For the first time in four weeks, US equity indices posted positive weekly performances, thanks to strong gains on Monday and Tuesday (+5.6% cumulative, the best two-day gain since 2020 and the third best October start since 1930). However, US equities gave up most of their gains by the end of the week, with the S&P 500 falling -2.8% on Friday.

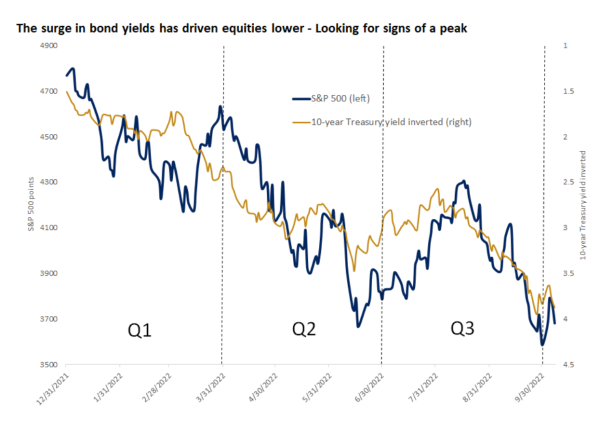

So far this year, the S&P 500 has recorded 52 declines of at least 1%, the most negative volatility in any calendar year since 2008. The end of quantitative easing and soaring bond yields continue to weigh on equity markets.