As highlighted in our latest Asset Allocation Insights (“The Facts, the Knowns and the Unknowns”), we have been gradually reducing our exposure to equities and credit over the last few months based not only on fundamental & technical indicators but also on systematic risk balancing.

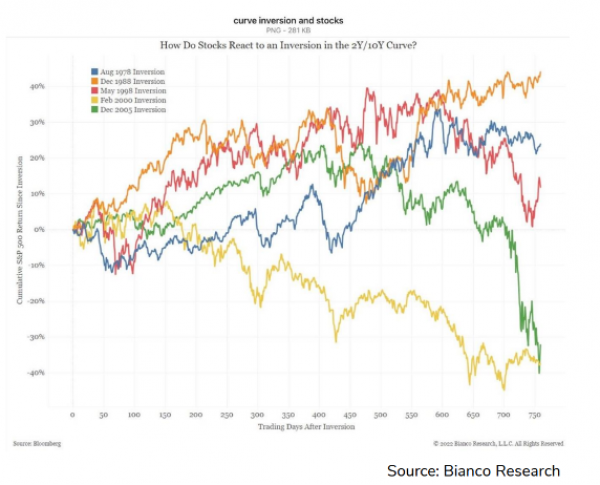

While staying invested, we chose to keep a cautious stance and wait for more visibility, on the geopolitical, macro- economic and corporate earnings outlook.

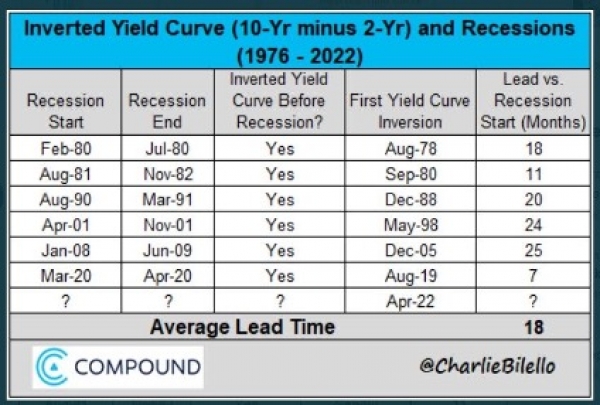

From what we have learned over the last few weeks, we continue to believe that the macro perspective has deteriorated. While we do not anticipate “stagflation” at this stage, our “core” scenario for 2022 has been adjusted toward slower growth and higher inflation. Unlike previous market or macro shocks, central banks are not expected to provide decisive support to the market unless the crisis deepens significantly. As we learned no later than yesterday, key people from the Federal Reserve (Fed Governor Lael Brainard and San Francisco Fed President Mary Daly) are emphasizing the central bank’s commitment to fighting inflation through higher interest rates. They also seek to start a ‘rapid’ balance sheet reduction as soon as May.

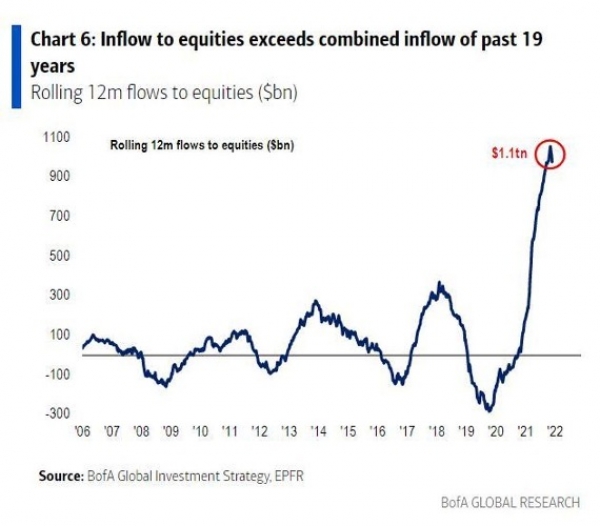

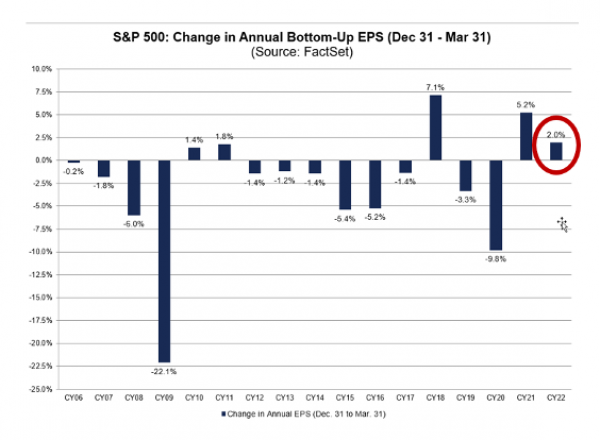

On the valuation side, equity markets are getting cheaper but there is still a risk for earnings forecasts to be adjusted downwards by consensus. On an aggregated basis, our fundamental indicators have turned negative, which lead us to be cautious with regards to our equity exposure.

On the positive side, our market technical indicators have been improving recently mainly thanks to signals stemming from volume, volatility and trend. As such, we have very slightly increased our exposure to global equities during March. Our favorite markets remain the US and Japan. From a style and sector perspective, we keep a mix of growth and value stocks.

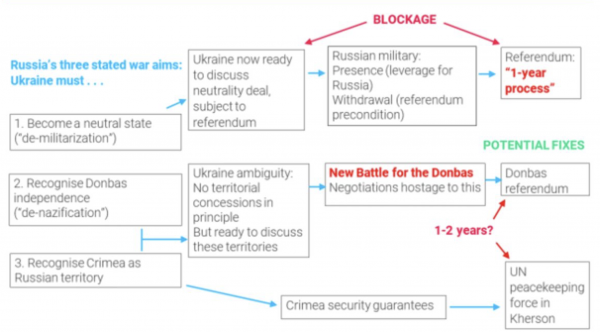

Last but not least, the Russia-Ukraine conflict remains a key risk for the markets. Despite ongoing negotiations, a stalemate with a prolonged economic impact looks likely. As mentioned by TS Lombard, "an early end to the global economic shock from this war and sanctions crisis is unrealistic." There is still a lot of uncertainty regarding the entire situation and the longer it takes to end the conflict, the longer the commodity supply shock will last, driving up commodity prices and thus inflation higher. As shown on the chart below, there is a difficult path to find a resolution to the Russia-Ukraine war. The organization of referendums and the battle for Donbas could take years. Sanctions on Russia create a major issue for the global economy: energy, metals and soft commodities are needed for virtually everything, yet Russia exports many raw materials, and unlike 1973, it’s not just the price of oil, but the price of all commodities that is surging. This ultimately increases the risk of a stagflation scenario which is not the best economic outcome for risk assets.