It was the most expected macroeconomic figure of the week: the August US inflation figures. After the pleasant surprise of July's numbers (lower than expected price increases), the market was expecting a confirmation that the US inflation peak is well and truly behind us. Unfortunately, the numbers turned out to be higher than expected. Headline prices rose by 8.3% year-on-year, compared to the expected 8.1%, while core inflation (excluding food and energy) rose by 6.3%, its highest level since March and higher than the 6.1% forecast.

Another reason why investors were disappointed with these figures is that while the contribution of energy declined, services inflation rose sharply. A development that does not please the Federal Reserve.

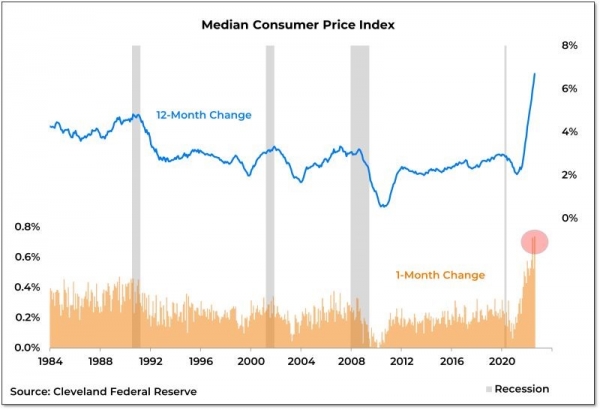

It should also be noted that the median CPI has recorded its two largest monthly increases in history over the last three months. US inflation does not seem to have reached its peak. In fact, it is accelerating and is taking root across the various layers of the economy. The Fed's task is far from over.

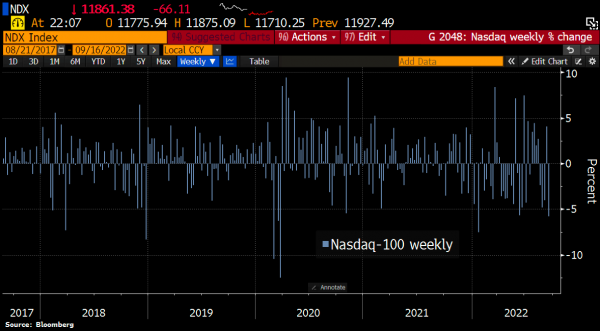

As inflation surprises on the upside, signs of a sharp slowdown in economic growth are increasingly apparent. On Friday, transportation giant Fedex lowered its earnings forecast for 2023. Its new CEO told CNBC that he expects a global recession. FedEx stock fell about 21% on Friday, further precipitating the major equity indices lower (see next item).