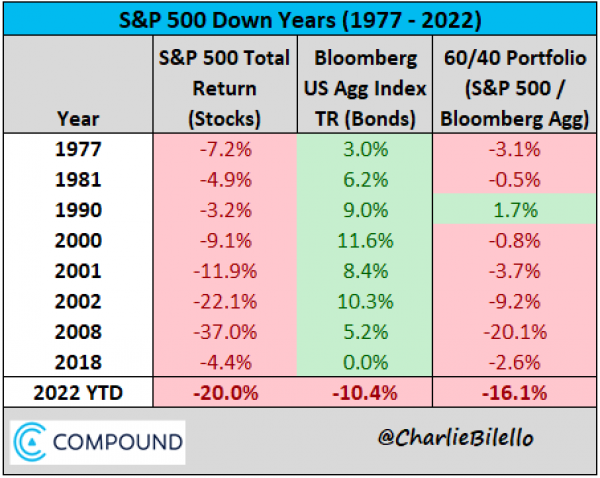

Last week the S&P 500 index posted its worst first half of a year since 1970. It also happened to be the worst-ever first half for multi-asset portfolios. A US 60/40 (equities/fixed income) portfolio fell 20% through June. The last eight times the S&P 500 fell during a calendar year, bonds finished the year higher, cushioning the blow. So far in 2022, it has been very different, with stocks and bonds both declining more than 10%, something we've never seen.

This double bear market also implies massive wealth destruction. Global equity and debt capital markets lost $31 trillion in the first six months of the year, the largest destruction of wealth ever recorded.