There are myriad approaches to ESG investing – best-in-class, thematic, risk mitigation – most of which started in the world of equities. In fixed income, responsible investing may address accountability and impact in a way that is unparalleled thanks to green bonds. Why is that? First and foremost, bonds are maturing. Therefore, projects need to be financed each time a bond is issued. Every time an issuer organises a roadshow to present and market the project’s funding requirements, there need to be convincing arguments. Secondly, real green investments are in greater demand than ever before. In 2019 alone green bonds made up 3.8% of overall bond issuance.1 This number has steadily increased from 1.9% in 2016, to 2.5% in 2017, to 3.2% in 2018 and is unsurprisingly trending upwards. Chart 1 illustrates the sheer size of this wall of fixed income money versus sticky money that is often raised only once to finance equity IPO. Hence, the fresh money from the fixed income market is a multiple in comparison to fresh money from the equity market. Let’s now assess what can be achieved with the powerful features bonds possess in combination with the growing trend in green bond issuance.

Green bonds we can believe in

Donnerstag, 01/16/2020While environmental, social and corporate governance (ESG) data has become a hygiene test for institutional investors around the world, what constitutes an ESG or sustainable investment remains vague and the methods adopted vary greatly. Unfortunately, in this new green frontier, a lack of accountability regarding the impact investments have on the real challenges of our time is increasingly exposing investors to greenwashing. This trend may be due to the lack of awareness of what counts most, because of the pursuits of those who have other goals.

“Green bonds represent unparalleled transparency.”

Meeting green standards

Firstly, targeted instruments which seek to effect ecological change in clearly defined areas are needed in this opaque world of responsible investing. In the environmental space, this exists in the form of green bonds. Not only are green bonds a more clearly defined and transparent alternative to ESG labels, they offer investors concrete opportunities to fund transformative environmental projects.

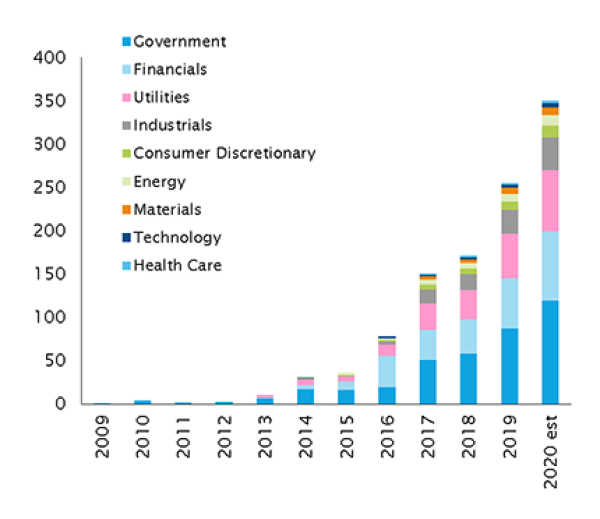

Secondly, Green bonds have existed since 2007, with initial issuances mainly led by Multilateral Development Banks, namely the European Investment Bank (EIB) and the World Bank. However, 2014 has been a game changer for green bonds. Since then, the International Capital Market Association serves as the Secretary to the Green Bond Principles (GBP).2 The GBP are voluntary guidelines for issuing green bonds, created, in turn, by market participants. The goal was to promote transparency and the integrity of the green bond market. Since 2014, we have seen a rapid rise in issuances, including private companies across sectors, with a high proportion in utilities and healthcare, see Chart 2.

Complying with the principles requires several elementary components. The first is to have a framework that ensures using the proceeds in green projects. An independent external review is then required to certify the action undertaken is aligned with the principles. The number of bodies qualified to make this approval has increased from a few independent scientific institutes to include large accounting firms. Third, all bond proceeds must be earmarked for investment in the green project. The final, crucial component is an annual report that measures results. The tangible impact of a green bond is easier to measure than quantifying the effects of a blended ESG letter rating code. Measuring change against agreed targets is a straightforward exercise. This is especially true when compared to evaluating a company’s overall ESG score, given discrepancies between companies’ environmental, social and governance records.

Green bonds are usually pari passu, and hence receive the same credit ratings as, a company’s corporate bonds – offering the same risk, return and liquidity profile. For this reason, they can be benchmarked against the overall bond market. Therefore, by replacing part of a traditional bond portfolio with green bonds, investors can expect the same output, with an added value to the environment. Moreover, due to the earmarking described above, green bonds are entirely transparent. That contrasts with traditional corporate bonds, which are usually issued to (re)finance general corporate purposes. This earmarking feature creates a transparency that is extraordinary for financial assets. Furthermore, the above-mentioned annual reporting ensures investors can understand how their money is used and hence gauge the transformative power of each bond. Taken as a whole, green bonds represent unparalleled transparency.

Making positive change

Green bonds ultimately have a direct benefit on the environment by bringing about positive change. Many ESG funds invest in companies that have already achieved substantial progress in ESG areas. But by confusing companies’ absolute CO2 emissions with the direction of change, ESG investors forgo the opportunity to effect change in those who have the most impact. Instead, we believe there should also be a focus on transitioning the laggards. To this effect, green bonds can be used with the sole purpose of helping companies and governments with imperfect records implement reforms. The transformation of Danish state-owned energy company Ørsted – from oil and gas production to renewables – highlights how green bond issuances can help a company completely shift its operational focus to align with global decarbonisation. This transition to a low-carbon economy is necessary, as the world is facing a climate crisis that is making a substantial impact on the economy. If investors do not support to curb the rise of man-made CO2 emissions, this will only exacerbate the rise of other global issues, such as poverty and drought. Whereas ESG investing is largely focused on mitigating the risks of damage from the environment, green bonds are a way of transforming the world’s governments and corporations to enable a greener future. So, green bonds are a way of embracing challenges and not simply avoiding them.

While the global green bond market remains a small portion of the outstanding bond market, issuances are growing at a phenomenal rate, see Chart 2. Displaying the same investment characteristics as regular corporate bonds, they are easily accessible. By making a slight adjustment to their fixed income allocation, investors can have a genuine and transformative impact on the environment.

Why are green bonds so important nowadays?

Firstly, the best proof of the concept is the fact that demand for this kind of bonds is huge, as shown above. In other words, the issuance of enough green bonds is currently the constraint in the market. Secondly, green investments must deliver a transformation into a new world.

In this respect, former senior BIS bankers Hervé Hannoun and Peter Dittus3 argue the current trajectory of policies in the G7 countries is leading to a systemic crisis. Moreover, they elaborate that the 2008 financial crisis may only have been a dress rehearsal for a worse crisis. They devote a particularly large part of their book to addressing the carbon-fuelled growth. But the authors also describe what can be done to transition into a low carbon economy. In another contribution4, Figueres, Schellnhuber, Whiteman, Rockström, Hobley & Rahmstorf state that delaying the transition to a low carbon economy will either lead to little time for adoption and hence costs for the economy, or to social impacts, such as intensified heatwaves, droughts, sea-level rise and many others. Therefore, they argue for a six-point plan to turn the global carbon dioxide emissions towards lower levels by 2020. Even politicians around the world understood the obligation for change, which finally ended at the 21st Conference of the Parties (COP21) to agree on one common goal. This is the reduction of man-made greenhouse gas emissions to zero by 2050.

The impact on risk-return

Does sustainable investing lead to lower returns? Within less than a second, Google returns almost 200 million answers to that question. In Academia, over 2,000 studies have been carried out in that vein. Most of them focus on equities. From a practical point of view, Swiss Re has been a pioneer in ESG investing. All of their benchmarks have been switched to ESG benchmarks in 2017. Their corresponding study showed that corporate bonds show a better risk-return profile than their non-ESG counterparts. ESG equities are better as well, but to a smaller extent. For both asset classes, the improvements come from a reduction in volatility and not from higher returns. Furthermore, Swiss Finance research chair and assistant professor of responsible finance at the University of Geneva, Philipp Krueger confirms that the main driver of improved ESG portfolios comes from risk reduction5. However, little effort has been made in investigating the portfolio characteristics of green bonds versus traditional bonds. Our stance is that since green bonds offer the same risk, return and liquidity characteristics as traditional bonds, there is no financial argument for not investing in green bonds. Moreover, since green bonds create value for the environment, this can be seen as a bonus feature.

This leads to the following conclusion

In contrast to speculative assets, bonds are instruments focused on downside protection. By their nature, bonds stand for capital preservation, regular income and are long-term oriented. They are a vehicle providing a credit to issuers. Hence, the counterparty has the obligation to pay back. From the issuer perspective, bonds help financing long-term projects. All of the above features make bonds the optimal financial instrument to finance long-term investments that transform the economy. Cities can finance their transportation systems, for instance, via green bonds. Energy companies can finance renewable energy plants. Auto manufacturers can finance research & development of low emission vehicles. There is no shortage of potential projects.

Most importantly, since: the interests of green bond issuers and investors are fully aligned; green bonds are on an equal footing with other bonds from the same issuer; the Green Bond Principles (GBP)6 were developed in 2014 by the International Capital Market Association (ICMA) and market participants on a voluntary basis and not by regulatory prescription; green bonds have the purpose of transforming the economy; and we are fixed income portfolio managers, YES WE CAN BELIEVE IN GREEN BONDS.

Greenwashing or not?

Can investments be mapped to do anything for the Sustainable Development Goals (SDGs)? Are the investments serving the purpose of transforming the economy? If both answers are a definite yes, they deserve the label green, whereas the other ones are rather “free-riders” profiting from the real green ones. This is because they pretend to be doing good, but in reality do not lead to the transformation required.

There are a few simple illustrations that help measure sustainability. One of the most popular ones is the carbon footprint introduced by William Rees and Mathis Wackernagel in the 1990s. It measures the greenhouse gas emissions of countries or individuals. For example, Switzerland consumed 1.5 times its capacity in the 1960s, whereas its consumption since 2010 has increased to 3 times the global capacity. In contrast, many countries in Africa show a ratio far below 1. Hence, in terms of sustainability, Switzerland along with many western countries is an ecological debtor to the world, and is even trending worse. But many African countries are an ecological creditor to the world.

Disclaimer

Dieses Werbedokument wurde von der Syz-Gruppe (hierin als «Syz» bezeichnet) erstellt. Es ist nicht zur Verteilung an oder Benutzung durch natürliche oder juristische Personen bestimmt, die Staatsbürger oder Einwohner eines Staats, Landes oder Territoriums sind, in dem die geltenden Gesetze und Bestimmungen dessen Verteilung, Veröffentlichung, Herausgabe oder Benutzung verbieten. Die Benutzer allein sind für die Prüfung verantwortlich, dass ihnen der Bezug der hierin enthaltenen Informationen gesetzlich gestattet ist. Dieses Material ist lediglich zu Informationszwecken bestimmt und darf nicht als ein Angebot oder eine Aufforderung zum Kauf oder Verkauf eines Finanzinstruments oder als ein Vertragsdokument aufgefasst werden. Die in diesem Dokument enthaltenen Angaben sind nicht dazu bestimmt, als Beratung zu Rechts-, Steuer- oder Buchhaltungsfragen zu dienen, und sie sind möglicherweise nicht für alle Anleger geeignet. Die in diesem Dokument enthaltenen Marktbewertungen, Bedingungen und Berechnungen sind lediglich Schätzungen und können ohne Ankündigung geändert werden. Die angegebenen Informationen werden als zuverlässig betrachtet, jedoch übernimmt die Syz-Gruppe keine Garantie für ihre Vollständigkeit oder Richtigkeit. Die Wertentwicklung der Vergangenheit ist keine Garantie für zukünftige Ergebnisse.