Emerging market (EM) sovereign and corporate bonds (hard currency) are off to the worst start in their history, with a performance of close to -4%. This added pressure to the already poor performance of 2021: since January 1, 2021, emerging market sovereign bonds have lost about 7%.

A bad start for debt

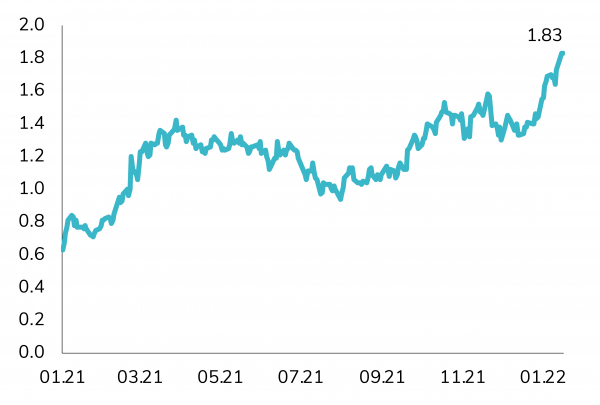

This performance is in part due to rising US interest rates. In fact, the US intermediate yield curve (7-10 years) has lost more than 3% since the beginning of the year.

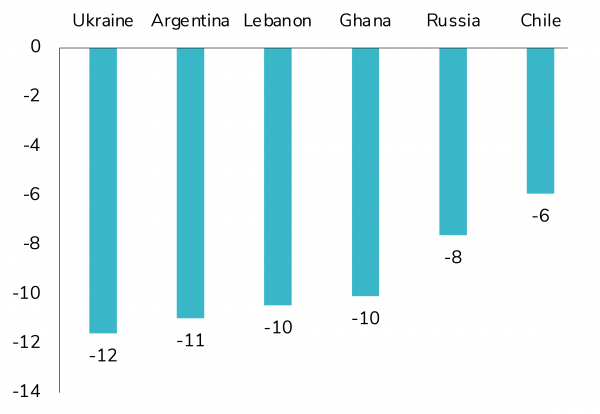

Furthermore, some idiosyncratic risks are also weighing on performance. Tensions between Russia and Ukraine have hit their bonds, with an average performance of -7.5% since the beginning of the year.

In Argentina, bonds, which are among the worst performers since the beginning of the year, lost nearly 10% due to difficulties in reaching an agreement with the IMF on debt restructuring. In Mexico, bonds were hit by a loss of more than 3% from a new supply (an amount of $6 billion) that gave an attractive premium.

The house’s take on things

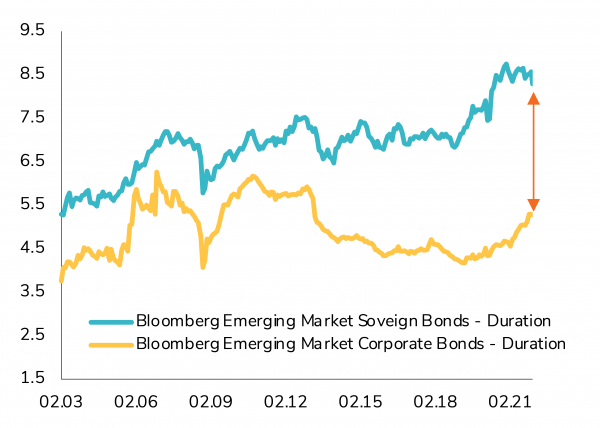

In general, we are less negative on EM debt, which is justified by rising commodity prices, more attractive valuations and the fact that the monetary policy tightening cycle is already well underway in Emerging Markets. We also prefer corporate bonds to sovereign bonds, as the latter are more sensitive to rising US interest rates (and a stronger US dollar).

On a negative note, geopolitical tensions are rising (e.g. Russia/Ukraine), which will continue to affect the performance of emerging market sovereign bonds. The Brazilian elections will also continue to put pressure on Brazilian bonds until the end of the year.

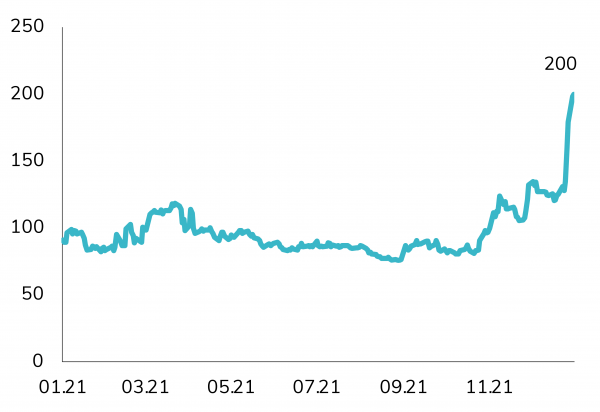

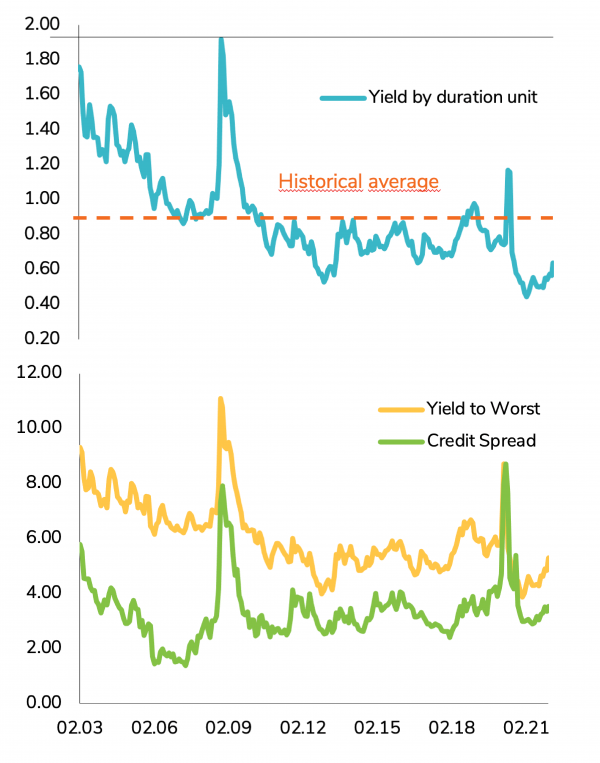

In addition, the average yield to maturity of the USD emerging market sovereign bond index is still below its historical average (5.2% vs. 6%). See the following graphs:

Conclusion

Overall, the entry point is much better than a year ago, but emerging market sovereign bonds could suffer again in the short term. We therefore recommend waiting for more stability before investing in cash bonds. We would also favor to invest now only via option strategies.

Disclaimer

Il presente documento di marketing è stato redatto dal Gruppo Syz (di seguito denominato «Syz»). Esso non è destinato alla distribuzione o all’utilizzo da parte di persone fisiche o giuridiche cittadini o residenti in uno Stato, un Paese o una giurisdizione le cui leggi applicabili ne vietino la distribuzione, la pubblicazione, l’emissione o l’utilizzo. Spetta unicamente agli utenti verificare che siano legalmente autorizzati a consultare le informazioni nel presente. Il presente materiale ha esclusivamente finalità informative e non deve essere interpretato come un’offerta o un invito per l’acquisto o la vendita di uno strumento finanziario, o come un documento contrattuale. Le informazioni fornite nel presente non sono intese costituire una consulenza legale, fiscale o contabile e potrebbero non essere adeguate per tutti gli investitori. Le valutazioni di mercato, le durate e i calcoli contenuti nel presente rappresentano unicamente stime e sono soggetti a variazione senza preavviso. Si ritiene che le informazioni fornite siano attendibili; tuttavia, il Gruppo Syz non ne garantisce la completezza o l’esattezza. I rendimenti passati non sono indicativi di risultati futuri.