As is often the case, August has not been as quiet a month in financial markets as those taking summer holidays would expect. After two months where the sweet nectar of upcoming rate cuts propelled equity and bond markets, a tweet was enough to remind investors of the harsh reality: trade tensions and uncertainties surrounding global growth are here to stay, and with them potential downside risks to sentiment and economic activity.

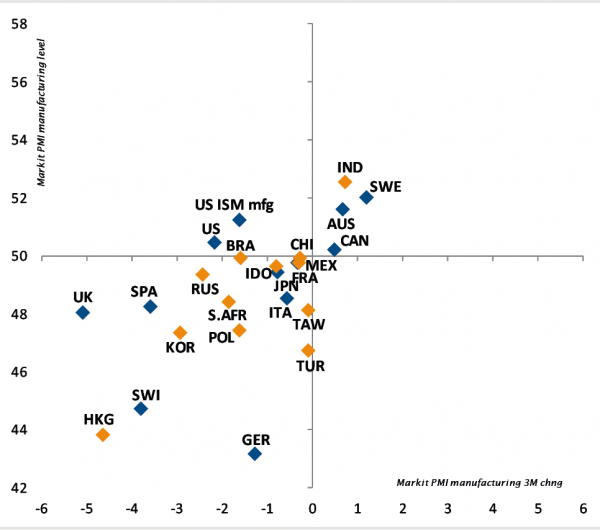

In this context, it is important to distinguish between real and potential developments. Objectively, the current situation is that global economic growth continues to slow down due to weakening cyclical momentum, softer industrial activity and uncertainties about global trade and geopolitical conditions – US tariffs and Brexit, just to mention a few. However, so far, economic growth remains supported by resilient service activity and household consumption, with low or declining unemployment, accommodative financing conditions and increased house prices.

Looking forward, the risk is clearly that the downward trend in industrial activity and business sentiment might spill over to the service sector and impact consumer confidence. The longer this downward trend continues, the higher the chances that such a spillover could trigger the dreaded scenario of a global recession. However, there is no evidence this scenario is taking shape yet. Hence, it would be as imprudent to assume such a negative scenario will materialise as it would be to assume things will finally take a turn for the better.

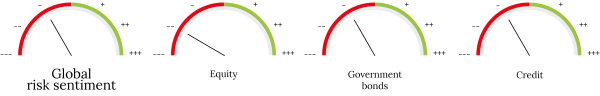

Depending on the scenario, valuations of equities or bonds might be seen as either too expensive or still attractive given the significant monetary policy easing that is expected. In this situation, we believe the best approach is to maintain a balance between assets likely to benefit from a scenario of growth stabilisation, such as equities, credit and emerging market (EM) debt on the one hand, and assets expected to defend portfolios on the other, should a global recession materialise. These include government bonds, gold and the Japanese yen.

We feel the main danger at this stage is to yield to the temptation of acting without a factual basis, thus destabilising the allocation and taking an unwarranted bet. While acknowledging the rise in downside risks, we are sticking to our ‘cautiously neutral’ stance, favouring intra-asset class reallocation to enhance the robustness of our portfolios.

_Adrien Pichoud