especially the export driven ones.

Finally, the Euro Stoxx 50 and the EURUSD exchange rate have posted returns of –6.1% and +9.0% (and YTD +4.0% and +13.1%) respectively since the 8th of May.

Euro Stoxx 50 index and the EUR/USD FX spot rate evolution

Source: Bloomberg, SYZ Asset Management. Data as of: 1 September 2017

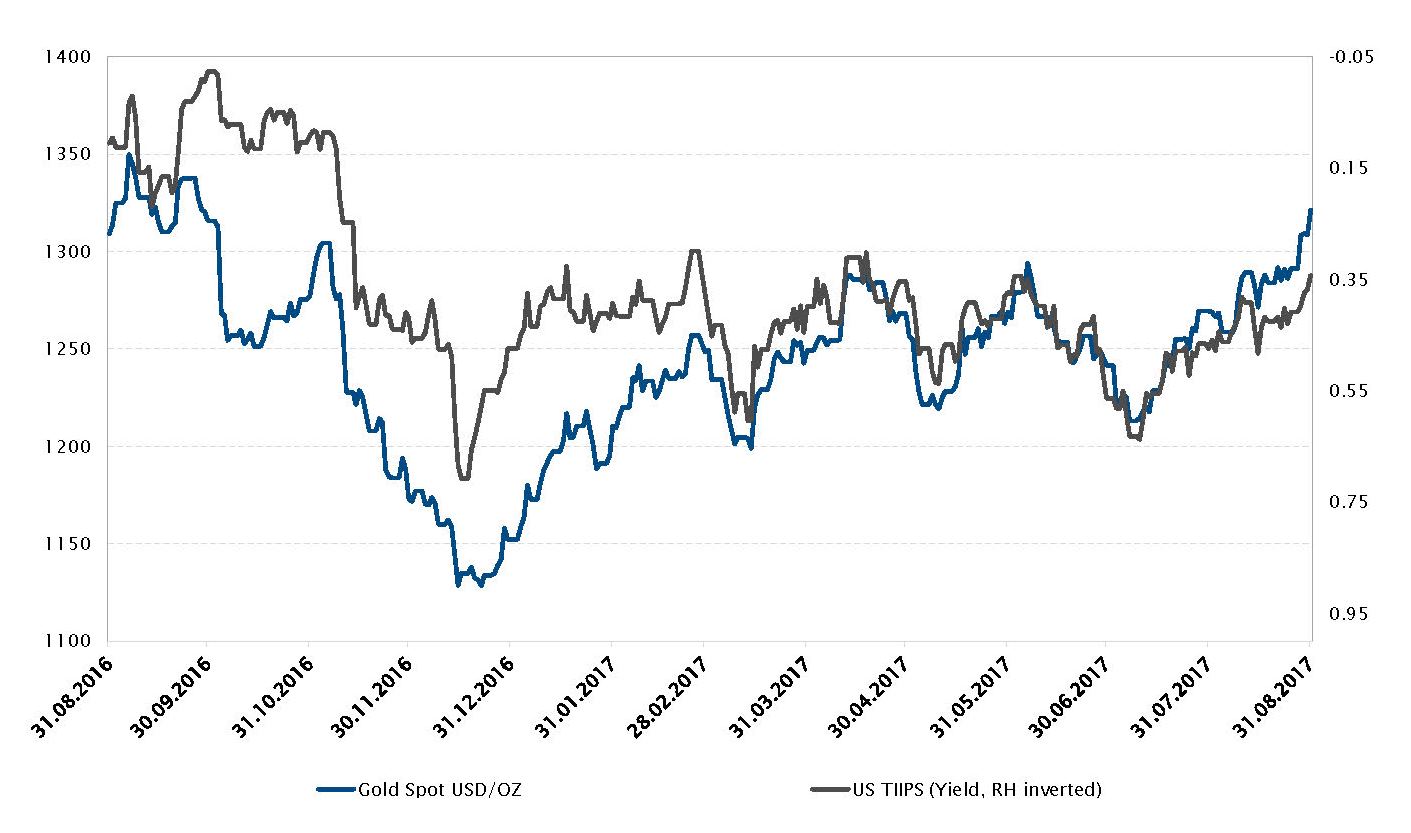

The price of gold (USD/OZ) and US government inflation-index bonds (yield) evolution

Source: Bloomberg, SYZ Asset Management. Data as of: 1 September 2017

Commodities - Gold is shining

Gold played its part as a safe haven during the month of August in the context of intensifying tensions around the geopolitical situation in North Korea.

Moreover, in the summer, the Fed’s more neutral approach with respect to increasing its key rates in September, contributed also to a reduction in the upward pressure on the dollar and therefore pushed gold prices higher.

Recently, the latest US employment report and inflation prints were weaker than expected and by a certain extent limited the upside to the US dollar, while interest rates were supportive for gold.

More generally, compared with lower real rates, precious metals were offering an alternative source of income for investors, especially with a lot of asset classes sitting in the expensive camp.

In this context, precious metals ended the month up 3.9% (YTD +14.5%) at 1320 USD/OZ while at the same time US 10-year Treasury yields fell 17bps (YTD -32bps).

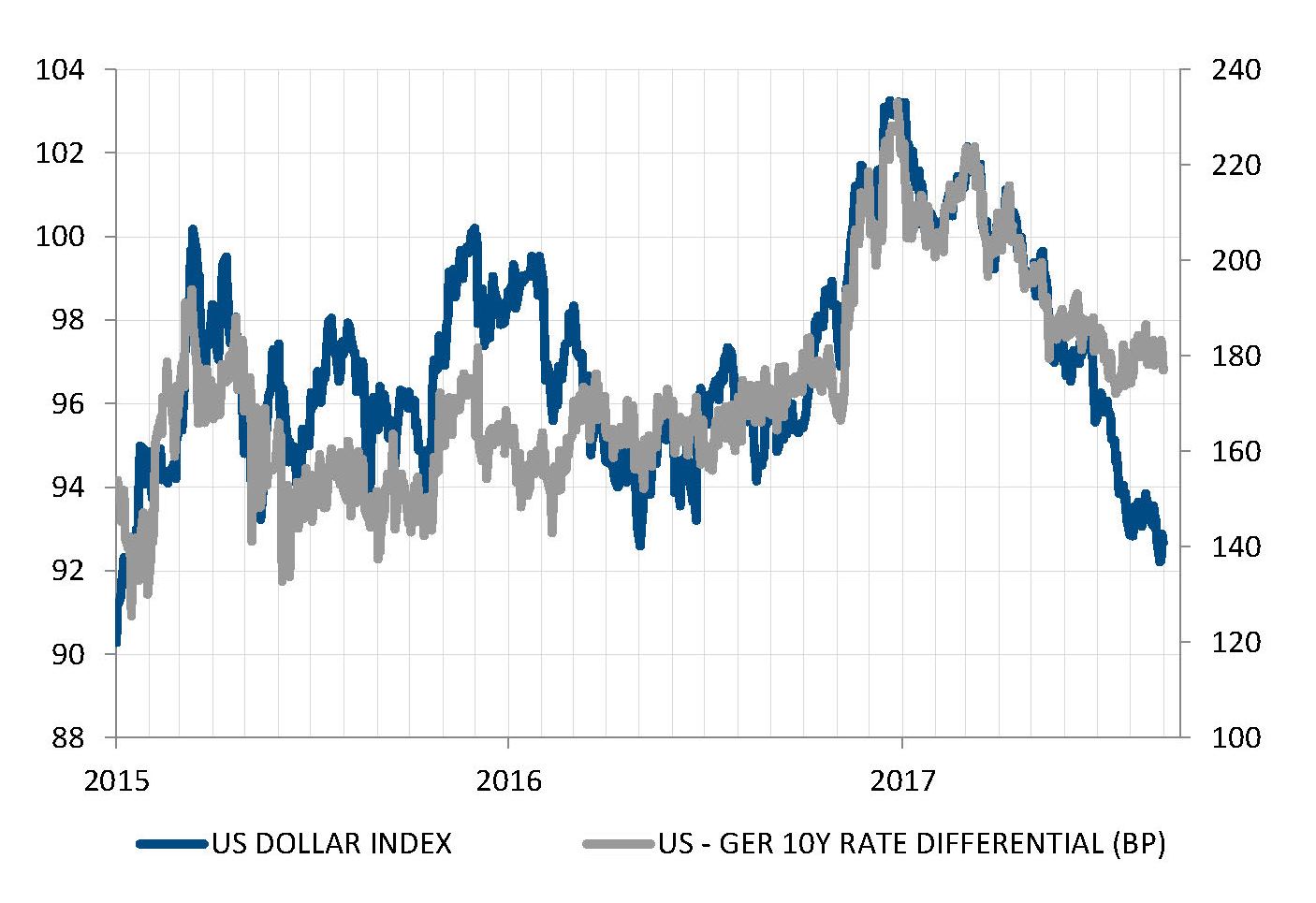

Forex - Rate differential cannot explain US dollar weakness

The euro is up 13% against the US dollar since the beginning of the year, with most of the appreciation having occurred since April. After hitting a 14-year high at the end of 2016, the Greenback has been softer across the board in 2017. Despite two Fed rate hikes, the dollar has experienced a significant pullback against the Japanese yen, the British pound, the Chinese yuan and most EM currencies.

Nevertheless, it seems that the relationship between rate differentials and currency movements has loosened somewhat in 2017. Even though US rates have trended lower, the magnitude of the movement has not been very pronounced. Long-term rates have also trended down in other markets.

A stronger dollar’s decline than what rate differentials suggest

Source: Factset, SYZ Asset Management. Data as of: 31 August 2017

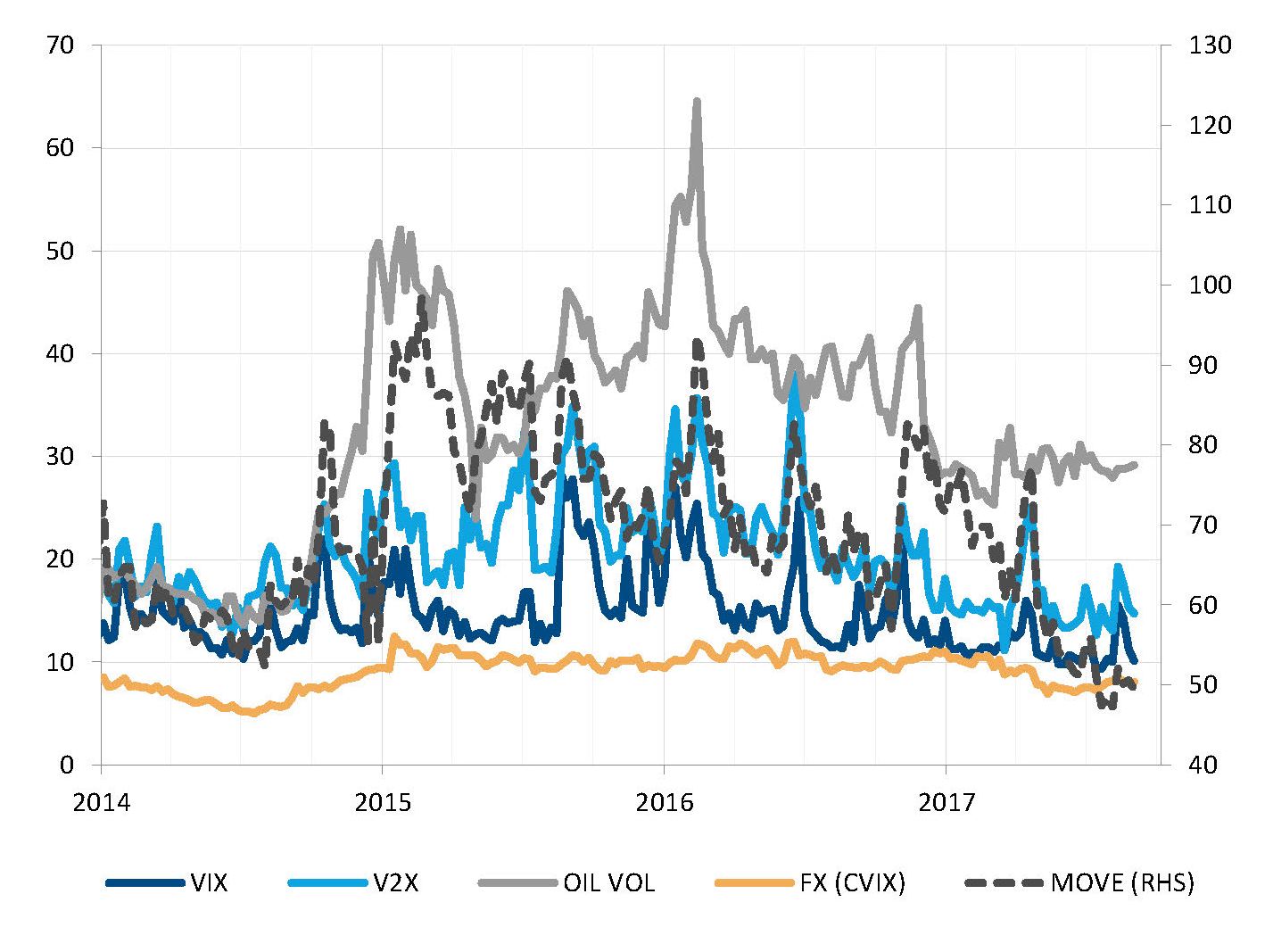

Compressed volatility regimes for all asset classes except oil

Source: Bloomberg, SYZ Asset Management. Data as of: 31 August 2017

Markets - Historically low volatility endure despite political and geopolitical uncertainty

The topic of low volatility on financial markets has been widely discussed this year, as several gauges reached historically compressed levels. Among the main asset classes, only oil remains in the relatively high volatile regime, as it has been in since the price collapse in 2014. Gauges of volatility for US equities (VIX), European equities (V2X), currencies (CVIX) and bonds (MOVE) all evolve at, or close to record low levels.

Yet, in August, there were events that could (or should) have pushed volatility higher. Political instability in the US, particularly the high-profile turnover in the Trump administration, could have been a trigger. The escalation of tensions around North Korea, with a ballistic missile flying over Japan caused an increase in volatility, but only for a short period of time before it settled back in its compressed regime. One can be left wondering what it would take to see volatility rise durably

on financial markets.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)