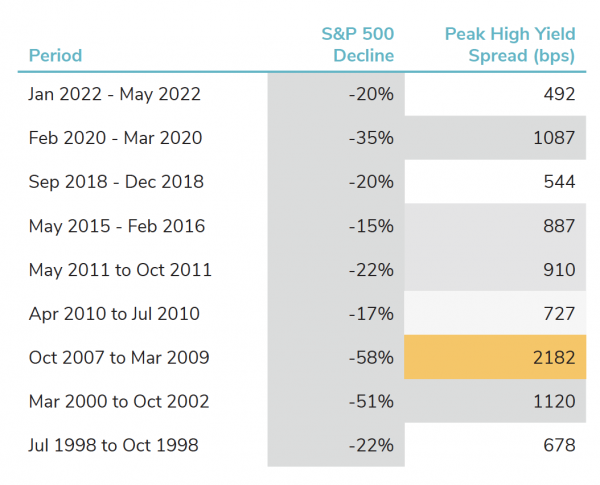

US equities continued their run of negative weekly performance. The S&P 500 index is suffering its 7th consecutive week of losses. Investors fear that rising inflationary pressures may cause consumers to cut back on discretionary spending, effectively increasing the risk of a recession. During Wednesday's market session, US stocks suffered their biggest daily decline since June 2020. Disappointing results from several major US retailers (Target, Walmart, Lowe's and Home Depot) weighed on overall market sentiment. Investors appear to be concerned that the retail giants will be forced to pass on more of their rising costs to customers in the coming months, which could put further pressure on inflation. Comments from several Fed officials during the week did little to calm market fears about the pace of interest rate hikes. US macroeconomic datafell for the fifth week in a row, with the Citigroup Economic Surprise Index slipping back into negative territory and reaching its lowest weekly close since last November.

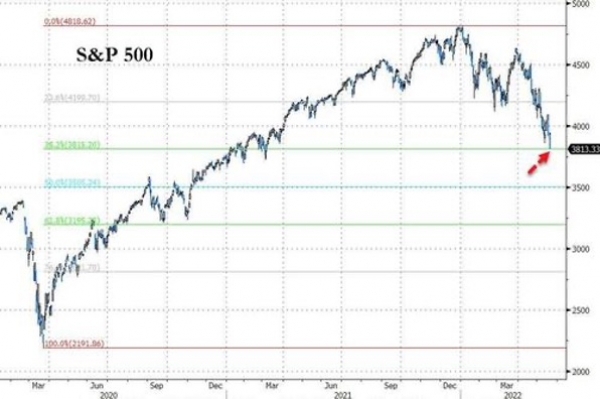

In Friday's session, the S&P 500 briefly entered a bear market, breaking the 20% threshold from its highs. The S&P broke through the 3855-point support, reaching its lowest level since March 2021. But the main US index rebounded at the end of the day to close the session unchanged.