When markets decline, of course investors want capital protection, but over the long run, the goal is to generate attractive returns - this is why investors take the ‘risk’ to invest in capital markets in the first place. In order to address these needs in this new market paradigm, investor will have to look beyond traditional balanced or popular risk-parity solutions to generate the risk/return profile they seek.

To better navigate financial markets today, the multi-asset portfolio managers at SYZ Asset Management benefit from a robust idea generation framework known as the Investment Strategy Group ("ISG"). The ISG serves to bring together all our multi-asset, credit and equity investment professionals so as to look at risks and opportunities across multiple vectors. This group analyses opportunities at a global, regional and sectoral level in addition to looking specifically at 23 different countries for investment ideas. The result of this broad research forum is that our multi-asset investment team is able to find and implement investment ideas (for both generating return as well as controlling risk) regardless of the market environment.

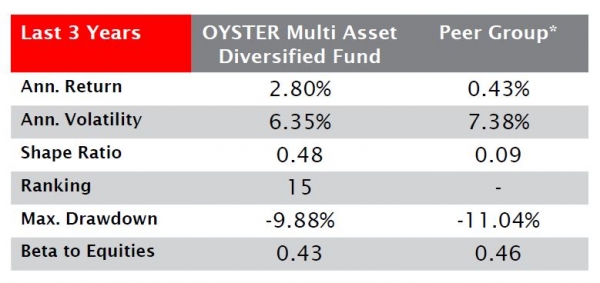

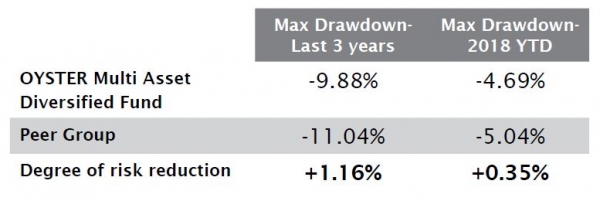

While our research and idea generation process serves to support our multi-asset portfolios managers, it is the implementation of these ideas where value is created and what has contributed to our strategies producing attractive returns over time. In the case of our Multi Asset Diversified strategy, we have for many years achieved to balance the objective of attractive returns within a tightly controlled risk framework.