There are plenty of reasons to be cautious, and that thus explain the current challenging market environment: the Facebook data scandal, trade disputes, monetary policy tightening and softer economic data, to name a few. While rising interest rates and weaker growth momentum in developed markets aren’t really a surprise, the conjunction of these two elements has created a more fragile market backdrop compared to last year’s perfect Goldilocks scenario. In this context, an escalation in the retaliatory imposition of tariffs is certainly the biggest worry for markets. So far, the numbers aren’t significant enough to derail global growth and we believe that the US (i.e. President Trump), as well as China and other major economic partners, have no real incentive for a trade war that will certainly lead to mutual destruction. In other words, rhetoric is cheap.

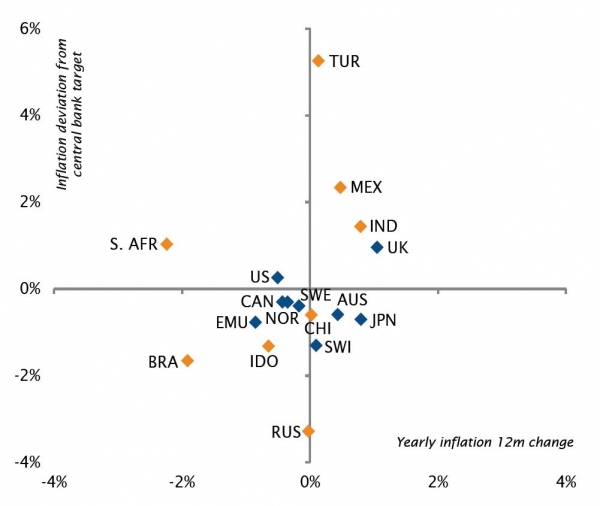

On a more positive note, US inflation concerns have receded, validating to some extent our tactical decision to upgrade duration to a mild disinclination last month. We are keeping this stance as there is perhaps a little bit more upside to emerge in the next few weeks, especially as government bonds valuations have improved since the end of last year. However, the medium-term picture remains challenging as inflation fears may resurface sooner or later and the central bank’s tightening path is reassessed.

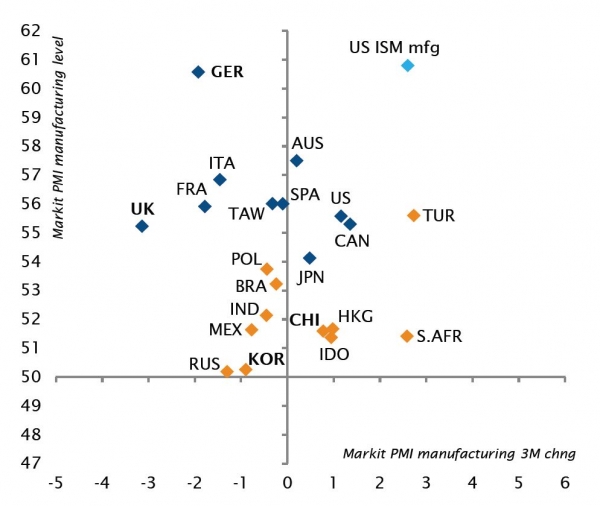

In the fixed income space, our mild preference for emerging market debt has been reinforced by an improvement in both absolute and relative valuations, especially versus credit. Furthermore, emerging economies are experiencing their Goldilocks moment with an improving economic backdrop, while some additional monetary policy easing should support a slow and gradual growth rebound. However, EM bonds, especially in local currency, might face some pressures with the coming Fed rate hike and/or a dollar rebound; hence, we remain tactical and selective within this asset class.

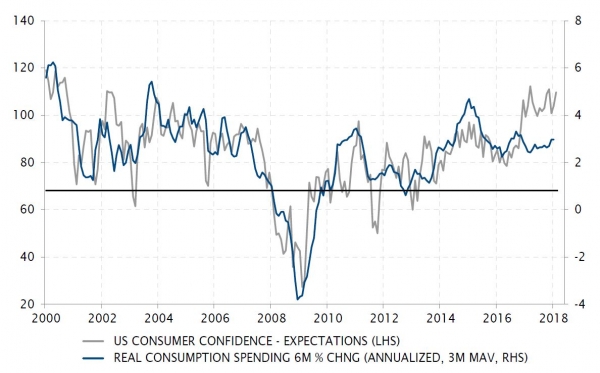

As far as the equity market is concerned, the potential regulatory headwinds for some big technology companies have translated into disillusionment with the market leaders. These uncertainties are weighing on our assessment of valuations, especially for high-flying names. But, we aren’t in the dot-com bubble any more - most of today’s technology companies exhibit strong earnings growth and cash flow generation. The same could be said for the rest of the equity markets; there has clearly been a change in the volatility regime since February, even if profit growth estimates have accelerated since the end of last year. Here is the intricate dilemma investors have to face: a currently very favourable economic backdrop, which is expected to deteriorate going forward. The million-dollar question is how much and how fast? We believe it’s more a mid-cycle slowdown than a recession. And on the other side of the equation, stretched valuations leave little room for manoeuvre to absorb external or political uncertainties, such as a full-blown trade war that could pose a serious threat to the macro picture. While the status quo is the least likely outcome (i.e. volatility does have some delayed impact), we are keeping a mild preference on risk as we continue to believe we are experiencing a correction rather than the beginning of a bear market. Spring should bring some green shots of hope.

_Fabrizio Quirighetti