If British assets (Pounds, Gilts) are suffering since Brexit, the accelerating element of the current crisis is of fiscal origin. The government of Elizabeth Truss, the newly elected Prime Minister of an elitist circle representing about 0.2% of the population, has decided to implement a growth-oriented policy by lowering taxes on the richest 5% of the population. This 45 billion tax cut plan is the biggest since 1972. The problem is that it is not financed, which means that the government has to resort to new borrowing even though the UK's debt is already very high (almost 100% of GDP). Although this plan does not come as a huge surprise (Miss Truss had mentioned these measures during the campaign), the financial markets did not welcome this announcement. It is in fact a real sovereign crisis, where a country as powerful as the UK is losing its credibility with the financial markets (NB: the government backtracked on Monday morning, cancelling the plan under pressure from the financial markets).

While most economists and institutions such as the IMF agree that Mrs. Truss' economic policies are completely irresponsible, this crisis has a history that dates back long before she took office. For years, the UK has faced great political instability. There have been no less than four prime ministers in six years. There have been three elections in seven years. Not to mention the famous 2016 referendum. The UK's current problems began with Brexit, which was itself the result of years of under-investment in education, housing and transport, causing a huge north-south divide and helping to fuel the social unrest that led to the country’s exit from the European Union. Following the vote, many skilled foreign workers left the island. The governments of the day had the weakness of thinking that a favourable tax regime would be enough to attract international companies. But without sufficient openness to the international workforce, taxation failed. In addition, years of underinvestment in energy infrastructure have made the economy dependent on energy imports. Inflation is rising, purchasing power is falling and workers are prepared to strike for higher wages. A wage-price spiral has gradually developed.

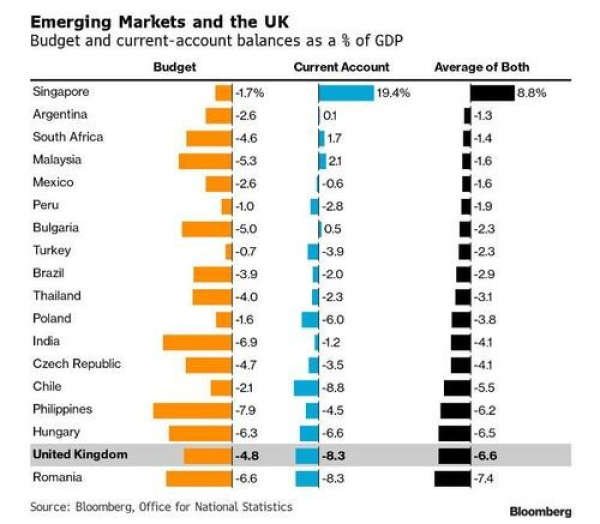

The UK economy is now facing structural problems and a lack of competitiveness, as evidenced by the current account deficit, which is over 8% of GDP. Successive governments have tried to keep the economy afloat through fiscal policy, first with handouts and now through tax cuts. But these blunt expenditures have only increased budget and current account deficits, with the corollary of a sharp rise in public debt. As for the Bank of England, it has been facing strong criticism from the Conservatives for several months.

In this context, the unfunded tax cut programme that has been put in place is perhaps the one that should have been avoided at all costs. This is the trap Sri Lanka fell into between 2019 and 2022. The culmination was a currency collapse and default.

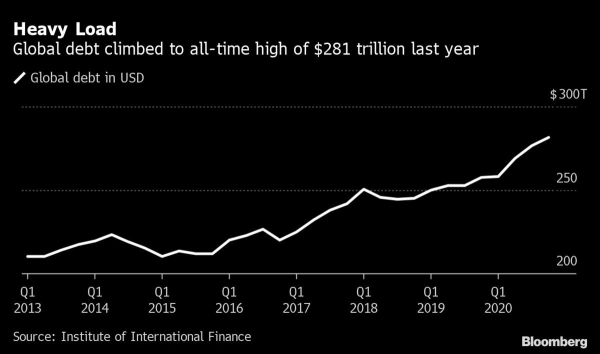

The comparison between the UK and an emerging country is not accidental. Firstly, because certain fundamentals are similar to those of some emerging countries (see table below). But also because investors' views have changed. Over the last few decades, the market has been almost blindly supportive of all the G10 countries, including the UK. Now however, the UK is facing a crisis of confidence. The markets are uncertain about the effects of such tax cuts on growth. On the other hand, the debt to GDP ratio of 100% leaves no wiggle room for the UK, which would have had to find the means to finance the tax cut. Moreover, the increase in the current account deficit in the short term has to be met by a weak currency and/or higher interest rates. But the fall in the pound creates more inflation while interest rate rises threaten to cripple the housing market and cause a deep recession, which runs counter to the government's growth agenda.

Finally, the fact that the 'independent' central bank is currently under pressure from the ruling party not to raise interest rates too much poses the risk of a currency collapse, a sovereign debt crisis and a banking crisis.

In the world of emerging economies, financing gaps are usually filled by a combination of fiscal or monetary tightening, and/or currency adjustment, which can be delayed through foreign exchange market intervention. But the Bank of England's foreign exchange reserves are limited, amounting to only $100 billion or 2% of GDP (compared to 20% of GDP in Japan and 100% of GDP in Switzerland...)

Another solution would be to resort to IMF assistance. However, this aid would surely be conditional on a tightening of the fiscal policy, which the Chancellor of the Exchequer Kwasi Kwarteng seems to want to rule out. Not to mention the dramatic and lasting reputational damage such a request of assistance would cause.

To reverse this negative spiral and without IMF assistance, the British government will have to convince itself of the capacity of its programme to revive real GDP growth and achieve competitiveness gains in order to close the large balance of payments deficit. If not, the pound and gilts are likely to continue to plummet. Indeed, the use of quantitative easing by the Bank of England against a backdrop of rising inflation, a falling pound and fiscal stimulus risks creating further inflation. And interest rate hikes will not help either.