- 25bp rate hike yesterday was, in line with market expectations

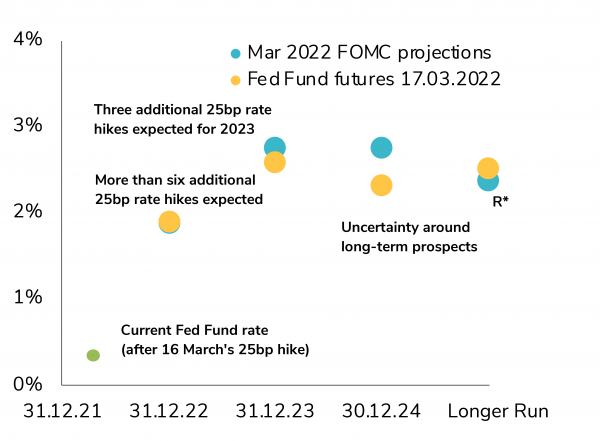

- Fed members’ median projections adjusted upward and now perfectly aligned with market expectations: a 25bp rate hike at each of the six remaining meetings in 2022 and a Fed Fund rate of 1.85% by the end of the year

- In parallel, the Fed will start Quantitative Tightening (reducing its holdings of Treasury, agency and MBS securities) probably before the summer (“at a coming meeting”). The expected impact is to be something equivalent to an additional 25bp rate hike in terms of monetary policy tightening for 2022

- Fed members expect the rate hike cycle to extend in 2023, with median expectations of three additional rate hikes (slightly more than current market pricing), and then the hiking cycle will come to an end. That would make the Fed’s monetary policy restrictive in absolute terms, as the long-term equilibrium rate is estimated to be between 2% and 2.5%

This tightening of monetary and liquidity conditions is predicated in an environment of strong economic growth (especially the job market), and high inflation. At this stage, the Fed appears more concerned by the risk on higher inflation from the Ukraine war, than by potential downside risks to US growth.

A less strong, but still strong economic growth outlook for the US: the Fed has revised down its GDP growth forecasts for 2022 (from 4.0% to 2.8%), to a level still clearly above the 1.8% long term potential growth rate of the US economy.

Higher inflation for longer: the Fed has revised its inflation forecast higher, not only for 2022 (to 4.3%) but also for 2023 (to 2.7%) and 2024 (to 2.3%). Therefore, in its current scenario, the Fed doesn’t see inflation coming back in line with its 2% target for quite some time.

To sum up, the Fed’s stance after yesterday’s meeting can be described in three words:

- Pragmatic: with clear rising inflationary pressures, a determined cycle of rate hikes and monetary policy tightening has to be initiated. It was widely expected and priced in by the market and yesterday’s communication just confirmed and acknowledged this factual situation

- Constructive: the Fed remains quite confident in the growth outlook for the US economy, especially in the job market dynamic, and does not appear overly concerned by potential downside risks from the war in Ukraine at that stage. If anything, the central bank appears more worried by the downside risks for growth coming from too high inflationary pressures (“That's a very, very tight labor market—to an unhealthy level” said J. Powell yesterday)

- Flexible: while the upward adjustment in median expectations described above is basically an alignment to current market expectations, the dispersion in Fed members’ views is large, and so is the dispersion around the median inflation forecast. In both cases with a bias toward possibly even higher inflation and more rate hikes than what the median reflects: 1 of the 16 members expects the Fed Fund rate to be raised above 3% by year end, and 4 others expect it to be around 2.5%. Those 5 members expect the Fed Fund rate to be between 3% and 3.5% in 2023

If inflation remains stubbornly higher than expectations and economic growth holds at a firm level, the balance among Fed members could rapidly shift toward an even-faster pace of rate hikes. But yesterday’s stance also allows for some moderation in case of a significant slowdown in economic growth in the months ahead.