Nomadism, originating from the Greek word « νομάς », meaning roaming about for pasture is by far the oldest human subsistence method, and the most efficient strategy for exploiting scarce resources. Within fixed income markets the equivalent search for resources, or yield, was never as intense, and well thought moves are crucial for a successful result.

Over the past few years, investors have turned to risker strategies as the European fixed income markets continue to provide low or negative yields due to supportive monetary policy from the European Central Bank, and volatility levels that remain at historical lows. Luckily, the relatively new asset class of subordinated debt offers an attractive balance between risk and return, and a range of positive characteristics.

Hunting for yield in safe grounds

Wednesday, 01/10/2018Subordinated debt offers an attractive balance between risk and return, and a range of positive characteristics, namely attractive yield, IG credit quality of issuers, liquidity, and the ability to absorb the impact of interest rate increases.

“Subordinated debt provides investors with high yield like carry, solid credit & liquidity profile, diversification within a fixed-income portfolio, and the support of strong fundamentals.”

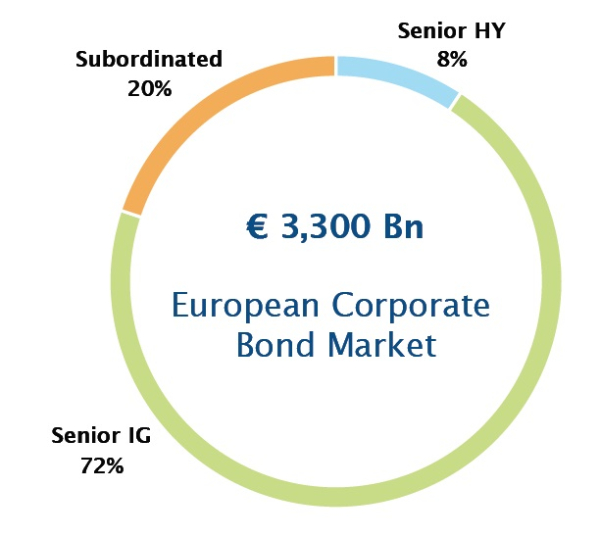

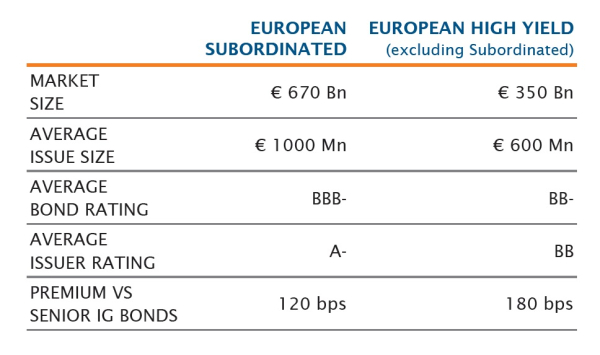

The European subordinated bond market is more than twice the size of the senior High Yield one and offers a variety of investment instruments, namely Contingent Convertibles and Tier 2 debt issued by banks, Tier 1 & Tier 2 debt issued by insurances and hybrids issued by non-financial companies. These instruments rank lower in the hierarchy among the debt owed to the company’s holders and exposed to specific risks such as coupon deferral or cancellation and loss absorption, but at the same time they are issued by highly rated companies and compensate investors with higher yield.

The subordinated debt universe is characterized by high issuer rating distribution with 95% of issuers being rated investment grade. This comes as no surprise as banks, re-capitalized and de-risked by doubling their core equity over the past 10 years, while at the same time decreased Risk-Weighted Assets and Non Performing Loan ratios. Within insurances, improvements in capital composition and solvency ratios lead to rating upgrades.

The asset class offers attractive relative value vs. high yield, and mispricing opportunities as there is much higher spread dispersion when compared to senior investment grade bonds, with the added benefit of lower duration exposure. Finally, an additional benefit of subordinated bonds is their ability to absorb the impact of interest rate increases, due to their embedded high risk premia, and therefore perform well versus other fixed income strategies in periods of rising rates.

In overall, as with the nomadic lifestyle, the subordinated debt asset class does not come without risks, but compensates investors by providing diversification within a fixed-income portfolio, high carry (high yield like) with solid credit & liquidity profile, and a long-term story driven by structural recapitalization of financials and supportive central bank activity.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)