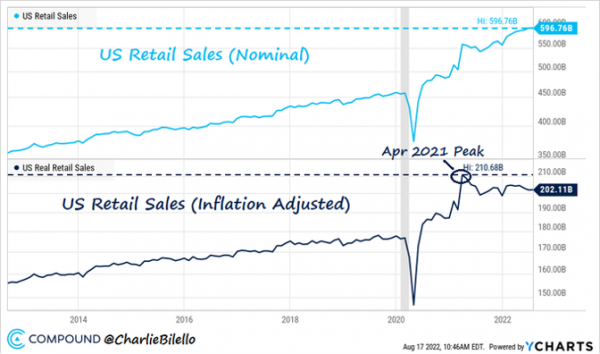

U.S. retail sales surprised on the upside, hitting a new all- time high in July, up 3.6% over the past six months. The picture is very different if one adjusts these numbers with the inflation rate taken into account. Indeed, real retail sales peaked in April 2021 and are down 1.1% over the past six months.

The week in seven charts

Montag, 08/22/2022Winter is coming ...

The dollar is the go-to investment for fund managers, and Europe imports natural gas from Australia while it braces itself for the coming winter. Each week, the Syz investment team takes you through the last seven days in seven charts.

Chart #1 — US retail sales in nominal vs. real terms

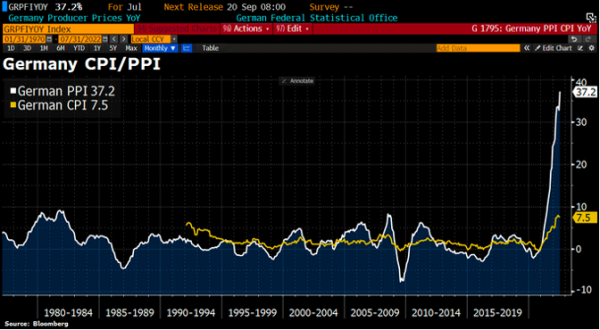

Chart #2 — Producer price index soars in Germany

Is the peak of inflation behind us? Clearly not in Europe! German producer prices rose by 37.2% (month-on-month) in July, a new record. This suggests that the consumer price index has probably not reached its peak and that Germany could suffer the same fate as the UK, i.e. double-digit inflation.

Chart #3 — European electricity prices continue to break new records

Electricity prices in Germany and France continue to rise and reach new records. The one-year electricity contract in Germany has exceeded €500/MWh for the first time in its history. The price of electricity in France for the next year is trading at around €700/MWh... Unless there are significant subsidies, this increase in electricity prices will weigh heavily on the purchasing power and margins of European companies.

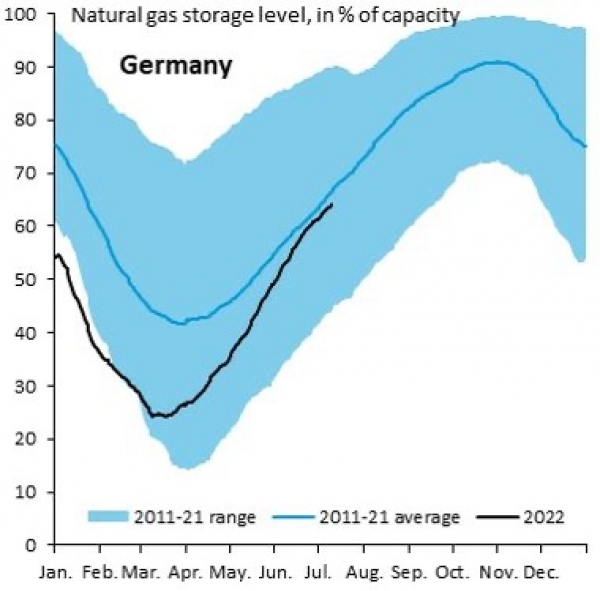

Chart #4 — The level of gas reserves in Germany is a misleading figure

Gas storage levels in Germany usually reach 90% by late autumn; this is the level required for Germany to get through the winter. But this assumption is valid if, and only if, the Nordstream pipeline - which transports imported gas from Russia - is fully operational. But the famous pipeline is currently only operating at 20% of its total capacity. As a result, even with storage levels close to 90 or 95 percent in the coming months, Germany will probably not have enough gas this winter. If Russia reduces supplies, the current storage level will not be able to cover 3 months’ worth of gas needs. Gas rationing this winter is a strong probability.

Chart #5 — Liquefied natural gas imported from... Australia

Europe is so desperate for natural gas that it is importing a shipment of liquefied natural gas from Australia (!). This Australian gas has been recharged in Malaysia and will now be shipped to the UK. According to Bloomberg data going back to 2016, Australia has never shipped Liquefied Natural Gas to Europe.

Chart #6 — Turkish National Bank surprises the markets again

Turkey is pursuing an unorthodox monetary policy. Despite inflation being at its highest level in 24 years and the Turkish lira near its lowest levels, it has just decided on an abrupt interest rate cut. The use of monetary stimulus less than a year before the elections reflects the determination of the Turkish authorities to keep Erdogan's promise of further rate cuts, prioritizing growth over price controls.

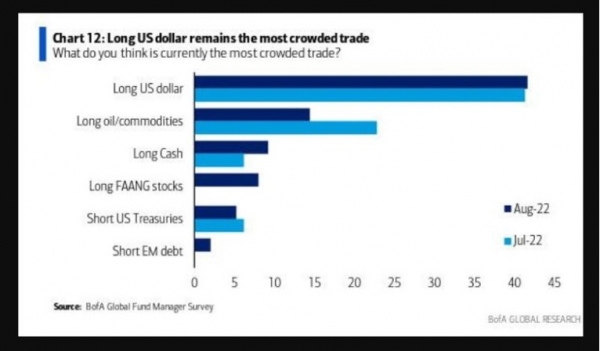

Chart #7 — The dollar is the asset perceived by fund managers as being the most crowded trade

Members of the Federal Reserve have been sending the dollar soaring in the past week with their media appearances. Their message is pretty clear: peak inflation may not be behind us, and the Fed will continue to raise rates. The Bloomberg Dollar Index was up 2% on the week, its biggest weekly gain since April 2020.

An opinion survey of fund managers conducted by BofA on a monthly basis (July in this case) shows that the long US dollar position is currently perceived as the most consensual ("crowded trade"). This is followed by commodities and cash.

Disclaimer

Dieses Werbedokument wurde von der Syz-Gruppe (hierin als «Syz» bezeichnet) erstellt. Es ist nicht zur Verteilung an oder Benutzung durch natürliche oder juristische Personen bestimmt, die Staatsbürger oder Einwohner eines Staats, Landes oder Territoriums sind, in dem die geltenden Gesetze und Bestimmungen dessen Verteilung, Veröffentlichung, Herausgabe oder Benutzung verbieten. Die Benutzer allein sind für die Prüfung verantwortlich, dass ihnen der Bezug der hierin enthaltenen Informationen gesetzlich gestattet ist. Dieses Material ist lediglich zu Informationszwecken bestimmt und darf nicht als ein Angebot oder eine Aufforderung zum Kauf oder Verkauf eines Finanzinstruments oder als ein Vertragsdokument aufgefasst werden. Die in diesem Dokument enthaltenen Angaben sind nicht dazu bestimmt, als Beratung zu Rechts-, Steuer- oder Buchhaltungsfragen zu dienen, und sie sind möglicherweise nicht für alle Anleger geeignet. Die in diesem Dokument enthaltenen Marktbewertungen, Bedingungen und Berechnungen sind lediglich Schätzungen und können ohne Ankündigung geändert werden. Die angegebenen Informationen werden als zuverlässig betrachtet, jedoch übernimmt die Syz-Gruppe keine Garantie für ihre Vollständigkeit oder Richtigkeit. Die Wertentwicklung der Vergangenheit ist keine Garantie für zukünftige Ergebnisse.