The last few decades have all been marked by a major stock market crisis, the main reason being excessive leverage. At the end of the 1990s, a speculative bubble had formed on new economy stocks. Investors had used leverage to gain as much exposure as possible. The bursting of the bubble in 2001 then impacted household savings and risk appetite, resulting in an economic recession and a widespread bear market in all equity markets. The great financial crisis of 2008 originated in the so-called "subprime" mortgage crisis. The over-indebtedness of American households and banks in this sector once again led to an economic crisis and a financial crash.

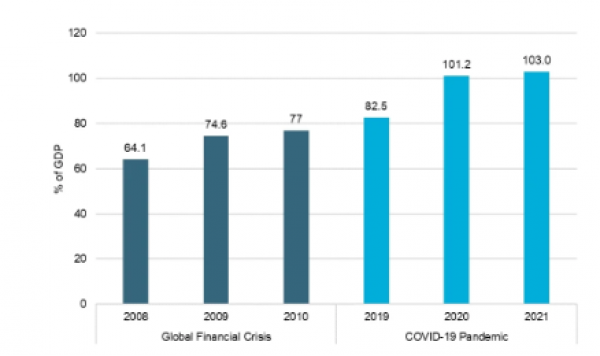

Today, over-leverage and excesses affect neither households nor companies, but the public sector. Since 2008, the governments of most developed countries have tried to solve crises caused by debt by issuing even more debt. This over-indebtedness accelerated during the Covid crisis, creating record levels of global government debt, equivalent to 103% of the OECD’s GDP, compared with a ratio of 75% at the height of the great financial crisis. Heading the most indebted governments are the so-called ‘advanced’ G20 countries, whose debt exceeds 140%, a ratio well above the 116% seen at the end of the Second World War.

OECD public debt as a percentage of GDP (in %)

Source: Euromonitor.com

Government debt has soared

Like any borrower, a government must pay interest on its debt and eventually repay it. Years of low inflation and even deflation after the subprime crisis have kept the cost of debt low or even insignificant. That has allowed several developed countries to borrow at zero or even negative rates for a long time. This advantageous situation is partly the result of a decade of quantitative easing (QE), where central banks buy government debt or other financial assets on a massive scale to inject money into the economy and so stimulate growth.

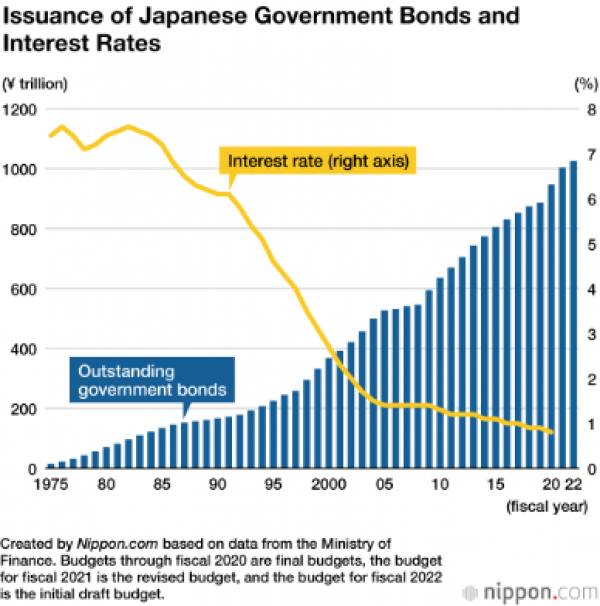

The Bank of Japan (BOJ) was the QE pioneer. Following the bursting of the real estate and stock market bubbles in 1991- 92, the Japanese economy slowed, leading to a long period of deflation. To combat this, the BOJ gradually lowered its key interest rate to zero. After the dot-com bubble burstin 2001 and faced with a still-deteriorating economy, the BOJ introduced a QE programme in March 2001. This was designed to help banks absorb losses from bad loans, and was to remain in place until inflation returned to a sustainable positive level. After a pause in 2006, the BOJ was soon forced to return to QE to combat the sharp decline in industrial activity and the resurgence of deflationary pressures.

Two decades of QE in Japan have led to a recovery in economic activity, financed stimulus packages, and stabilised the public finance deficit. But the abuse of QE has also created many imbalances.

Indeed, the Japanese government took advantage of this zero-interest-rate policy and QE to issue massive amounts of bonds.

Source: nippon.com

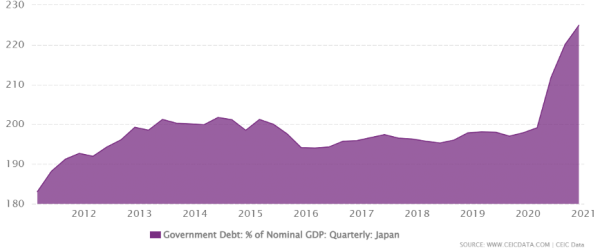

The result is a debt ratio, of 225% of GDP, that far exceeds other developed countries'.

Source: ceicdata.com

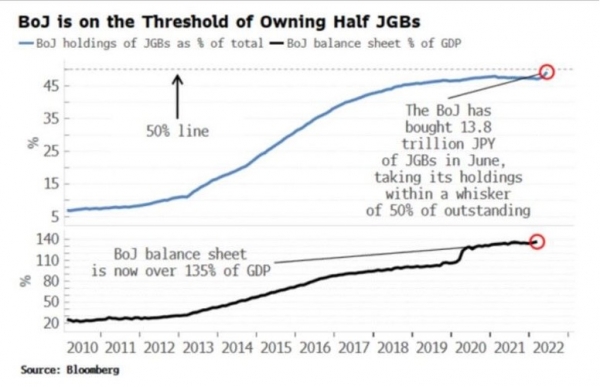

The unconditional support of the Bank of Japan

Any developing country would have seen the cost of its debt explode faced with such a rise in indebtedness. But Japan’s public debt is largely owned by domestic investors, with only 5% of these bonds held by foreigners. Despite very low or even negative rates, Japanese bonds (JGBs) continue to find buyers among Japanese investors. Insurance companies hold 20% of JGBs, banks 15%, and pension funds 7%. Finally, the BOJ now owns almost 50% of Japanese public debt!

Source: Bloomberg

At a time of global inflationary pressures, the BOJ is going against the flow by maintaining an ultra-expensive monetary policy just as the rest of the world is raising interest rates and phasing out QE policies. One consequence of this differential between the BoJ and Western central banks is the weakening of the yen, which inflates the cost of importing food and energy products from Japan.

In a way, the BoJ is achieving its objective as Japan faces inflationary, rather than deflationary, pressures. This should lead to higher bond yields, but Japan cannot afford to pay too much interest, because of its very high debt. That is why it uses a mechanism known as yield curve control (YCC), which consists of buying JGBs to ensure that yields do not exceed an upper limit -which currently stands at 0.25% for 10-year JGBs.

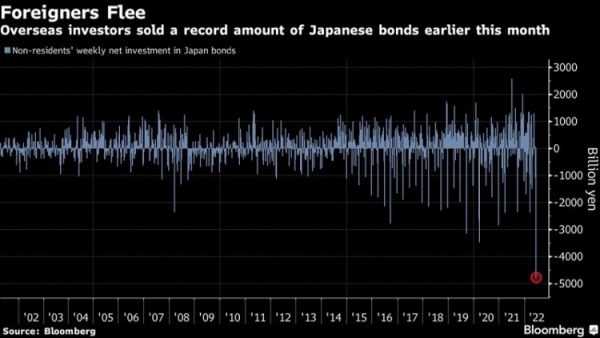

However, hedge funds are now betting that the YCC is unsustainable and are therefore selling JGBs short in a repeat of George Soros' attack on the Bank of England in 1992. This latest ‘big short’ became visible in statistics of non-residents’ weekly net Japanese bond investments (see chart below).

Source: Bloomberg

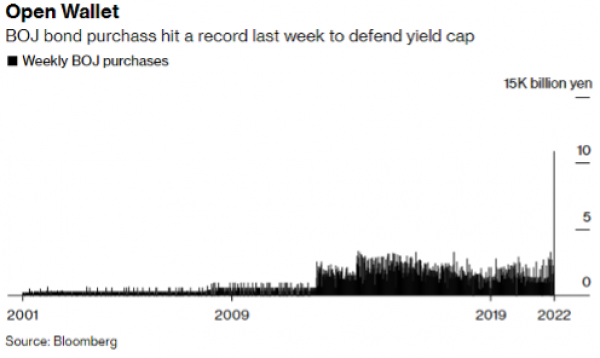

The BOJ is therefore forced to buy even more JGBs to contain rising yields. The central bank’s buying spree has thus accelerated to double its monthly pace at its peak under ‘Abenomics,’ creating a ‘monster’ government bond portfolio worth about 20 trillion yen. That's the equivalent - adjusted to GDP - of 750 billion in monthly QE for the US Federal Reserve.

Source: Bloomberg

What are the risks of such a strategy?

The Bank of Japan’s QE excesses are not without consequences. First, the domestic consequences. By capping the rise in long rates, the BOJ risks pushing inflation well beyond its initial targets. Indeed, the BOJ's bond purchases imply equivalent credit issuance, reinforcing price rises. The yield differential with other developed countries weakens the yen, effectively raising the cost of imported goods and services. The fact that bond yields remain artificially low removes one bulwark against inflation, i.e. the rising cost of credit. The cumulative effect of these factors could create the conditions for inflation to suddenly spiral out of control, implying an inexorable and violent adjustment in the bond market.

Another corollary of the BOJ's unbridled purchases of JGBs is the risk that the sovereign bond market becomes dysfunctional. Given the astronomical amounts it is buying, the BOJ has created a shortage of government bonds and so has intensified the pressure on domestic financial institutions, causing them to turn to the BOJ for relief. As a result, the central bank is forced to lend the equivalent of the billions of bonds it is buying in the market to avoid a complete paralysis of what was once the world's second deepest bond market.

But Japanese monetary policy also creates many risks on the international stage. The weakening of the yen could lead to a currency war in Asia, which could, in turn, fuel rising inflation in neighbouring countries, increase the cost of servicing their dollar-denominated debts, and so increase the risks of default by less creditworthy countries.

Another international consequence with even greater ramifications is the risk of a sudden unwinding of the carry trade. As mentioned above, the BOJ is obliged to lend the equivalent amount of the bonds it buys. This market context - access to very low-rate financing in a constantly depreciating currency - favours the use of carry trades. For example, a ‘long Brazilian real, short yen’ strategy has already generated gains of 35% this year. But the risk of this type of strategy is a sudden reversal of the trend in place. Indeed, if the yen strengthens and/or if JGB yields rise (due to the BOJ abandoning the YCC), there is a risk of a sudden and massive unwinding of carry trades, with a cascade liquidation of risky assets. This would lead to panic selling of equities, forced selling of the dollar, and a rise in US bond yields (because of the rise in JGB yields). This type of financial accident could effectively worsen the downward movement of risky assets and precipitate a global recession.

Conclusion

The bleak scenario described above is far from a certainty. First, the imbalances created by the Japanese authorities (over-indebtedness and manipulation of the bond market) have been pointed out for many years now without ever leading to a major accident.

On the other hand, we should remember that Japan has had to fight deflationary periods over the last 20 years. A little excess inflation is good news for their economy. Moreover, the rise in prices - primarily related to higher energy and agricultural prices - may only be temporary. If the labour market and wages tighten, Japan could break a taboo and resort to immigration. Almost 98% of Japan’s population was born in Japan. Open borders could moderate wages, but also help solve fiscal and debt problems.

Finally, the Japanese authorities are aware of the risks involved and seem to want to proactively manage this situation. An expert on Japanese government bonds (with experience of the market turmoil of the late 1990s) has just been appointed to a key role in the Ministry of Finance. Michio Saito - nicknamed ‘Mr JGB’ - will head a division that covers the bond market and could strengthen communication with the central bank, according to some strategists. For the BOJ to seek a smooth exit from its massive bond-buying policy, close cooperation with the finance ministry is essential, hence the appointment of an experienced official.

However, the current situation in JGBs, in a context of high market volatility, is perilous, to say the least. And any market stress due to the end of the QE in Japan may have another consequence for international financial markets: the loss of confidence in major central banks' monetary policies.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Hyperbitcoinisation is not just about the growing success of bitcoin. It is actually a scenario in which the digital token becomes the world's dominant currency. Overview.

For as long as markets have been open, traders have been exploring different techniques to earn quick profits on the financial markets. Among the various strategies pursued is the "Turtle Trading" system. Developed in the early 1980s by commodity traders Richard Dennis and William Eckhardt, this system was at the heart of an experiment to determine whether anyone could be trained to become a successful trader. They formed a group nicknamed the "Turtles", who generated over $175 million in combined profits over five years, proving the effectiveness of this method. This article provides an overview of the "Turtle Trading" programme, illustrating its origin, principles, and current relevance.

At the end of the week, a major event will take place in the cryptocurrency world. It's called the bitcoin halving. Scheduled 15 years ago, this process occurs approximately every four years, making bitcoin rarer over time. Preview below.

.png)