Catalonia held a disputed referendum on independence on October 1st and later in the month pro-independent parties in the Catalan regional parliament unilaterally declared independence from Spain - a move which led the Spanish government to assume direct control of the region. The uncertainty caused by this crisis has provided an opportunity to add exposure in the Spanish housing sector. Two names we are particulary focused on are of Neinor Homes and AEDAS Homes, both of which recently became assessable following their public listings.

Hunting for Value in the Catalan Crisis

Wednesday, 12/06/2017Pro-independence parties in Catalonia held a disputed referendum for independence on October 1st and later in the month unilaterally declared independence from Spain after the contested vote - a move which led the Spanish government to assume direct control of the region. Neinor Homes and AEDAS Homes are two newly listed names in the housing sector that we believe offer attractive prospects, especially in light of the uncertainty caused by this domestic crisis.

“ The uncertainty created by the Catalan crisis has provided an opportunity to look at some domestically-focused stocks that are currently under pressure due to the turbulent political situation. ”

Crisis Triggers Housing Sector Opportunity

Political turmoil erupts in Catalonia

Following a tumultuous 2016 on the political front, 2017 was closing out to be a rather less eventful year. Europe had come through a number of precariously balanced elections largely unscathed, and political risk was less of a market issue. Then, virtually out of the blue in October, Spain descend into political crisis. An unauthorised and contested referendum in Catalonia, followed by a unilateral declaration of independence by a slim coalition of pro-independence political parties in the regional government triggered a constitutional crisis. This led to the Spanish government seizing control in Catalonia under the extraordinary powers granted under Article 155. For the time-being, the government’s temporary measures have defused the tensions, but with snap elections looming uncertainty remains high and a significant amount of damage has already been done. Some 1800 companied are believed to have moved their legal domicile out of Catalonia since the beginning of October, and regional macro indicators have already begun to weaken. As contrarian investors, we are attracted to these kinds of situations, which may throw up long term investment opportunities in high quality companies.

We have struggled to find many ideas in Spain of late, not for the lack of interesting companies, but mainly due to the fact that the strong economic recovery has been reflected in valuations. However, a structural theme we have been investing in is the housing recovery in Spain, and the uncertainty caused by the Catalan crisis has provided an opportunity to add exposure in this sector.

Playing the Spanish housing recovery

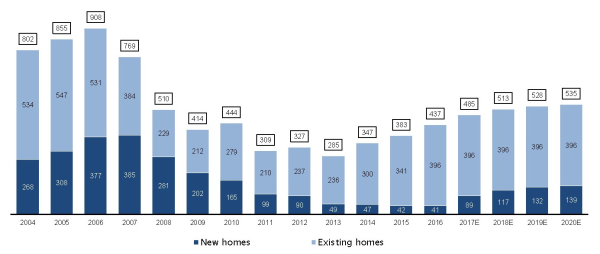

Spanish housing is a very attractive long-term recovery theme. We have been looking at this sector for a while and exploring potential entry points. The recent listings of Neinor Homes and AEDAS Homes has presented us with our chance to deploy capital in this sector. Activity in the housing sector contracted very sharply after the financial crisis, but has begun to recover strongly over the last couple of years. Housing demand is improving on the back of population growth, falling unemployment, low interest rates and better availability to mortgage credit.

At the same time, excess supply has been largely absorbed. The pre-2008 housing bubble led to an excess of properties being built throughout Spain that resulted in empty, unsold properties and significant declines in prices. While there remains considerable stock in some regions, in the main cities this is now very small.

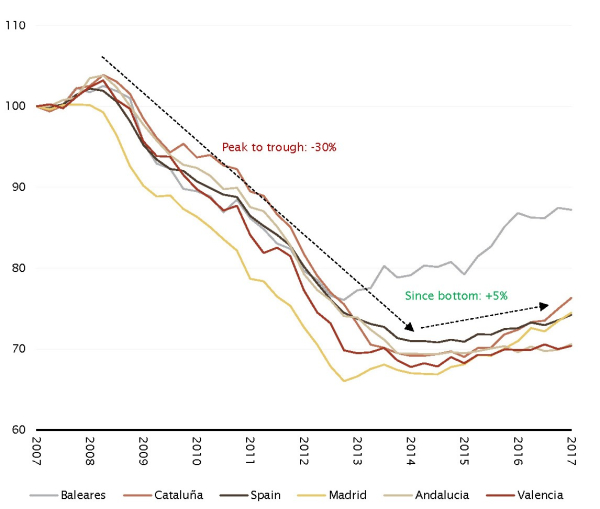

These supporting structural housing dynamics have seen house prices recover from the bottom in 2014-15. In 2016, house prices rose by 2%, although this varied significantly by region. In Madrid, Barcelona and Mallorca, house prices rose much more strongly. Despite this recovery, house prices remain c25% below their peak in 2008.

With housing starts still around 80% below their peak, the opportunity for a pick up in housebuilding activity in Spain is considerable in our view.

This is providing a very attractive backdrop for new and well-managed housebuilders, especially as most of the competition was wiped out when the housing bubble burst after 2008.

Enter the newcomers

Two of the major IPOs in Spain this year have been that of the housebuilders: Neinor Homes and AEDAS Homes. As contrarians, we are often attracted to investors and companies with a similar mind-sets. In anticipation of a housing recovery, the backers of both Neinor and AEDAS saw an excellent opportunity to build up a high quality land bank in some of the best cities and regions in Spain, and at very cheap valuations. With that land bank now secured, the management teams have raised capital from the public markets to allow them to fund and execute the building phase, and deliver the planned new units in the coming years. We believe these two companies have amongst the best land banks, first-mover advantage and high quality management teams capable of executing their strategies. This is a long-term theme, but we believe the cash generation potential is very strong a few years out and are therefore we, as investors, are happy to wait patiently for these rewards. Housebuilding is, however, not without its risks. The recovery is of course largely dependent on the continuing strengthening of the macro conditions both in Spain and more broadly across Europe. The Catalan crisis is a new risk in Europe, but most likely not the last one we will see over the short and medium term (for example, with Italian elections looming large in 2018).

Will the Catalan crisis derail the Spanish housing recovery?

We think not, at least not in the long-term. We believe the structural drivers underpinning the housing recovery, coupled with strengthened banking system, will continue to support the broad-based recovery in the coming years. The Catalan crisis has shocked the regional economy, and doubtless will lead to a slowdown in Catalonia as investment is deferred. Accounting for around 20% of GDP, Catalonia is an important part of the Spanish economy so its slowdown will be felt across the country but we believe this will be short-term and limited. A lot of the companies have relocated their legal domiciles outside of Catalonia, but to other parts of the Spain and not outside of Spain altogether., This has mostly been a fiscal and trade-protection move to ensure a presence within the E.U.Around 15% of the land banks of Neinor and AEDAS are exposed to Catalonia. It is early days still, but we expect a slowdown in regional activity as a result of the political turmoil and resulting uncertainty. However, given the relatively limited exposure to the region, we believe this risk is manageable and largely priced in to the shares.

We will continue to monitor the Catalan situation closely, and assess whether any further turmoil and uncertainties around the elections will provide opportunities to add to our exposure within this theme or any other value opportunities that may emerge.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)