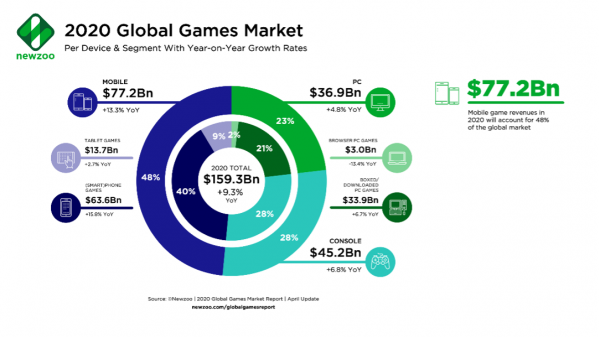

Global gaming is one of the fastest growing categories in the Media industry. Video games attracted an estimated ~3B gamers globally, a number which is expected to rise to 4.5B by 2030. As of today, the video games industry generates more revenues than movies, music and books combined.

Over the last decade, gaming has greatly transformed itself:

Microsoft bets on the Metaverse

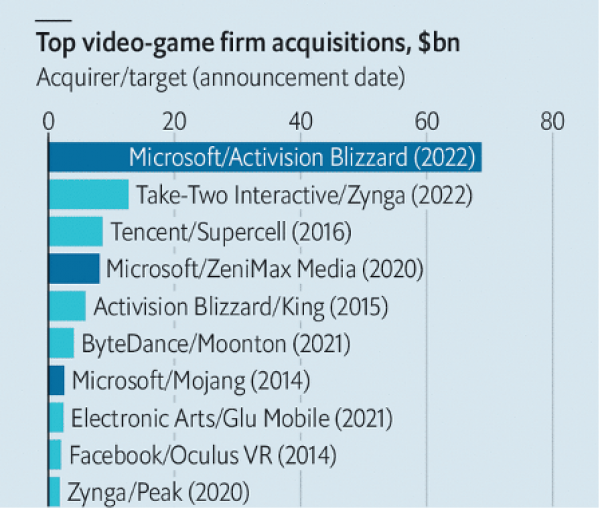

Donnerstag, 01/20/2022This week, software giant Microsoft announced a deal to acquire the American video game publisher Activision Blizzard in an all-cash transaction valued at $68.7 billion ($95/share). What are the strategic reasons behind this gaming mega deal?

Video Games: a booming industry

- Digitalization: a few years ago, video games were bought at a retail store (ex. GameStop). They can now be downloaded in minutes from home on various digital platforms. This convenience has not only decreased the friction of the purchase act, but it has also allowed gaming companies to stop sharing part of their profits with the distribution network.

- The revenue stream has changed. Before, a video game was generating revenue only when it was sold on a stand-alone basis. With the “free-to-play” model, players can start playing a game for free and later purchase in-game items and / or upgrade their subscription to level up faster (commonly known as in-game purchases). Other games offer extensions and online passes. Altogether, games can now generate 2-3x more revenue than their original purchase price. Another type of revenue model has been introduced by streaming services (e.g Netflix) which give gamers access to a library of content (here games) for a fixed monthly fee, improving the recurrence and visibility on revenues for gaming companies.

- E-sports: nowadays, teenagers can spend more time watching people playing than playing themselves. This has been unlocking tremendous market opportunities for gaming companies since they can now negotiate license fees with broadcasters (pay per views) and advertisement companies that want to associate their brands with these new sports idols. For instance, one of the latest TV ads by Coca Cola features e-sport players. Apparel companies are already sponsoring e-sport teams, football clubs now create their own e-sport team, etc.

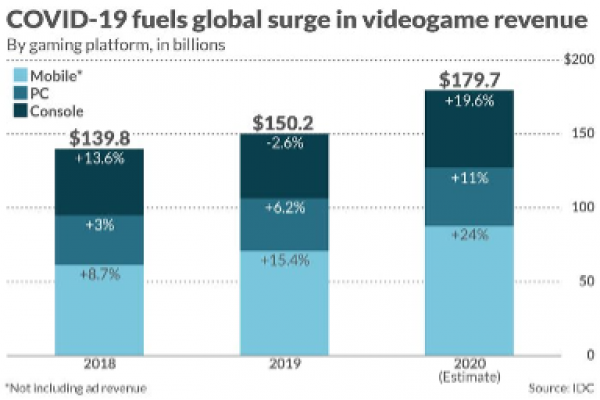

On top of the secular trends aforementioned, the gaming industry has enjoyed three recent tailwinds:

- Covid-19: People were locked at home, sometimes with no jobs, giving them time for home entertainment, which of course includes gaming.

- A new hardware generation: the launch of PlayStation 5 and Xbox Series X as well as VR headsets (ex. Oculus) is opening a new realm of possibilities.

- The Metaverse: Today, gaming is probably the closest thing to the definition of the Metaverse - a virtual world where people can connect. It is therefore not a surprise to see the growing popularity of this theme bringing back the gaming space on investors’ radar while encouraging companies from all horizons to assess how they could benefit from its development.

As companies target the Metaverse, gaming is also becoming increasingly relevant given its collection of virtual communities.

A bold move by Microsoft

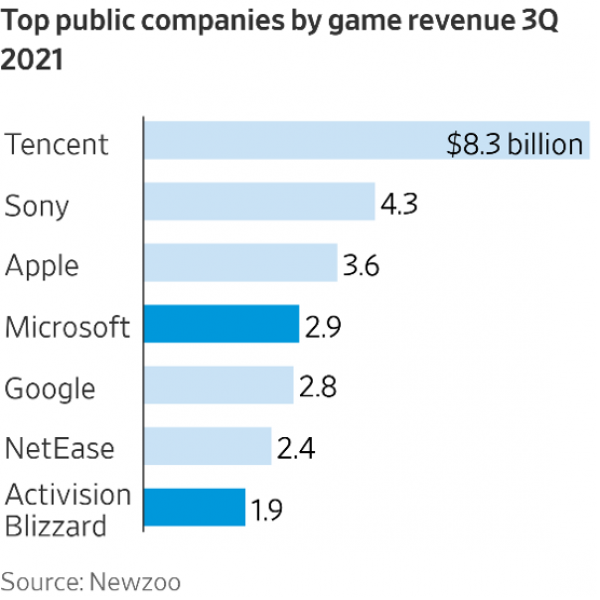

Microsoft (MSFT) announced on Tuesday a deal to acquire Activision Blizzard (ATVI) in an all-cash transaction for $68.7B (or $95/share). The deal is expected to close by the end of Microsoft’s FY23 (June 2023) and would strengthen Microsoft’s position in this space, making it the third-largest gaming company (as measured by revenue) in the world after Tencent and Sony.

Content is key in entertainment, and Microsoft’s strategy is to increase its capacity on this front. What we are now witnessing in the gaming industry is similar to what we saw with movies & TV shows (Disney acquiring Marvel and Lucas Films, AT&T taking over Time Warner, etc.). Activision Blizzard is a leading developer with strong titles across console, PC and mobile. While Microsoft does already have some strong Intellectual Property of its own, the addition of the Activision Blizzard portfolio will allow it to substantially level-up, so to say.

Microsoft claims that the deal will help to accelerate the creation of a Metaverse proposition, while driving subscriber growth for Xbox Game Pass and providing exposure to the fast-growing mobile gaming segment, in which Microsoft has not yet built a significant presence. The deal should also accelerate Microsoft’s ambitions in cloud gaming with enhanced mobile capabilities and the inclusion of highly successful franchises such as Overwatch and Diablo in the near-term.

At first glance, a $69 billion price tag looks hefty. It implies a 45% premium to Friday’s close. However, we should keep in mind that ATVI shares have taken a major hit over recent months following allegations of misconduct at the firm. In fact, the $95/share price is almost a 10% discount to the highs of 2021. The deal values Activision Blizzard at around 7.3x forward bookings, 17x FY22 EV/EBITDA and 25x FY22 P/E based on consensus estimates.

From a regulatory standpoint, the fragmented nature of the industry and a wide number of gaming competitors/platforms should ease concerns but the vertical nature of the deal will likely receive scrutiny by antitrust authorities. It seems that the market is indeed pricing in some antitrust issues as ATVI shares currently trade at a -15% discount versus the proposed take-out price.

More M&A to be expected

Not many firms are able to spend $70bn for a gaming company. Nevertheless, we would not be surprised to see further consolidation in the sector. Indeed, the deal furthers the trend within the global gaming industry whereas companies are always fewer and bigger. As companies target the Metaverse, gaming is also becoming increasingly relevant, given its potential to create, grow and cater to virtual communities. Among the possible candidates for a takeover: Electronic Arts (~$38bn market cap), Take-Two (~$18bn and which is currently acquiring Zynga) or Ubisoft ($6bn). Apple or Netflix could be potential buyers as they want to make a push in this industry.

Disclaimer

Dieses Werbedokument wurde von der Syz-Gruppe (hierin als «Syz» bezeichnet) erstellt. Es ist nicht zur Verteilung an oder Benutzung durch natürliche oder juristische Personen bestimmt, die Staatsbürger oder Einwohner eines Staats, Landes oder Territoriums sind, in dem die geltenden Gesetze und Bestimmungen dessen Verteilung, Veröffentlichung, Herausgabe oder Benutzung verbieten. Die Benutzer allein sind für die Prüfung verantwortlich, dass ihnen der Bezug der hierin enthaltenen Informationen gesetzlich gestattet ist. Dieses Material ist lediglich zu Informationszwecken bestimmt und darf nicht als ein Angebot oder eine Aufforderung zum Kauf oder Verkauf eines Finanzinstruments oder als ein Vertragsdokument aufgefasst werden. Die in diesem Dokument enthaltenen Angaben sind nicht dazu bestimmt, als Beratung zu Rechts-, Steuer- oder Buchhaltungsfragen zu dienen, und sie sind möglicherweise nicht für alle Anleger geeignet. Die in diesem Dokument enthaltenen Marktbewertungen, Bedingungen und Berechnungen sind lediglich Schätzungen und können ohne Ankündigung geändert werden. Die angegebenen Informationen werden als zuverlässig betrachtet, jedoch übernimmt die Syz-Gruppe keine Garantie für ihre Vollständigkeit oder Richtigkeit. Die Wertentwicklung der Vergangenheit ist keine Garantie für zukünftige Ergebnisse.