- 1. Household consumption continues to support US economic growth

- 2. Eurozone – The divergence between manufacturing and service sectors cannot last

- 3. Eurozone – Investors have given up on inflation expectations

- 4. The US dollar has little upside… but also limited downside potential

- 5. Rates – Greece 5Y government bond yields fall below US 5Y

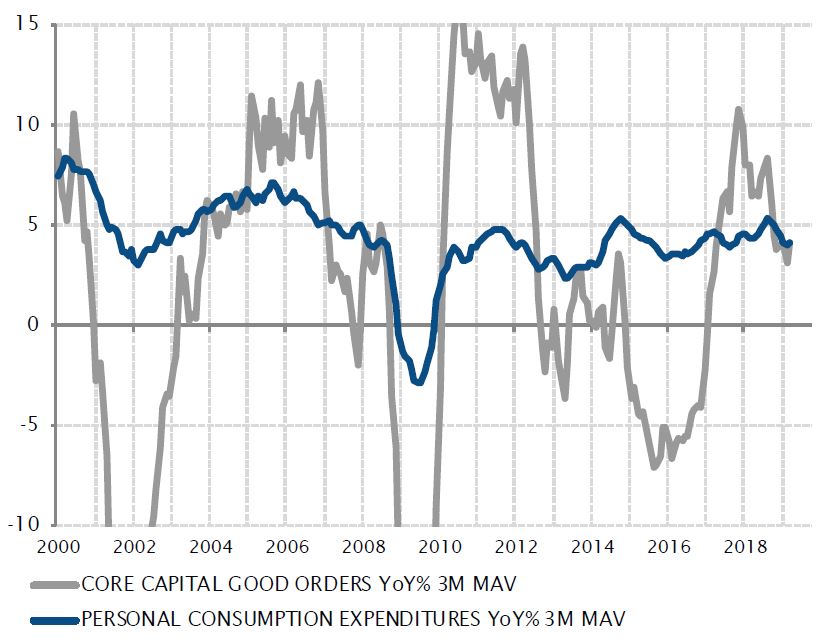

Household consumption continues to support US economic growth

The US economy is bending, but not breaking. Economic growth momentum has been softer since Q4 last year, due to a variety of factors. These include the dissipating fiscal impulse triggered by President Trump’s 2018 tax cuts, tighter credit conditions for businesses and households caused by Federal Reserve interest rate hikes, as well as the impact on domestic investment from the deteriorating US-China trade relationship.

In this context, the US growth slowdown witnessed over the past few months is hardly surprising. The question we must ask ourselves is whether this is the early stage of a more concerning downward trend likely to extend in the months and quarters ahead.

We are reassured by the main contributor to US GDP growth – household consumption is still growing at a decent pace, supported by positive job market dynamics. Business investment has essentially adjusted to this less favourable environment. Rather than collapsing, this cyclical side of the economy has merely corrected since the strong pickup of the past two years.

With the Fed having paused – if not ended – its rate hike cycle, and the dissipation of the Trump tax plan’s ‘base effect’, headwinds to US growth have diminished. US-China trade discussions remain a pending threat to the outlook, but domestic drivers are set to maintain GDP growth around its long term potential of 2%.

Investment spending ebb and flow, firm and resilient household consumption

Sources: Factset, SYZ Asset Management. Data as at : 08.05.2019

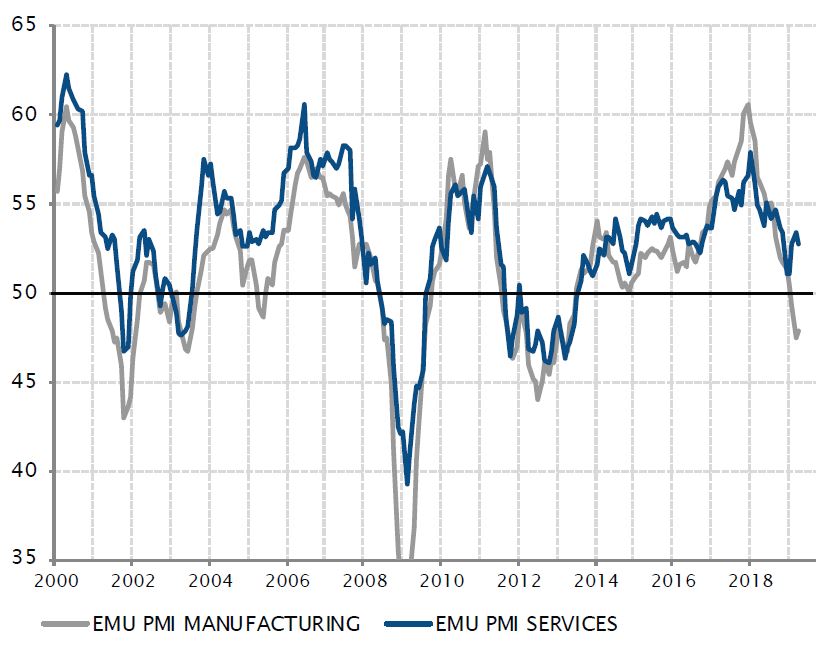

Divergence between service and manufacturing sectors can hardly widen further

Sources : Factset, SYZ Asset Management. Data as at : 08.05.2019

Eurozone – The divergence between manufacturing and service sectors cannot last

Since the beginning of the year, diverging growth dynamics have raised a large question mark around the eurozone’s short and medium-term outlook. The industrial manufacturing sector has practically entered a mini-recession, led by Germany, as the impact of weaker China demand in 2018, US tariffs on steel and aluminium and Brexit uncertainties concurred to create the sharpest decline in activity since 2013. At the same time, domestic demand and domestic-related service activity have held up reasonably well, helping fuel the growth pickup witnessed in Q1, up 0.4% versus 0.2% in Q4 2018.

This divergence between the manufacturing and service sectors cannot last long. The most likely outcome is a confirmation of early pickup signs in the manufacturing sector. With Chinese growth stabilising under the influence of politically-driven monetary and fiscal stimulus, and with the support of resilient domestic demand fuelled by positive job market dynamics, business investment in Europe should at least stabilise in the months ahead – even if Brexit continues to hang over the heads of European companies like the Sword of Damocles. Given current household consumption dynamics, this should be enough for the eurozone to stabilise around its long-term potential – at 1-1.5% – in the second half of 2019.

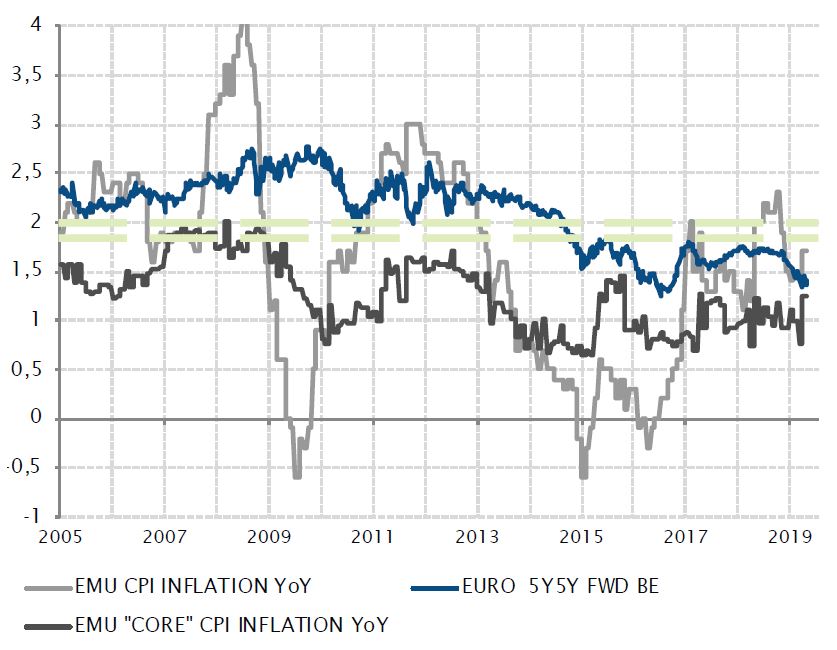

Eurozone – Investors have given up on inflation expectations

Has Europe slipped into the same trap as Japan two decades ago? Despite numerous similarities between the two cases, many differences also remain. However, there is one clear area where the eurozone has turned Japanese – subdued inflation dynamics and what central bankers call ‘the de-anchoring of inflation expectations’.

Not only has inflation consistently been below the central bank target of ‘less than, but close to 2%’ since 2013, core inflation has been below target for the last decade. It has also been consistently below the market’s medium-term inflation expectations – measured by five-year expected inflation in five years’ time, or the ‘5Y5Y’ forward breakeven. Having constantly proved overoptimistic, inflation expectations have gradually drifted lower, settling below the ECB’s target level.

In plain English, this means since 2015 markets have not believed inflation will come back within the ECB target range anytime soon. This raises a credibility issue for the ECB with respect to its inflation target – similar to what the Bank of Japan has experienced. It also means the only way for the ECB to defend the credibility of its inflation targeting framework is to maintain a super-accommodative stance for as long as necessary to bring inflation expectations back in line with its target. This could take a long time – as the BoJ is well aware.

Low inflation expectations reflect a disbelief inflation can significantly pick up anytime soon

Sources : Factset, SYZ Asset Management. Data as at : 08.05.2019

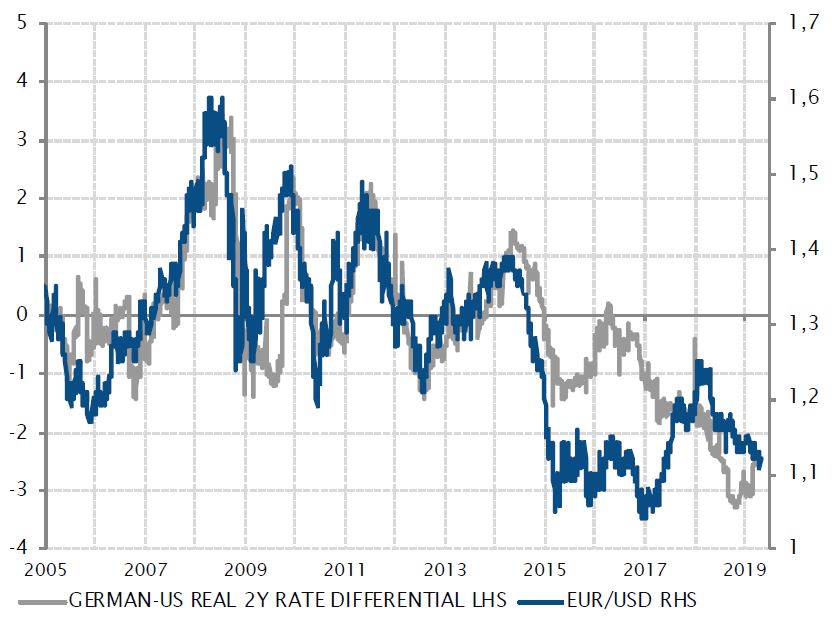

USD/EUR yield differential supports the dollar, but has likely reached a peak

Sources : Factset, SYZ Asset Management. Data as at : 08.05.2019

The US dollar has little upside… but also limited downside potential

Following the Fed’s monetary policy U-turn in Q1, US dollar strength has lost the underlying support of monetary policy normalisation, a trend which has been rising since 2015. As a result, the widening divergence between US short-term rates and the rest of the world has been paused for some time. It may even have reached its peak, if the Fed has in fact completed its rate hike cycle.

Beyond the evolution of short-term rates, the announced end of the Fed’s balance sheet unwinding by September – and implicit neutrality beyond then – has also contributed to stopping the diverging trend between the US and other major economies. In such a context, the upside potential for the greenback now appears quite limited.

That being said, the yield differential in favour of the US dollar remains hefty, whether in nominal or real terms. This differential is likely to prevent a significant decline in the US currency as long as it remains around current levels. A change in short-term rates or inflation dynamics would be required to trigger a sizeable movement in the greenback going forward.

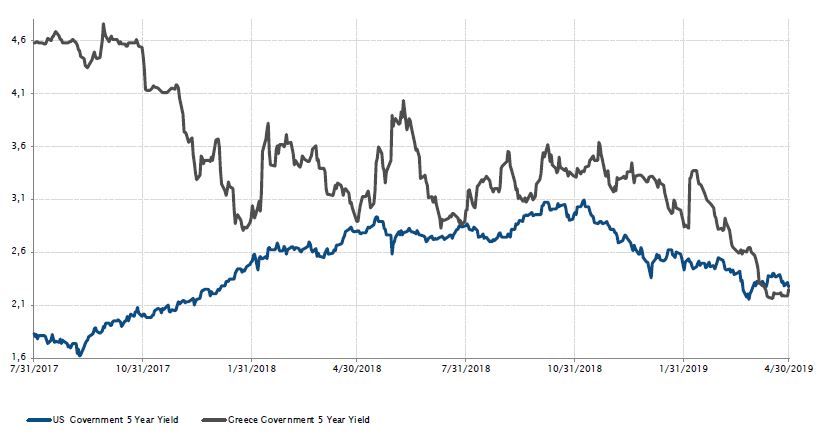

Rates – Greece 5Y government bond yields fall below US 5Y

The Greek 5-year bond yield fell below the US 5-year yield, at 2.28% against 2.26% at the end of April. At the peak of the European periphery crisis, Greek 5-year yields broke the 20% threshold, later falling below 5%. At the time, Greece was at the epicentrel of the eurozone debt crisis – it plunged into a deep recession, followed by several IMF bailouts.

Greece was not the only periphery country whose financing cost made a comeback. The Portugal 10-year yield decreased from its peak – at more than 13% in 2011 – to its current level of 1%.

More recently, Greece embarked on a fiscal reform programme, which fuelled investor confidence. In this context, Athens took the opportunity to tap the international fixed income market, selling its first 10-year bond since 2010 with a yield of 3.36% at the end of April.

Evolution of US and Greek 5-year yield (%)

Sources : Bloomberg, SYZ Asset Management. Data as at : 16.05.2019

EM hard currency debt spread has not tightened as much as plain corporate credit

Sources : Bloomberg, SYZ Asset Management. Data as at : 30.04.2018

Credit spreads – EM versus HY

There was some pullback in rates after the strong gains posted last month, especially as the growth backdrop improved and risky assets resumed their ascent. Thus, while core government interest rates rebounded by 10 to 15bps in April, credit spreads tightened even further in the high beta segment, finally leading to more-than-decent returns for US high yield, up 1.3%, and European subordinated financials, up 1.4%.

Emerging market bonds, up 0.3%, as well as EM equities, up 2.5%, were positive last month, albeit masking country-specific stories. Although EM debt, especially in hard currency, should once again find itself supported by the current goldilocks context, idiosyncratic difficulties concerning Turkey and Argentina weighed on the global EM spread, which did not tighten as much as plain investment grade or high yield credit spreads in April, or since the beginning of the year. In fact, it has barely moved year-to-date, and the high yield index’s spread is now marginally tighter than the EM hard currency debt spread.

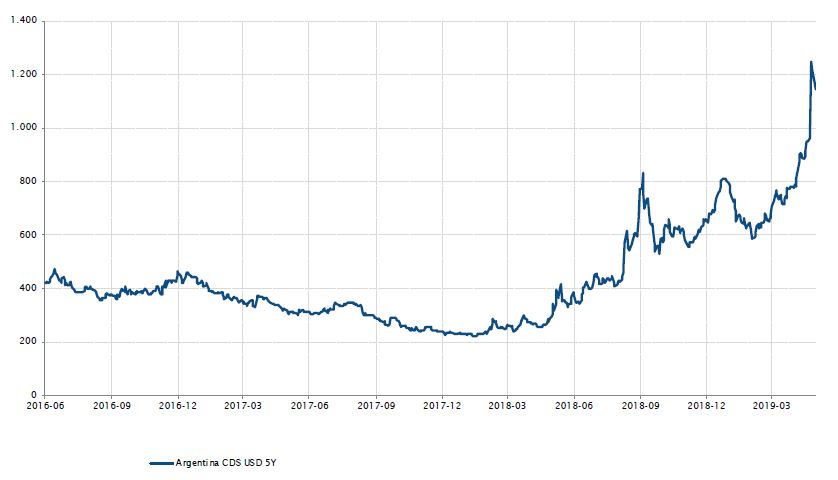

Argentinian assets feel the heat again

On 25 April, a wave of panic washed over EM investors after polling results suggested a victory for Cristina Kirchner in a potential run-off vote against Mauricio Macri in the presidential election later this year. A potential comeback for former President Cristina Kirchner raised investor concerns regarding policy continuity and the likelihood of a sovereign debt default. As a result, Argentina’s 5-year CDS spread surged by more than 360bps over the month, and the insurance cost against a sovereign default reached 12%.

Rising by 4.7% MoM to reach 54.7% YoY, March inflation figures disappointed, compared to consensus expectations of 4% MoM. The lack of economic progress, especially in curbing inflationary pressures without hurting growth, is undermining President Macri’s chances for re-election.

While polls should be read with caution at this stage, due to the high numbers of undecided voters, Macri needs macroeconomic conditions to improve ahead of the October election in order to maximise his chances of being re-elected.

Argentina 5Y CDS spread surged above 1200bps

Sources : Bloomberg, SYZ Asset Management. Data as at : 30.04.2019

RBI reversed rate hikes delivered last year

Sources : Bloomberg, SYZ Asset Management. Data as at : 30.04.2019

India – RBI cuts interest rates to boost growth

Ahead of the Indian general elections, the Reserve Bank of India lowered its policy rate by 25bps for the second consecutive time, bringing interest rates down to 6%. This second rate cut was expected by consensus, after Governor Shaktikanta Das – who was appointed after Urjit Patel’s exit last December – surprised the market in February by cutting rates at his first policy meeting. Weak inflation figures and rising growth concerns paved the way for this monetary policy U-turn, which reversed the rate hikes delivered last year.

Headline CPI has been in a downward trend since mid-2018 and has remained at the bottom of the RBI’s inflation target range of 4(+/-2)% for several months. Low inflation in March, which came in at 2.9%, broadly in line with consensus, supported the rate cut. At the same time, activity data indicated a weakening in growth momentum – in Q4 2018, growth decelerated to 6.6%, below its 7% potential.

In the near term, subdued inflation opens the door for further easing, but this will become more difficult in the second part of the year, as inflation is expected to pick up.

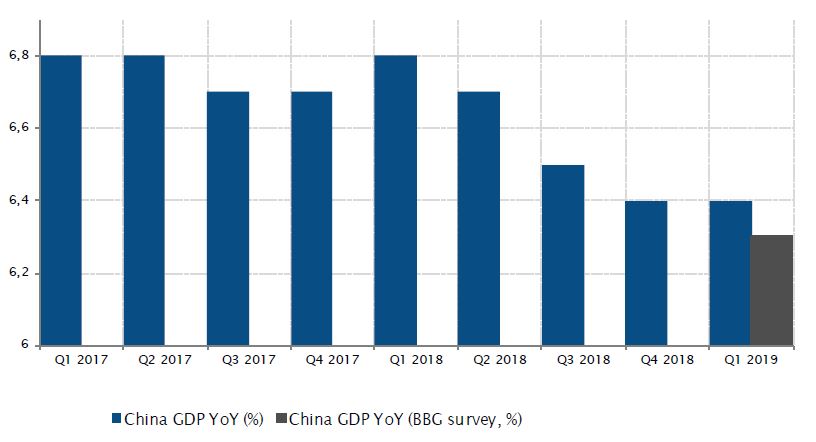

China – Encouraging but fragile signs of stronger growth

Monetary and fiscal stimulus recently implemented by Chinese authorities to support stronger consumption and internal demand has finally started to bear fruit. Q1 GDP positively surprised markets, increasing by 6.4%, compared to consensus expectations of 6.3%. Chinese export and credit data shot up, sending positive signals. Retail sales, industrial production, fixed asset investments, PMI and services also edged higher last month.

However, it is still too early to call whether a strong recovery could spread to eurozone countries, which have been dealing with a growth slowdown for more than a year. Moreover, the trade war situation is not yet resolved and the recent escalation is hampering investor confidence.

Chinese GDP growth (%)

Sources : Bloomberg, SYZ Asset Management. Data as at : 17.05.2019

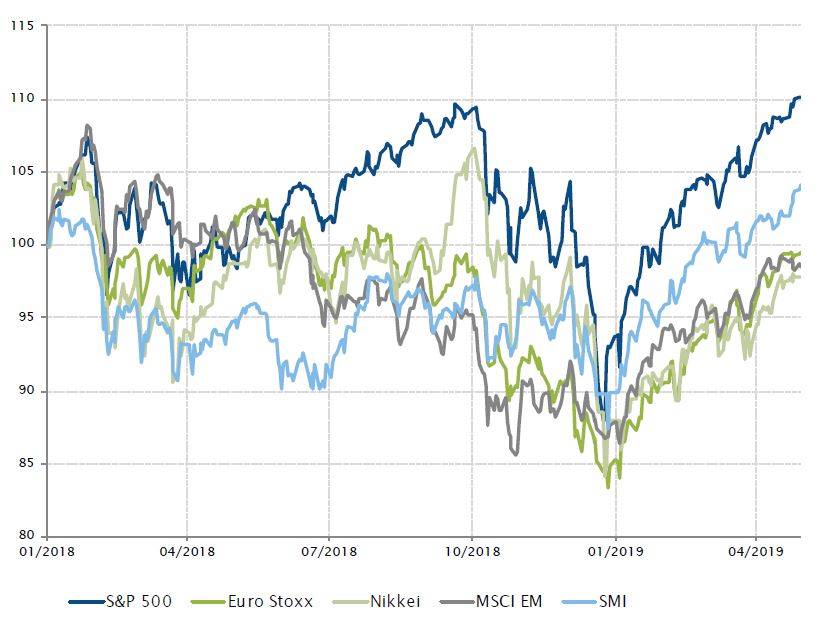

S&P500 reached record highs

Sources : Bloomberg, SYZ Asset Management. Data as at : 30.04.2019

Equities – New highs

April extended the exceptionally strong run for risky assets this year, particularly for US equities. As a result, the S&P 500 and the Nasdaq hit record highs. The S&P 500 jumped 3.9% in April – up 17.5% YTD – closing the month at 2946, while the US Technology Index jumped 4.7% – up 22.0% YTD. And returns were strong across the board for equity markets, with the MSCI World l.c. up 3.6%. The goldilocks environment was reinforced by improved growth prospects, especially in China and the US, while central bank dovishness remains in place and inflationary pressures are still missing. The German Dax outperformed last month – up 7.1% and 6.9% YTD – catching up, while Japan remained a laggard – with the Topix up 1.7% and 8.3% YTD. In the meantime, the VIX continued to land lower, ending the month close to 13.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)