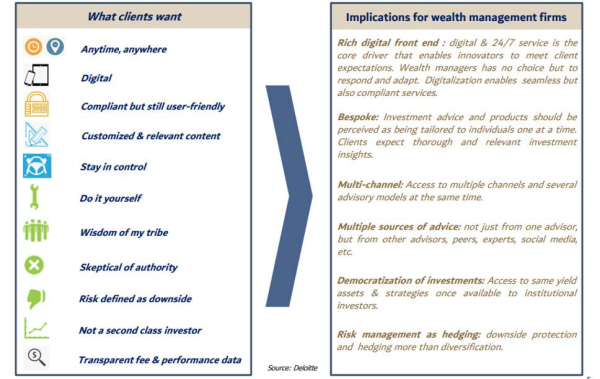

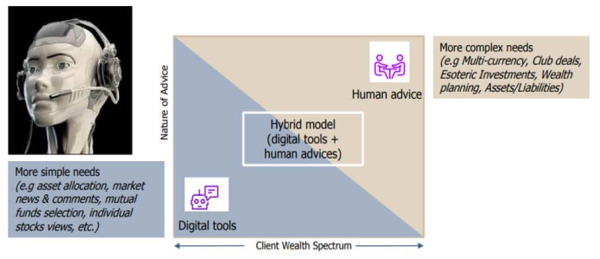

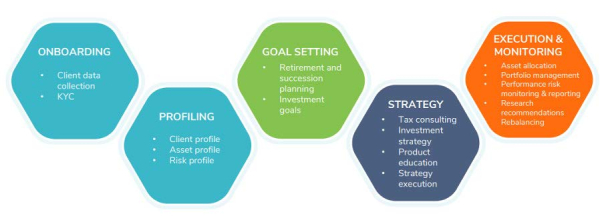

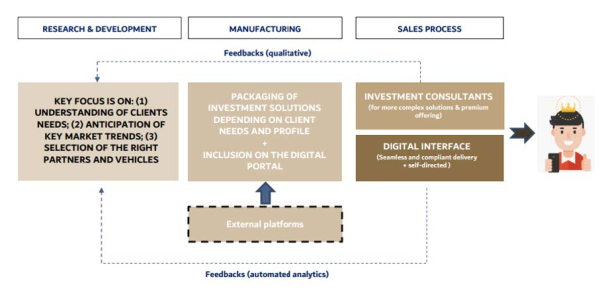

The needs of private customers have changed significantly in recent years. Most of them want to receive information anywhere, anytime, with just a few clicks. They understand the regulatory constraints but want the smoothest possible client experience - from the account opening process to the monitoring or their positions. When it comes to investment advice, the content must be personalized and consistent with the client's specific needs. The banker is no longer seen as the only competent source for advice and management: many clients want to keep control of their investments and want access to different sources of advice. Most private clients - including those in the "affluent" segment - no longer want to be treated as "second-class" investors.

They demand access to complex solutions that were once reserved for institutional investors (venture capital, private debt, real estate, structured products, etc.). Performance and fees must be transparent.

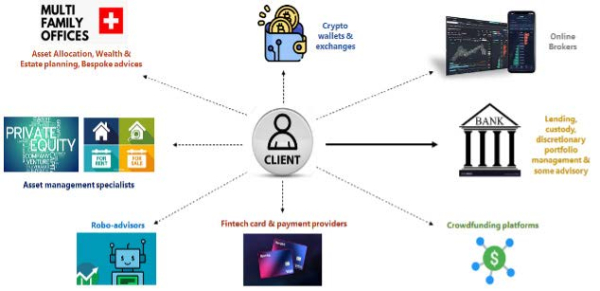

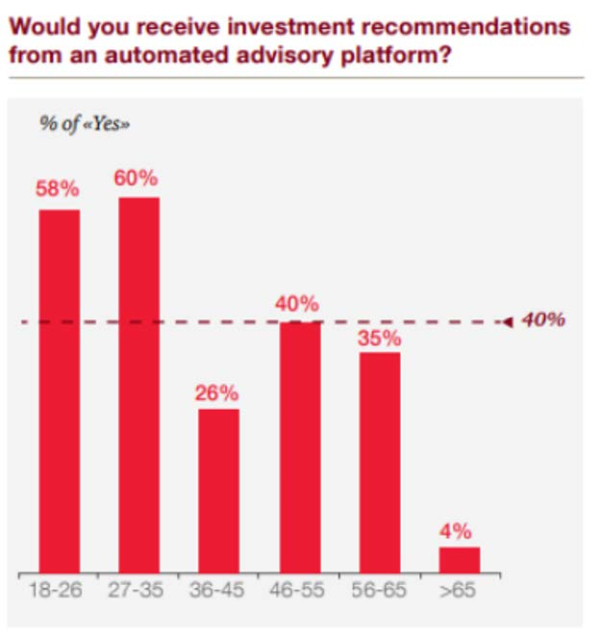

This evolution of needs has important implications for banks and asset management companies. A 24/7 digital interface is becoming a necessary tool to serve them and meet their expectations. Investment recommendations must be perceived as being as targeted as possible. Advice must be provided through different platforms (blogs, messaging, email but also live) and come from various sources (social networks, specialized websites, webinars, experts, peers).

We are now talking about democratization of investments in order to give everyone access to sophisticated investment strategies and products. Risk management involves the use of downside protection instruments rather than simple portfolio diversification.