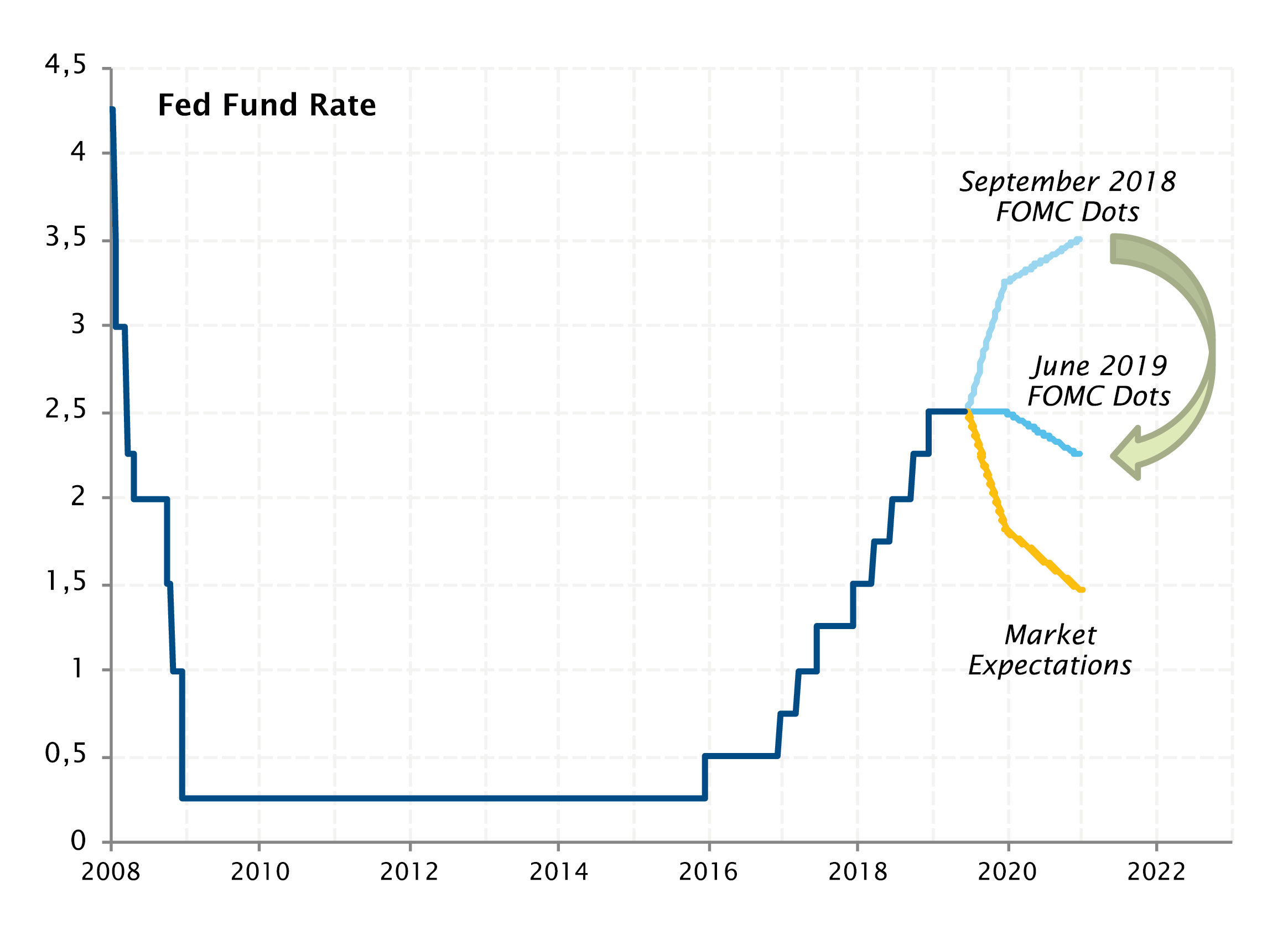

The Fed opens the door to interest rate cuts

The spectacular U-turn of the Fed regarding its monetary policy outlook has extended one step further in June. If the majority of FOMC members expect no change in the Fed’s key short-term rate till year end, a growing number of them now expect 50bp of rate cuts in the next 6 months. Only 9 months ago, FOMC members were expecting 75bp of rate hike by the end of 2019.

This sharp and quite unusual reversal can be attributed to a combination of factors: weaker global economic growth, the threat of persistent and possibly rising trade tensions, slowing US growth momentum since the beginning of this year, and the drop in medium-term inflation expectations. Expectations over rising prices are now down to their lowest level in three years; a worrying development for the Fed, as it goes against conventional economic theory in a context of low unemployment.

In its June press release, the Fed opened the door to the possibility of rate cuts in the months ahead, depending on developments in the US job market, inflation and “financial and international developments”. Investors already expect those elements will warrant a significant monetary policy easing, with futures pricing a100bp cut in the Fed Fund rate in the next twelve months.

From multiple rate hikes to multiple rate cuts…

Sources : Source: SYZ AM, Bloomberg. Data as of: 8 July 2019

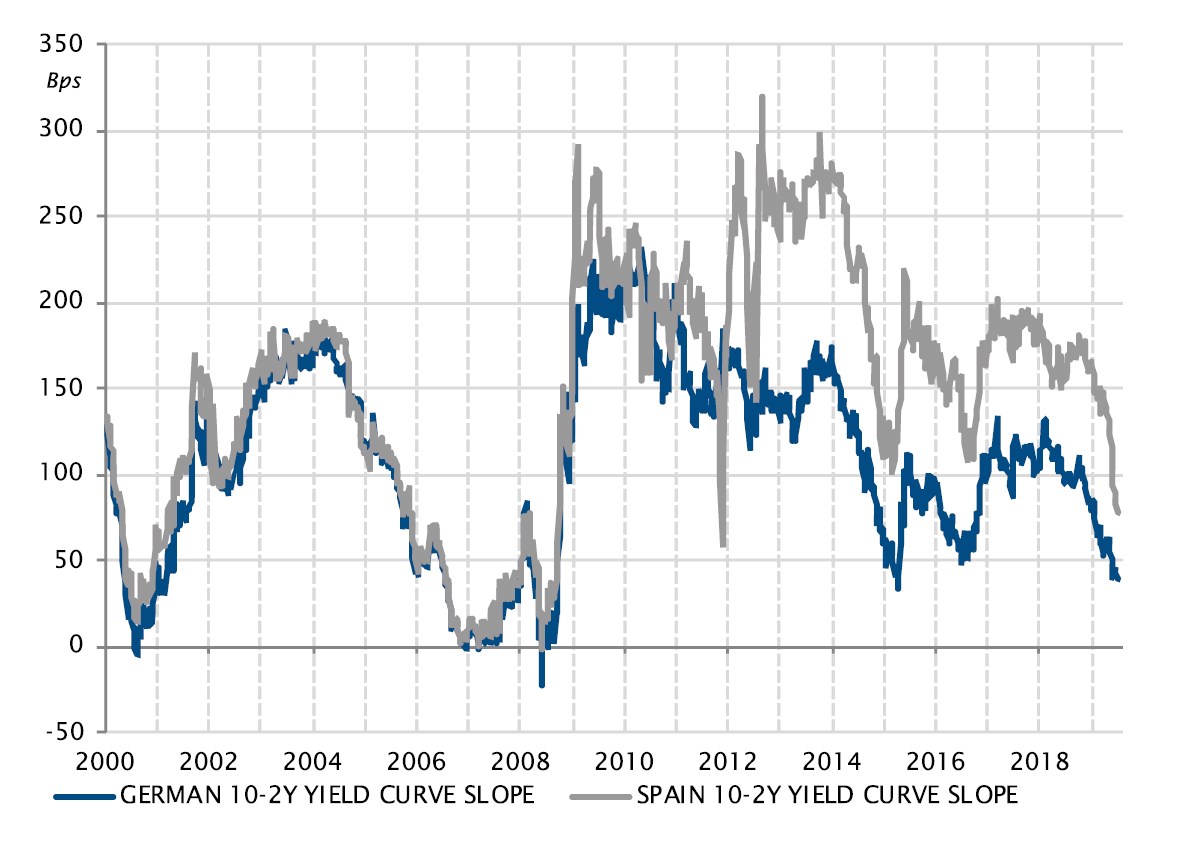

EUR sovereign yield curves got flatter after Draghi’s Sintra speech

Source: SYZ AM, Bloomberg. Data as of: 8 July 2019

Draghi sets the ECB back in monetary policy easing mode

Mario Draghi has done it again. Seven years after his famous “Whatever it takes” speech that de facto framed the ECB monetary policy, and once again outside a formal ECB monetary policy meeting, the incumbant ECB president has delivered in Sintra another decisive speech in June that will likely drive Eurozone monetary policy beyond the end of his mandate.

Unlike the Fed, the ECB has not had the chance to raise short-term rates in the past few years and the deposit rate remains negative at -0.4%. Still, Mario Draghi emphasized in Sintra last month that, given the downside risks weighting on the growth and inflation outlook, further cuts in rates and a resumption of asset purchases by the central bank are viable options. This unexpected announcement, obviously conditioned to economic developments, nevertheless conveys one very strong message: the ECB’s monetary policy will not be tightened anytime in the foreseeable future, with the potential for further easing.

Rate markets got the message loud and clear, with two main consequences: the drop of interest rate levels to new historical lows, and a brisk flattening of EUR sovereign yield curves. The most spectacular movement was possibly seen on Spanish rates, with the 10y yield down to 0.4% and the difference between the 10y and the 2y rate down below 100bp.

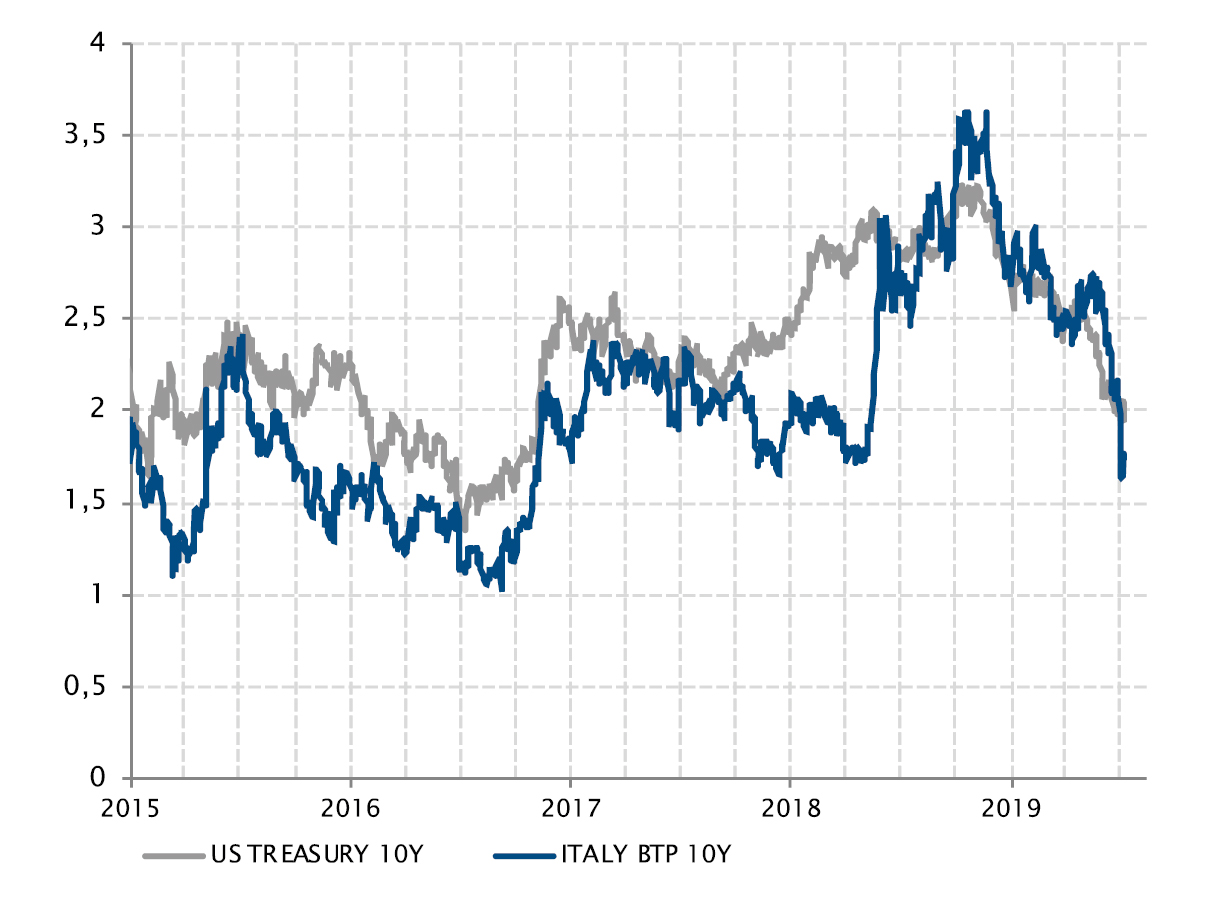

Italian government yields fell dramatically in June

Italian government bonds have been among the best performers of the sovereign space over the past three months. After experiencing volatility and negative newsflow in 2018 when the Lega-5 Star government took the helm of the country and challenged the EU fiscal framework, they have benefited from a string of supportive developments.

Firstly, the shift in influence within the government after 5 Stars’ costly electoral promises significantly lost ground at recent European elections. Secondly, the stated willingness of the Italian government to remain within the EU’s fiscal framework. Thirdly, the prospect of renewed ECB monetary policy easing. And lastly, an increasingly attractive relative value dynamic compared to other eurozone government bonds.

As a result, Italian 10y rates have droped 57bp in June, down below 2% for the first time in a year. In comparison, the decline in German 10y rates was much more modest (-13bp), implying a significant contraction in the BTP/Bund spread. Anecdotally, this movement drove Italian 10y rates clearly below the US Treasury 10y rate, as was the case before the introduction of the Lega/5 Starts government in May 2018. In the current context, the key factor for Italian rate evolution is probably the commitment to remain within the EU fiscal framework. As long as it lasts, the support of the ECB policy and the appeal of positive yields is likely to sustain demand for Italian government bonds.

Italian 10y rates have dropped to a 1-year low in June

Source: SYZ AM, Bloomberg. Data as of: 8 July 2019

The UK economy slows significantly

Source: SYZ AM, Factset. Data as of: 8 July 2019

The UK economy loses steam amid continuing Brexit uncertainties

Theresa May has finally thrown in the towel. After spending months attempting to get parliamentary approval for her Brexit agreement with the EU, she had to admit there was no possible majority in a fragmented British Parliament for her plan. Boris Johnson has now taken the helm and will have his own attempt at sealing a deal with the EU before the October 31st deadline.

The Brexit saga is, therefore, far from over and taking a rising toll on the economy. Indeed, after a surprisingly strong level of activity in the first quarter, economic data has deteriorated across the board over Q2.

There has been a sharp drop in industrial production, a continuation of the rise in jobless claimants, a decline in retail sales, and a pronounced decline in June activity indicators in the manufacturing and construction sectors. Activity in the service sector has also slowed down but remains positive for the moment. All in all, the data suggests the economy stalled as summer approached. The task of the new prime minister may well be made even more complex if broader economic troubles mix with the Brexit quagmire.

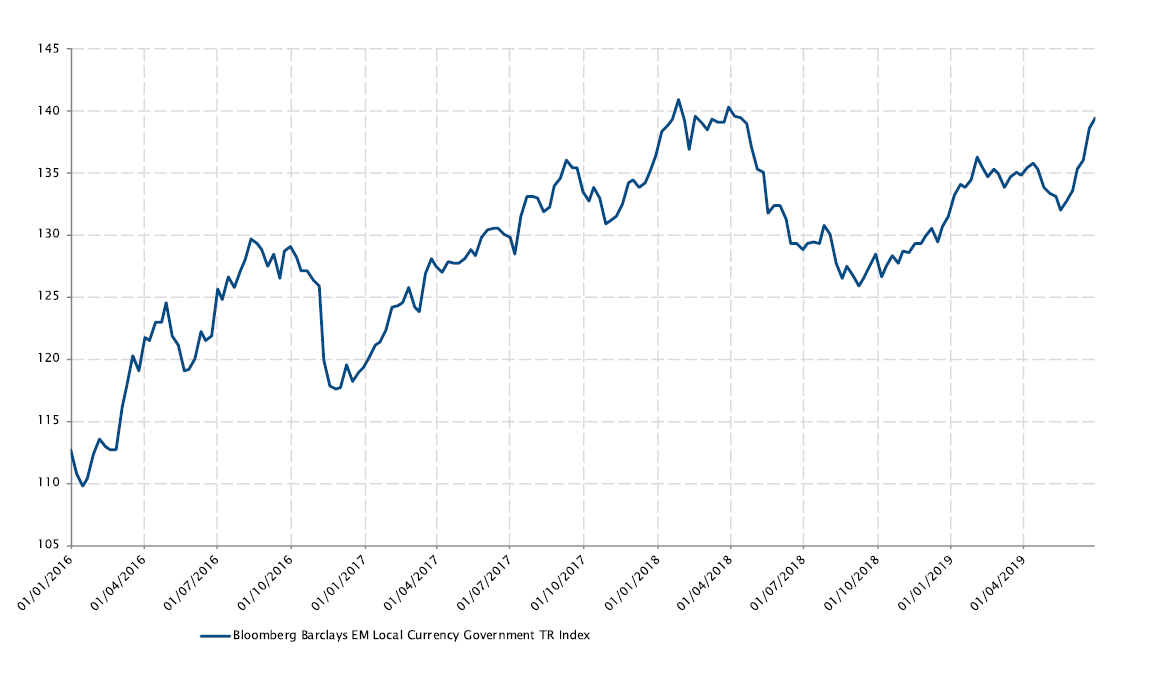

EM bonds rally on the back of dovish monetary policy

The Bloomberg Barclays EM local currency government index posted its strongest performance over the past 3 years, returning 4.4% over the month.

The dovish U-turn of the Fed - advocating for low US interest rates and a weak US dollar - has opened the door for EM central banks to ease monetary policy, which is dragging sovereign rates lower.

In the face of decelerating growth and muted inflation, several EM central banks have already cut interest rates this year, such as in India or Russia. Meanwhile, the ones that have remained cautious so far have already changed their tone and suggested a possible policy easing, such as Indonesia.

In a world where about a quarter of the Bloomberg global bonds index have rates in negative territory, EM local debt is well placed to benefit from the investors’ appetite for yield as it offers an attractive source of carry.

EM govies post best monthly performance over 3 years

Source: SYZ AM, Bloomberg. Data as of: 30 June 2019

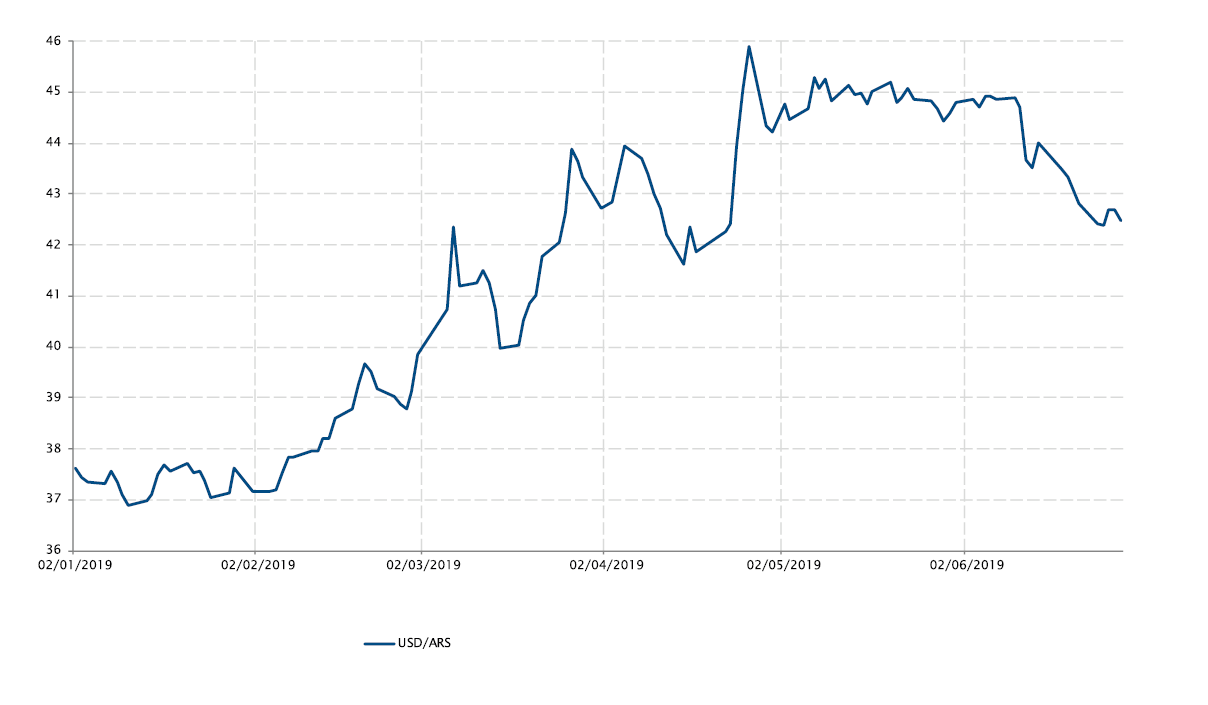

Argentine peso strengthens against the US dollar in June

Source: SYZ AM, Bloomberg. Data as of: 30 June 2019

Argentina - is ARS bottoming out?

After being under pressure since the beginning of the year, the Argentina peso was the best performer among emerging market currencies during the month of June, increasing by 5.4% against the USD.

On one hand the Argentine peso benefited from the positive investor sentiment towards high yielding currencies after the dovish U-turn of the Fed and on the other hand it was helped by domestic factors.

On the political side, President Macri announced that the opposition leader, Senator Pichetto, will run as its vice president candidate for the general election in October. This choice broadens Marci’s voter base and increases its chance to be re-elected. Regarding the economy, inflation figures started to edge lower, which is also benefiting to Marci. In addition, the central bank declared, at the end of April, that they will increase its FX intervention in order to halt the fall of the currency.

However, beside the overall global risk appetite for EM currencies, the rally on Argentine peso could be short-lived as the reelection of Macri is highly uncertain and inflation remains very high.

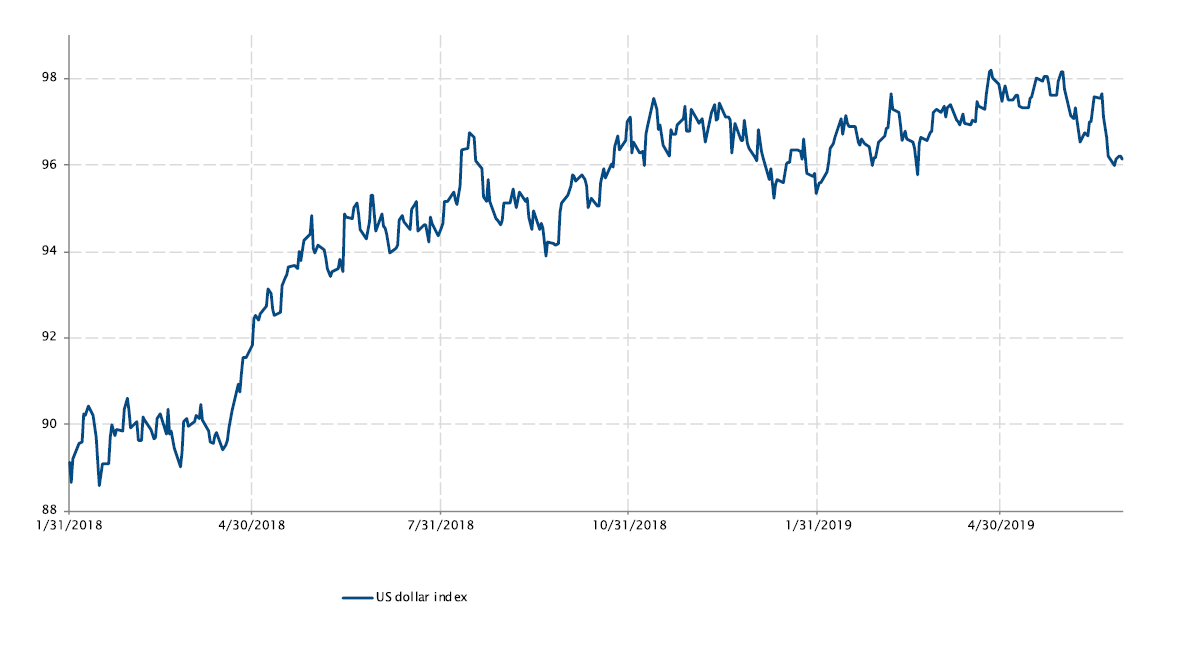

FX: Pull back of the US dollar

The capitulation of the US Federal Reserve in its monetary policy normalization was again confirmed in the last FOMC meeting in June. The trade war escalation could be seen as one important factor for this shift towards a more accommodative regime even though growth is above potential growth estimates.

The repricing of the US monetary policy is bringing, at the same time, US interest rates to new lows (UST 2Y and 10y yield respectively at 1.8% and 2.0%) and contributing to a pullback in the greenback.

In this context, after rising four consecutive months, the US dollar index was down 1.7% in June, and back to the end of last year levels. Looking at the US dollar against the euro, it lost 1.8% in June. The euro proved to be stronger, even if the European Central Bank continued to err on the dovish side.

Finally, even if some structural factors are advocating for the opposite (a weaker US dollar), the lack of an alternative is keeping the dollar stronger than other developed currencies…

US dollar index evolution

Source: SYZ AM, Bloomberg. Data as of: 03 July 2019

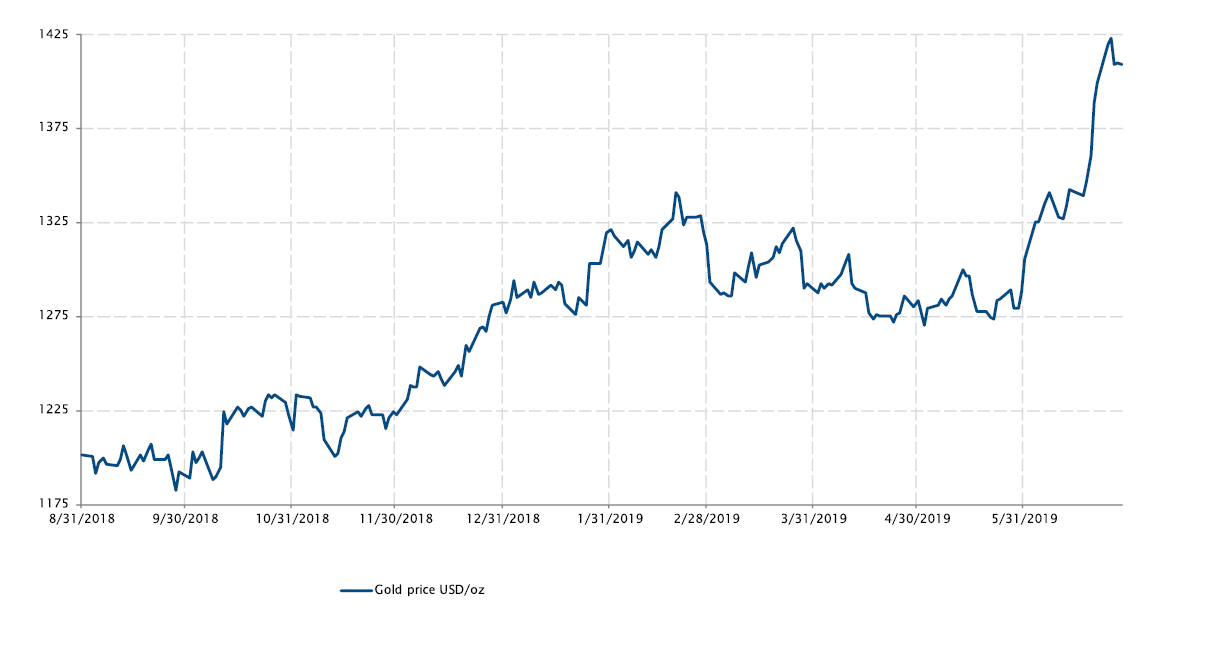

Weak dollar adds to gold’s glimmer

Source: SYZ AM, Bloomberg. Data as of: 03 July 2019

Commodities: Gold price reached five year all-time-high

The gold price started to shine again since the fourth quarter of last year. At the end of June, gold price reached 1’409 USD/oz, respectively up on a MTD and YTD basis +8.0% and +11.2%.

In the developed world, dovish central banks pushed interest rates (especially US real yields at nearly 0%) to very low levels and markets are pricing this year three rate cuts in the United States. Moreover, another determining factor for the gold price is that the US dollar thas been trading a bit weaker in June: the US dollar index was down -1.7%. The combination of those factors have made gold more attractive.

Furthermore, geopolitical tensions coupled with trade war uncertainties recalled gold attractiveness as a portfolio hedge and diversifier.

Investors have gained again faith in the precious metal for its historical safe haven characteristics and ,at the same time, two of the biggest threats for gold - higher interest rates and a stronger greenback – have been fading away.

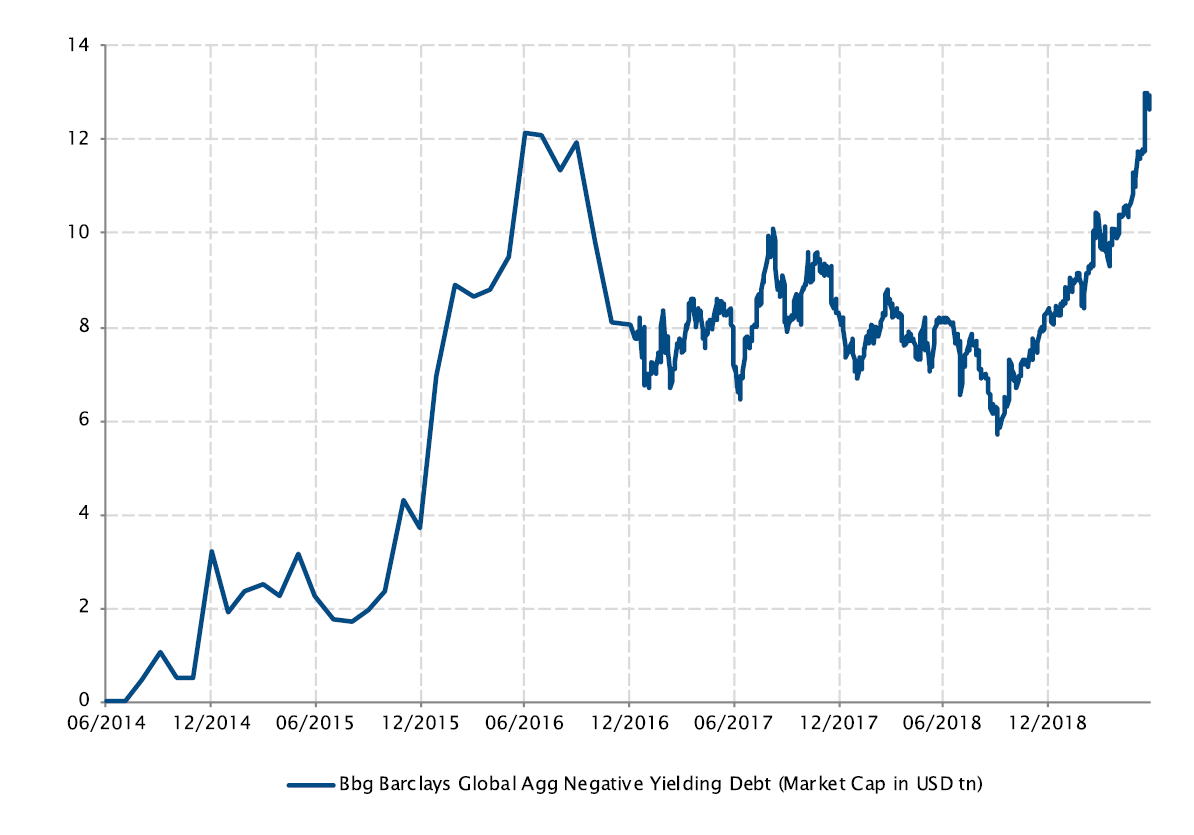

To infinity and (much) below

After the dovish tone of the Fed meeting at the end of May, Mario Draghi kicked open the door to cutting rates deeper into negative territory during the ECB’s annual symposium in Sintra, while also reiterating there was “considerable headroom” for the central bank’s bond-buying programme. These statements, in a context of still disappointing economic data and falling inflation expectations, led to a massive rally in bonds. 10Y rates reached a new record (negative) low last month in Germany. However, yields aren’t only negative on German or Japanese government bonds but now even on 10Y French or 5Y Spainish and Portuguses bonds for example. The desperate hunt for yield is now even pushing the short end of the credit market below 0%. As a result, the total market value of debt with a negative yield have risen from less than $6 trillion 9 months ago totheur a new record high of $13 trillion last month: the Medici family is likely turning in their grave.

Bloomberg Barclays Global Agg Negative Yielding Debt reached a new record…high

ource: SYZ AM, Bloomberg. Data as of: 01 July 2019

Easy money is not lifting all equity boats equally

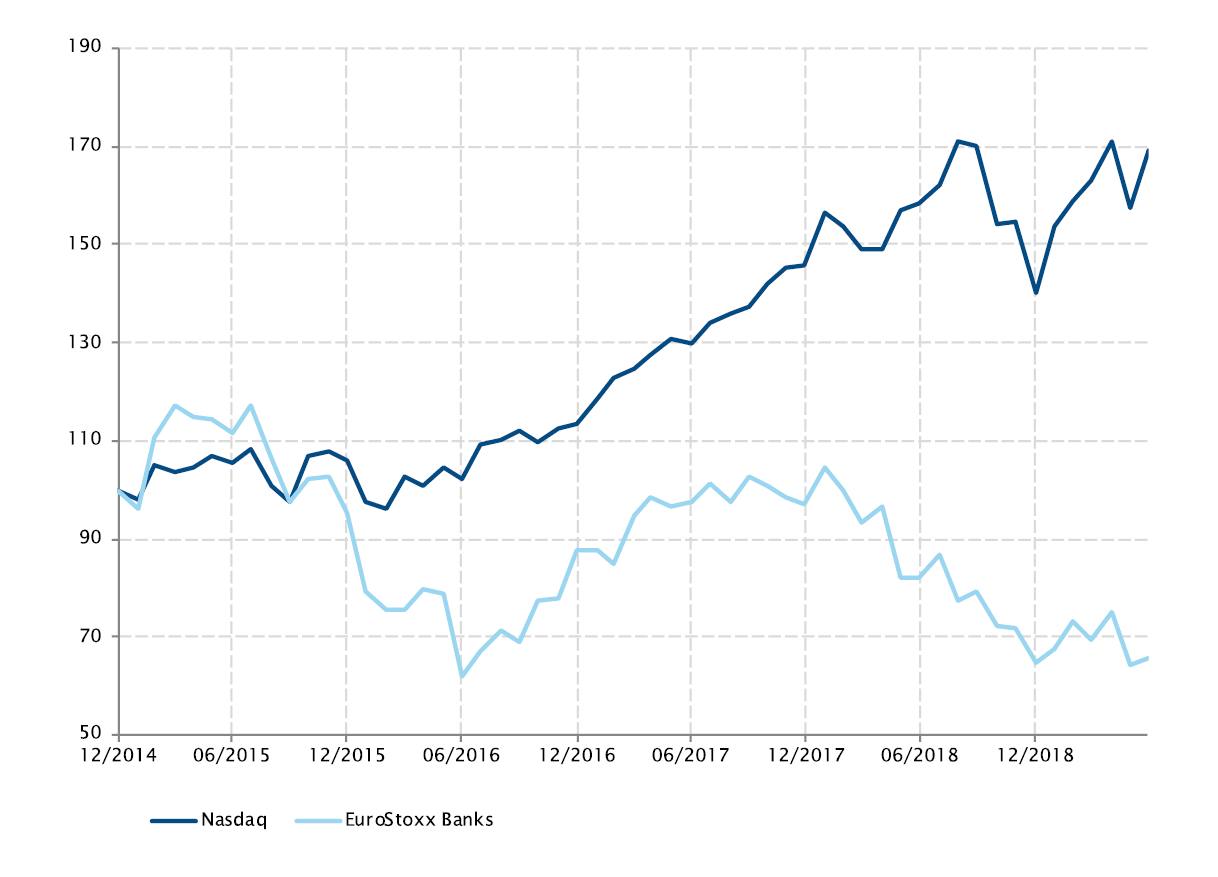

Source: SYZ AM, Bloomberg. Data as of: 30 June 2019

Winners and losers

As the market priced a lower-for-even-longer rate scenario, a rising tide of further easy money to come lifted all asset prices in June. Equity markets weren’t spared, benefitting –once again- from the financial repression despite weak economic data and uncertainties around trade tariffs. Looking into the last month performances details, the US technology sector remained among the main beneficiary of this low rates, low nominal growth context, as the Nasdad jumped +7.4 in June, outperforming the MSCI world index in l.c. (+5.8%). At the other side of the spectrum, once again, European banks posted only a meagre +1.6% gain. So, the conclusion is not all equity sectors or styles are lifted equally by easy money.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)