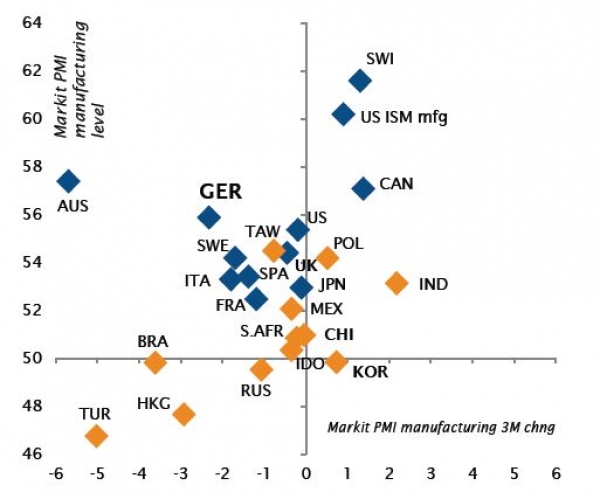

The not-so-bright geopolitical backdrop, dominated by trade war rhetoric, has been on the forefront of investors’ minds over the last several months. At the same time, economic growth indicators in Europe and Japan have disappointed expectations – which were inflated after an exceptionally good year in 2017. Moreover, the US yield curve has continued to flatten and could be inverted within the next six to twelve months – in the past, this has signalled a recession was coming in the next half year to a year. US expansion is not in its infancy; the better part of its recovery and expansion are now behind us and thus a recession, or at least growth moderation or stagnation, will happen in the future. But this is still too early to call and it is too early for us to act accordingly in our portfolios. Furthermore, tentative signs of growth stabilisation in the rest of the developed economies are reassuring. The picture is more mixed in emerging markets, but we also expect it to improve going forward, as the dollar should stabilise and the Fed’s tightening has been priced in for the foreseeable future.

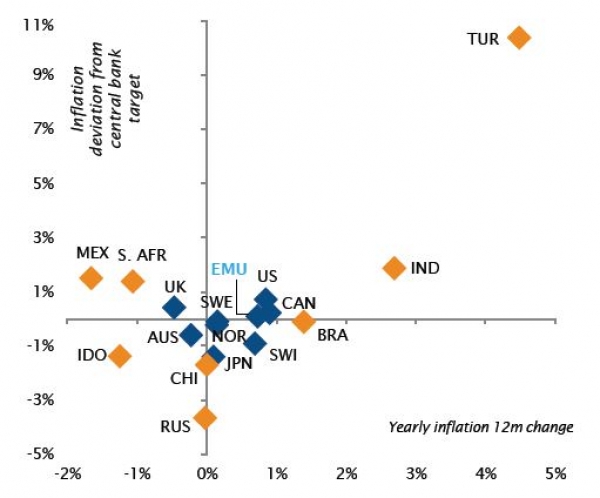

On the bright side, overall growth remains decent, inflation is behaving well and, except for the Fed, other major central banks’ monetary policies remain clearly supportive. China’s slowdown remains under control as its government switched back to an easing policy of monetary and fiscal stimulus and a weaker yuan. US Q2 earnings season started on a strong note, as banks announced massive shares buyback, and US equities valuations, which were very expensive at the beginning of the year, appear close to fair value. Credit, especially European high yield and investment grade, has also become less expensive over the last few months.

In a context where inflation has not yet become an issue, financial conditions remain on an accommodative side and growth has not faltered, we have kept a favourable stance on risk and a mild disinclination on duration – the path of least resistance for rates remains on the upside. However, in order to somewhat hedge our pro-risk positioning from an eventual trade war escalation, which remains impossible to predict or quantify, our geographic equities positioning remains clearly tilted towards the US and avoids strong sectorial bias globally. On the fixed income side, an additional pinch of European credit – or at least a relative overweight compared to US credit – seems a good way to recognise European growth.

_Fabrizio Quirighetti