Emerging market (EM) sovereign and corporate bonds (hard currency) are off to the worst start in their history, with a performance of close to -4%. This added pressure to the already poor performance of 2021: since January 1, 2021, emerging market sovereign bonds have lost about 7%.

A bad start for debt

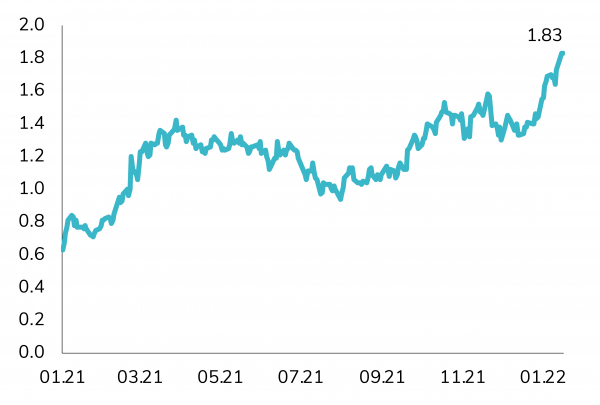

This performance is in part due to rising US interest rates. In fact, the US intermediate yield curve (7-10 years) has lost more than 3% since the beginning of the year.

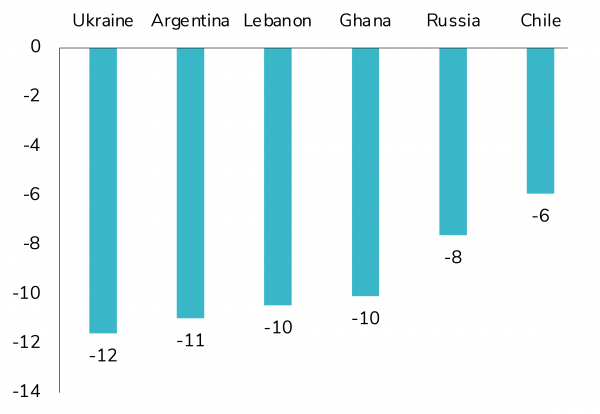

Furthermore, some idiosyncratic risks are also weighing on performance. Tensions between Russia and Ukraine have hit their bonds, with an average performance of -7.5% since the beginning of the year.

In Argentina, bonds, which are among the worst performers since the beginning of the year, lost nearly 10% due to difficulties in reaching an agreement with the IMF on debt restructuring. In Mexico, bonds were hit by a loss of more than 3% from a new supply (an amount of $6 billion) that gave an attractive premium.

The house’s take on things

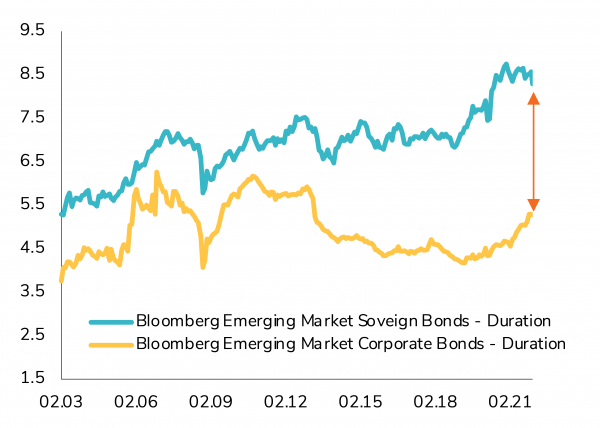

In general, we are less negative on EM debt, which is justified by rising commodity prices, more attractive valuations and the fact that the monetary policy tightening cycle is already well underway in Emerging Markets. We also prefer corporate bonds to sovereign bonds, as the latter are more sensitive to rising US interest rates (and a stronger US dollar).

On a negative note, geopolitical tensions are rising (e.g. Russia/Ukraine), which will continue to affect the performance of emerging market sovereign bonds. The Brazilian elections will also continue to put pressure on Brazilian bonds until the end of the year.

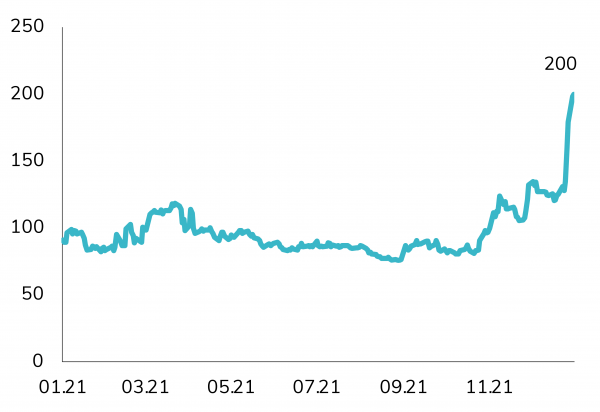

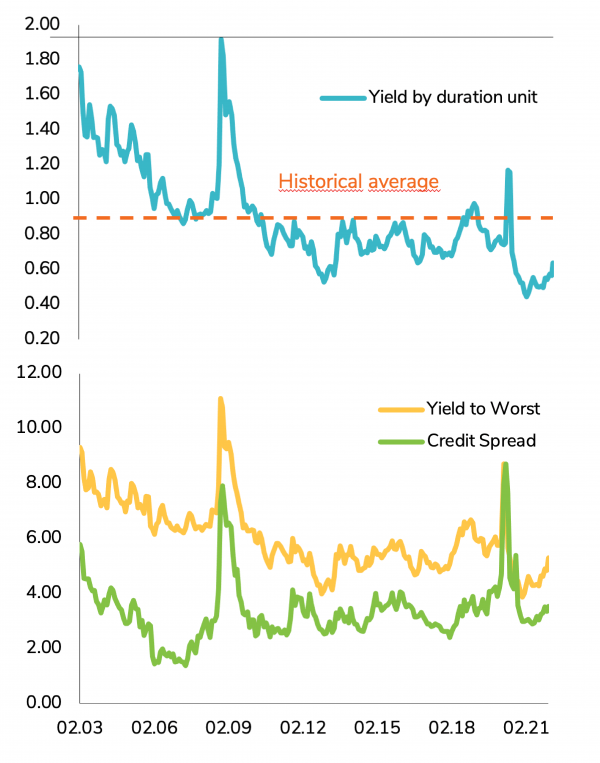

In addition, the average yield to maturity of the USD emerging market sovereign bond index is still below its historical average (5.2% vs. 6%). See the following graphs:

Conclusion

Overall, the entry point is much better than a year ago, but emerging market sovereign bonds could suffer again in the short term. We therefore recommend waiting for more stability before investing in cash bonds. We would also favor to invest now only via option strategies.

Disclaimer

Le présent document a été publié par le Groupe Syz (ci-après dénommé «Syz»). Il n’est pas destiné à être distribué ou utilisé par des personnes physiques ou morales ressortissantes ou résidentes d’un Etat, d’un pays ou d’une juridiction dans lesquels les lois et réglementations en vigueur interdisent sa distribution, sa publication, son émission ou son utilisation. Il appartient aux utilisateurs de vérifier si la Loi les autorise à consulter les informations ci-incluses. Le présent document revêt un caractère purement informatif et ne doit pas être interprété comme une sollicitation ou une offre d’achat ou de vente d’instrument financier quel qu’il soit, ou comme un document contractuel. Les informations qu’il contient ne constituent pas un avis juridique, fiscal ou comptable et peuvent ne pas convenir à tous les investisseurs. Les valorisations de marché, les conditions et les calculs contenus dans le présent document sont des estimations et sont susceptibles de changer sans préavis. Les informations fournies sont réputées fiables. Toutefois, le Groupe Syz ne garantit pas l’exhaustivité ou l’exactitude de ces données. Les performances passées ne sont pas un indicateur des résultats futurs.