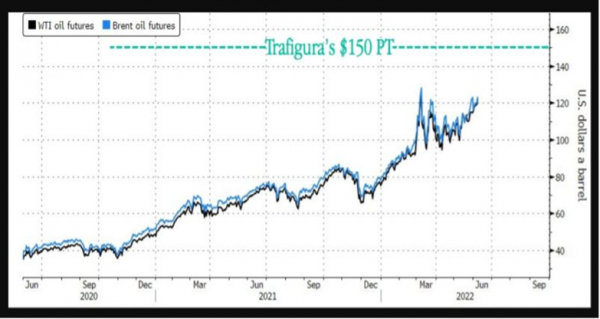

The most anticipated figure of the week was of course the US consumer price index. While the market thought that “peak” inflation was behind us, May's numbers came as a rude awakening. Inflation rose 8.6% year-over-year versus 8.3% expected, the highest since 1981; core inflation (excluding energy and food) rose 6% versus 5.8% expected.

The gap between these two measures of inflation is the widest in 10 years. Headline inflation, driven by rising oil and food prices, has risen considerably in recent months, while core inflation has shown signs of slowing very gradually.