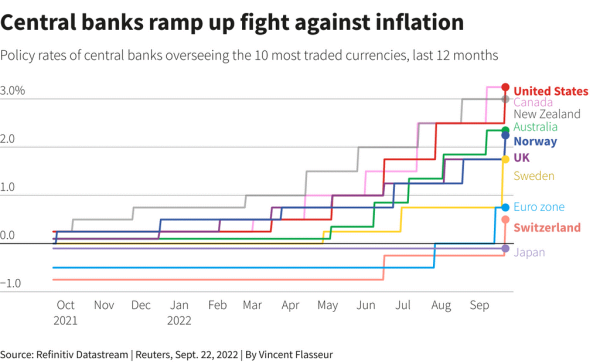

Global equities recorded a second consecutive week of declines after the Fed announced a 75 basis points rate hike while suggesting that monetary policy will remain tight in the coming months.

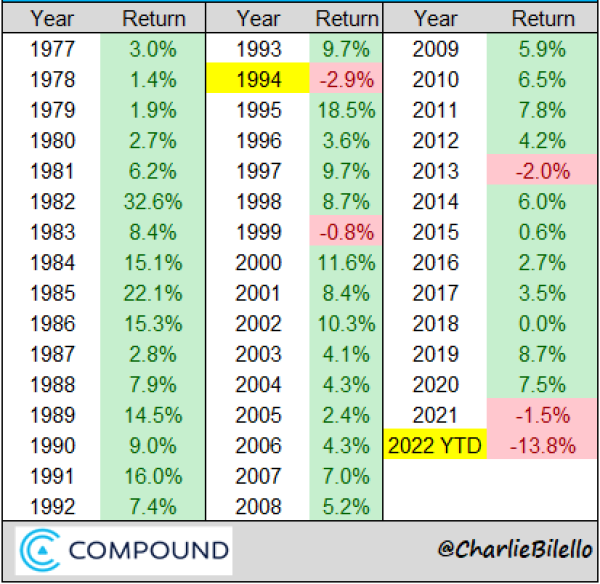

During the session, the Dow Jones Industrial Average reached its lowest level since the end of 2020, while the S&P 500 and Nasdaq Composite are holding mid-June 2022 levels for now. The S&P 500 is now down 22.5% year-to-date, the fifth worst run in history.

As for the Nasdaq, traders only have a few sessions left to prevent the index from recording its three worst consecutive quarters since 2008.