The biggest story in February was undoubtedly the start of the war between Russia and Ukraine. Despite the fact that a Russian incursion into Ukraine was widely expected, Russian President Vladimir Putin's decision to conduct a large-scale attack beyond the breakaway Donbass region stunned the globe. At the time of our writing, investors need to weigh in different scenarios: 1) A Russian military victory leading to an unstable Ukraine and Cold War II; 2) A negotiated deal between Russia and Ukraine; 3) A coup against Putin and; 4) A Russia-NATO armed conflict including the use of tactical nuclear weapons. The last scenario is a “very fat tail” event which does not look to be priced as a likely scenario by the markets – at least for now.

February market review: The war, commodities and inflation

Donnerstag, 03/03/2022After a rough start to 2022, the month of February did not help reduce market volatility. In fact, the Russia- Ukraine crisis and the resulting geopolitical instability shook markets even more, impacting commodity prices, creating additional supply chain bottlenecks and further enhancing inflation pressures. Here are 10 stories to remember from an eventful month.

Story #1 — Invasion of Ukraine

Story #2 — Sanctions imposed on Russia

Various nations around the world condemned Russia’s actions and sanctions have been imposed in response by the West. While each country’s sanctions vary, the sanctions issued thus far generally target a number of key Russian individuals and financial institutions. They include measures such as freezing assets and prohibiting transactions with certain Russian businesses, and now around 80% of the Russian banking system is under sanctions with sharply reduced or no ability to settle international transactions.

Also, in the U.S., there is a ban on American firms and individuals trading and investing in the secondary market of new Russian government debt. Russia has also been partially cut off from SWIFT, the international banking and messaging network.

Story #3 — The collapse of Russian assets

The impact of the Russian-Ukrainian war and resulting international economic sanctions weighed heavily on Russia’s stocks and its currency. The ruble collapsed by 30% as the dollar now trades above 100 ruble for the first time ever. Over the month, the Russian equity index (in $) is down nearly 50% as Russian stocks have become almost un-tradable by international investors. The main Russian equity index tumbled 33% the last Thursday of the month, its largest decline in its history, which led to a 16-sigma event. Bond markets collapsed as well as Russia's credit rating was downgraded to "junk," indicating that default is a distinct possibility. Finally, the Russian central bank was forced to raise interest rates from 9.5% to 20% in order to protect its currency as it fell to new lows.

Story #4 — Commodity prices surged

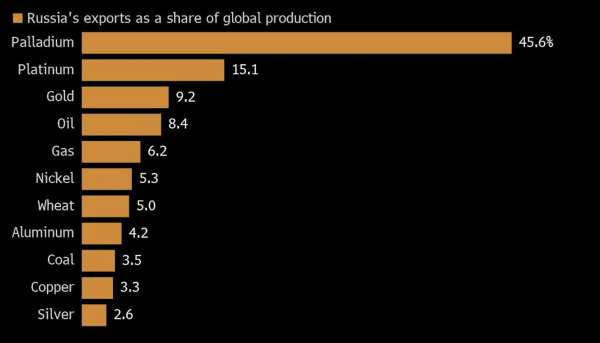

On the back of the Russian invasion, Brent oil broke above USD 100 per barrel, a threshold reached for the first time since 2014. Russia is a major commodity exporter, accounting for 13% of global crude oil production and 17% of global natural gas production. Together, Russia and Ukraine, account for nearly a fifth of world wheat exports. As a result, an interruption in the supply of energy and other agricultural goods is the primary risk of the Ukraine/Russia conflict. The impact is significant on Europe as it gets nearly 40% of its natural gas and 25% of its oil from Russia. For some countries such as Egypt, which consumes twice the global average of bread and imports about 85% of its wheat from Russia and Ukraine, a hampered supply can have far reaching social and economic consequences. It's worth noting that precious metal prices rose in response to the invasion news. Investors regard gold to be one of the few remaining portfolio hedges. Platinum and palladium prices have risen, with Russia accounting for a substantial portion of supplies. Commodities were the best-performing asset class in February (+6.2%), as well as the best-performing asset class since the beginning of the year (+15.6%).

Story #5 — Inflation at multiple decade highs

From a macroeconomic standpoint, global GDP continues to rise above trend and inflation keeps surprising on the upside. In the US, headline inflation for January was 7.5% year-on-year, comfortably ahead of expectations. Looking closer at the details, both core goods and core services inflation increased their contribution to the headline number, suggesting that underlying inflationary pressures are continuing to build. Europe's inflation is also at multi-decade highs. While the conflict's immediate impact on the world economy is expected to be limited (Russia's economy accounts for less than 2% of global GDP), rising oil costs could fuel greater or at least more persistent inflation, eating into household disposable income.

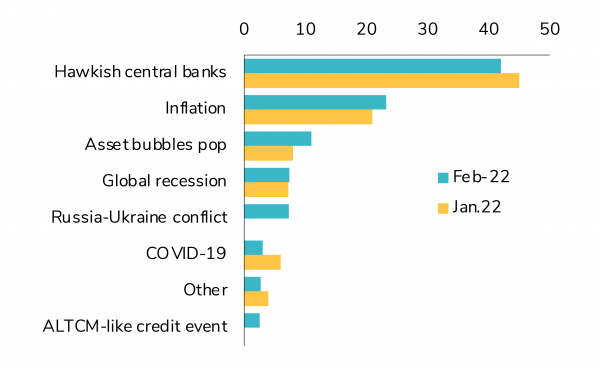

Story #6 — A tale of two stories for central banks and rate expectations

Expectations for the number of interest rate hikes provided by the US Fed, the BoE, and the ECB quickly increased in the first half of the month. Investors were afraid that, in their efforts to bring inflation under control, central banks may stifle growth. With rising inflation and solid job growth, the market expected the Fed to raise interest rates six to seven times by the end of the year. The situation in Ukraine captured investors' attention in the second part of the month, while the impact of the war on central bank actions is still unclear. Will central banks react to higher energy prices by increasing the magnitude or speed of interest rate hikes in order to combat inflation, or will they reduce their pace of tightening in order to support the economy? While 2022 rate forecasts were unchanged during the invasion week, bond markets began to reduce their projections in the latter days of the month. It's also worth noting that the Fed and ECB's rate expectations are starting to diverge significantly, with the 2-year bond yield differential reaching its maximum since April 2020.

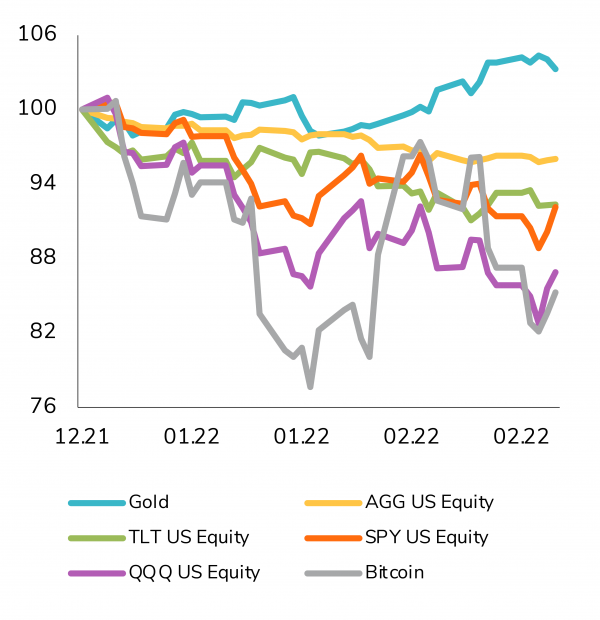

Story #7 — Bond markets provided no hedge; only Gold does

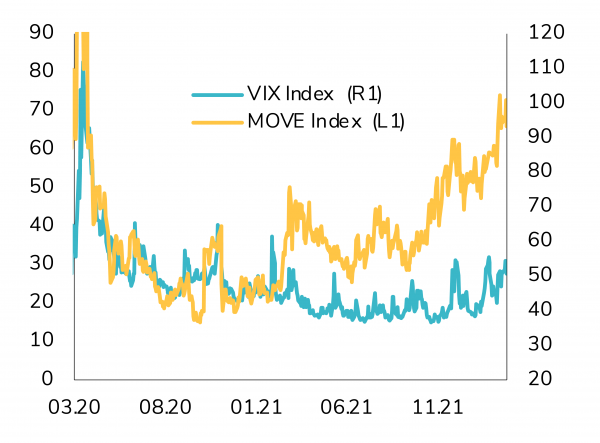

Despite the surge of geopolitical risk, investors didn’t rush into government bonds as they don’t appear to be considered as a safe haven anymore. US Treasuries declined by 0.7% over the month while the MOVE index (the VIX equivalent for US Treasuries) reached record levels. The global aggregate bond index fell 1.2% in February as credit spreads widened. Emerging Markets debt was the worst performing group with a -5.5% decline for the month. Euro High Yield (-3.2%) significantly underperformed US High Yield (-0.9%). On a year-to-date basis, the global aggregate bond index is down -3.2%, which is one of the worst start of the year ever. Government Bond yields did not provide any hedging to global portfolios during an equity market correction for the first time in the Quantitative Easing Era. Only Gold has this property – see chart below.

Story #8 — A rocky road for global equity markets

It was another month of negative and volatile returns for equity markets. Developed equity markets recorded a -2.5% decline while Emerging markets were down -3%. Japan was the best monthly performer (-0.4%) and MSCI Europe ex-UK was the worst (-4.3%). Note that with a weight of 0.3% of the global equity index, the collapse of Russia equities on world equity value didn’t have much direct effect. From a style perspective, Global Value (1.6%) outperformed Global Growth (-3.6%). Rising oil and gas prices have boosted the energy sector of the S&P 500, contributing to Value's outperformance. In the United States, the S&P 500 index momentarily entered correction territory (Minus 10% from the record high hit on January 3rd), marking the index's first correction since the pandemic began. The Nasdaq composite index entered correction territory roughly five weeks before the S&P 500, with a January fall that took the drawdown to almost 12 percent. Since the start of the year, the SP 500 has lost 8%, its worst first two months since 2009.We note that the Cboe Volatility Index—also known as the VIX—reached an intra-month high of 36, a significant rise but still well below the level observed during previous crisis.

Story #9 — Strong corporate earnings and more affordable US equities

Investors have been concerned about the outlook for corporate profitability due to rising inflation and bond yields, but the fourth quarter earnings season produced reassuring numbers. Companies in the United States reported earnings growth of more than 30% year over year, compared to predictions of 20% at the start of the reporting season.

Despite this, fears over the situation in Ukraine and stricter monetary policy damaged equities markets in February, with the S&P 500 falling 3%. As a result, according to FactSet, the S&P 500's forward price-to-earnings ratio has fallen below its five-year average for the first time since April 2020.

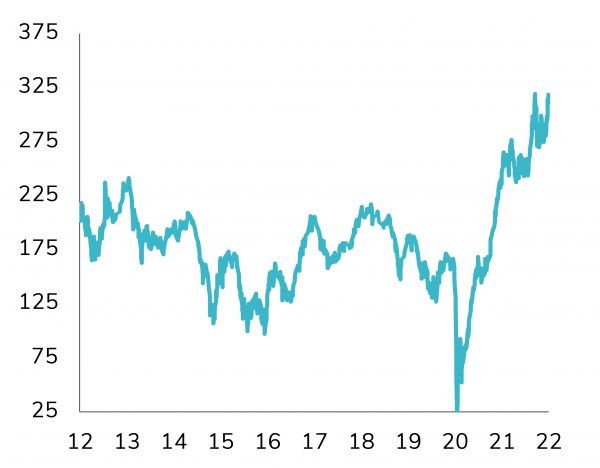

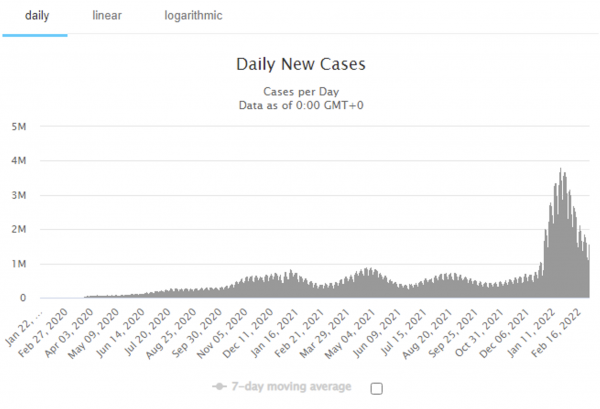

Story #10 — COVID cases have collapsed

To end this monthly market review on a positive note, we would like to highlight that COVID cases and death have collapsed since January. Going forward, this should help the “reopening trade”, i.e sectors such as tourism, travel, restaurants, etc. but also strengthen the case for rate hike cycle and increase the demand for energy…

Disclaimer

Dieses Werbedokument wurde von der Syz-Gruppe (hierin als «Syz» bezeichnet) erstellt. Es ist nicht zur Verteilung an oder Benutzung durch natürliche oder juristische Personen bestimmt, die Staatsbürger oder Einwohner eines Staats, Landes oder Territoriums sind, in dem die geltenden Gesetze und Bestimmungen dessen Verteilung, Veröffentlichung, Herausgabe oder Benutzung verbieten. Die Benutzer allein sind für die Prüfung verantwortlich, dass ihnen der Bezug der hierin enthaltenen Informationen gesetzlich gestattet ist. Dieses Material ist lediglich zu Informationszwecken bestimmt und darf nicht als ein Angebot oder eine Aufforderung zum Kauf oder Verkauf eines Finanzinstruments oder als ein Vertragsdokument aufgefasst werden. Die in diesem Dokument enthaltenen Angaben sind nicht dazu bestimmt, als Beratung zu Rechts-, Steuer- oder Buchhaltungsfragen zu dienen, und sie sind möglicherweise nicht für alle Anleger geeignet. Die in diesem Dokument enthaltenen Marktbewertungen, Bedingungen und Berechnungen sind lediglich Schätzungen und können ohne Ankündigung geändert werden. Die angegebenen Informationen werden als zuverlässig betrachtet, jedoch übernimmt die Syz-Gruppe keine Garantie für ihre Vollständigkeit oder Richtigkeit. Die Wertentwicklung der Vergangenheit ist keine Garantie für zukünftige Ergebnisse.