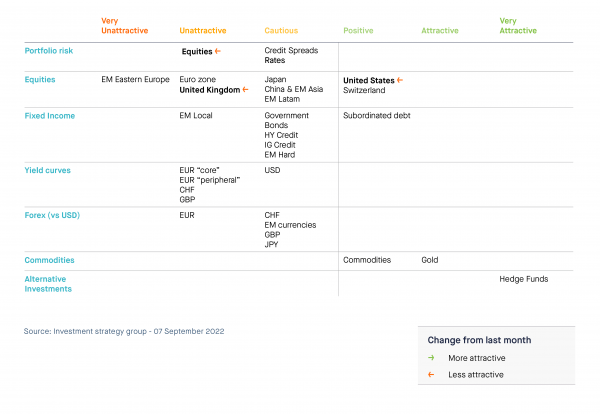

On an aggregated basis, our indicators point towards an “UNATTRACTIVE” view on risk assets, which is a slight deterioration from the “CAUTIOUS” stance in place last month.

‘Not a time to be brave’

Mardi, 09/13/2022Global equity markets declined in August, ending the rebound that began in July. Most of the economic data released last month points to an economic slowdown. Central banks are choosing to ignore this as they focus efforts on fighting inflation amid an energy crisis of historic proportions. Meanwhile, market trends remain bearish as market breadth deteriorates. In this context, it is not the time to be brave in asset allocation choices. Market bounces are likely to be part of a more volatile environment which will continue until the conditions for a market bottom are met.

Executive summary

- From a fundamental standpoint, we continue to believe that macroeconomic and liquidity conditions remain a headwind for risk assets. Policymakers face an inflation-versus-growth dilemma. Governments in Europe and even in the US are taking steps to cushion the impact of rising energy prices on households’ purchasing power. In containing the economic growth slowdown, government subsidies are feeding inflationary dynamics. Without support, the economic and political toll will be high. Central banks across developed economies have no choice but to hike rates from super-low levels as inflation is far from their targets and no longer ”transitory.” By raising interest rates during a growth slowdown, central banks risk creating (or amplifying) a recession. But if they don’t, the consequences for inflation and their credibility will be heavy. While the market believes that peak inflation and peak hawkishness may be behind us, in our opinion, this seems too complacent. Inflation may be near its peak, but it is likely to stay above central banks’ targets for a long time, forcing them to maintain a hawkish stance for longer than currently priced by the market. Equity valuations look attractive outside the US. But the S&P 500 P/E is now back to almost 17-times earnings for the next 12 months, a level that cannot be considered cheap in light of the various macro-economic and geopolitical risks investors currently face. When it comes to market dynamics, the trend remains negative. Market breadth has been deteriorating and sentiment is still not oversold enough. While signals began improving in early summer, our proprietary indicators are now close to flashing red.

- Our tactical asset allocation process is based on five indicators. The macro and fundamental factors are still tilted towards a negative stance on risk assets. The most active factor in our process - market dynamics – has again moved back from positive to neutral. As such, the evidence from aggregated fundamental and market indicators has deteriorated from ‘cautious’ to ‘unattractive’ on equity markets, in other words, we are becoming even more underexposed on risk assets. From a regional standpoint, we are downgrading US equities from “attractive” to “positive” and keep a positive stance on Swiss equities. We are downgrading UK equities from “cautious” to “unattractive”. We are also cautious on China and emerging markets Asia, Japan and emerging LatAm. We keep an “unattractive” stance on eurozone equities. Our least-favoured market remains EM Eastern Europe equities (“very unattractive”). We keep a “cautious” stance on fixed income, credit spreads and rates. We keep a positive view on commodities (with a “preference” stance on gold) as well as a very attractive view on hedge funds. In forex, we are positive on the US dollar against all currencies. We keep an “unattractive” stance on the euro as the eurozone is facing a major energy crisis that is worsening the fundamentals of the common currency.

Indicators review summary

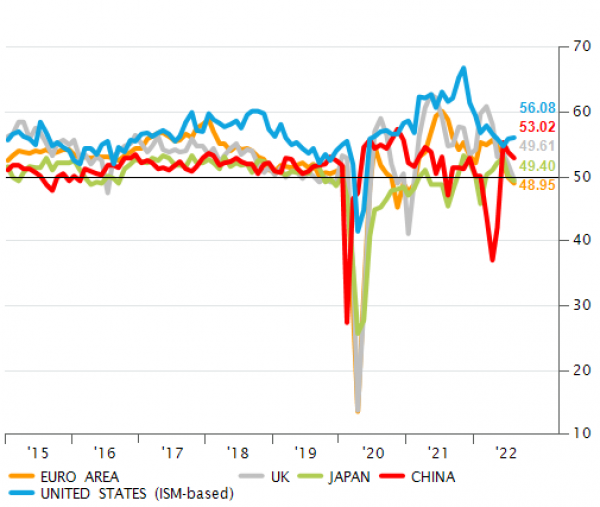

Indicator #1: Macro-economic cycle - Negative

Economic growth is slowing globally with Europe particularly hit by the surge in energy prices. The United States is proving quite resilient so far, except for interest-rate sensitive sectors of the economy such as the housing market. Europe (Continental and the UK) is already under heavy pressure from the surge in energy prices. Switzerland stands out for the moment but will be affected by weaker demand in neighbouring Europe. China is struggling with Covid resurgence and real estate turbulence while looser monetary policy tries to soften the blow ahead of the Party Congress. Meanwhile, some EM economies, Brazil, India, are showing signs of resilience.

Peak inflation is (probably) behind us in the US, but not in Europe, where energy could push inflation rates into double-digits. Rising wages, higher energy prices and fiscal intervention will sustain inflationary pressures. We note that inflation rates have climbed to new multi-decade highs across developed economies. Upward price pressures are coming from the entire goods and services spectrum. Commodity and energy prices are not the only culprit, although they are the main inflation contributor in Europe. The succession of supply and demand shocks since 2020 has broken the “low inflation equilibrium” of the past 25 years. Higher inflation is feeding into households and business expectations, creating “second round effects” and a dynamic of rising wages, forcing central bankers to act.

As discussed last month governments and central banks face an inflation-versus-growth dilemma - damned if they act, damned if they don’t. Governments in Europe and even in the US are taking various steps to contain the impact of rising energy prices on households’ purchasing power. In containing the economic growth slowdown, government subsidies are feeding inflationary dynamics. But if they don’t, the economic and political toll will be high.

Central bankers across the developed world have to hike rates from highly accommodative levels as inflation is proving both persistent and far above monetary targets. However, by hiking interest rates as economies slow, policymakers risk triggering or intensifying a recession. Yet if they don’t tighten borrowing costs, the consequences for inflation and their credibility will be severe.

Overall, we believe that the macroeconomic landscape of still very high inflation and declining growth (without a deep recession) is NEGATIVE for risk assets. Political uncertainty also remains high heading into the final months of 2022 with US mid-term elections, shockwaves in Europe from the Ukraine war and sanctions on Russia, tensions around Taiwan, as well as elections in Brazil and Italy.

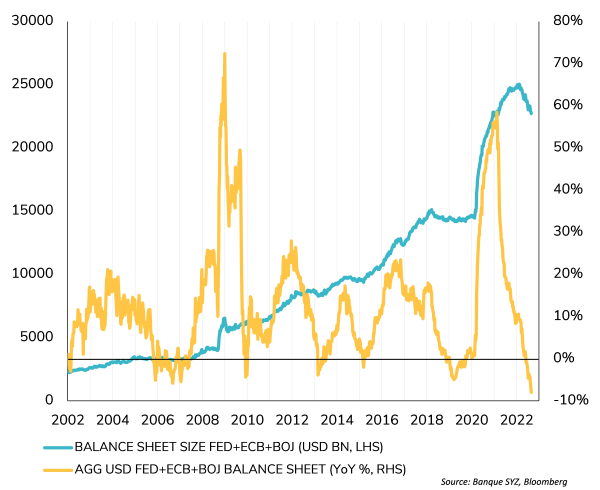

Indicator #2: Liquidity - Negative

During August, the major central banks emphasized their determination to control inflation, despite the inherent risks to the growth outlook. This resolutely restrictive tone weighed on the performance of equity and bond markets.

The focus on fighting inflation at the expense of growth was made clear in Jerome Powell's speech at Jackson Hole. The Fed chair also issued a clear warning to the American public: prepare for hard times. For Powell, reducing inflationary pressures will likely require an extended period of below-trend growth. While much inflation is supply-driven, it is the Fed's responsibility to reduce demand to restore price balance, he said.

Market expectations for US interest rates were revised upwards throughout August. The yield curve now anticipates a 75-basis point (bps) rise in September, followed by another 50 bps in November and 25 bps in December. The tone adopted by the European Central Bank (ECB) has also become more hawkish. As expected, the ECB hiked rates by 75 bps at September’s meeting, the largest increase in its history. But the ECB still lags far behind inflation. It is very rare to experience periods of monetary policy tightening when stock markets are falling. In the previous eight bear markets, the Fed's bias was decidedly expansionary with rate cuts and quantitative easing. This is not the case with the current bear market. The most recent historical equivalent bear market with rate hikes was in the early 1980s under the Fed’s then-chair Paul Volcker.

Overall, global liquidity is no longer growing as the combination of higher interest rates, quantitative tightening and a strong dollar implies global liquidity reduction. This is NEGATIVE for risk assets.

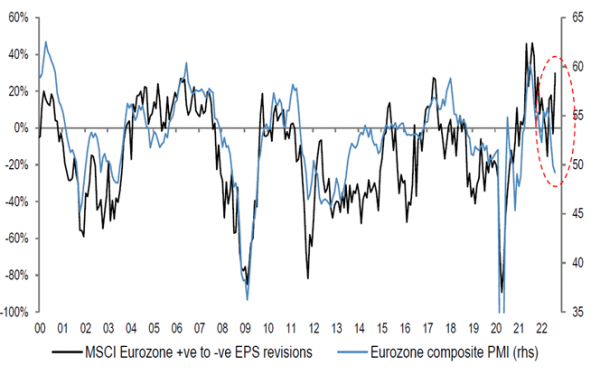

Indicator #3: Earnings growth - Neutral

In the second quarter of 2022, 75% of S&P 500 companies reported a positive earnings per share surprise and 70% of the index’s firms positively surprised on revenue.

However, growth momentum is weakening. over the quarter, the aggregate earnings growth rate for the S&P 500 was 6.3%. This is the lowest earnings growth rate since a 4% increase in the fourth quarter of 2020.

After reaching a record high of 13.5% in the second quarter of 2021, S&P 500 profit margins fell to 10.9% in Q2 2022 as sales growth slowed and companies found it harder to pass on higher costs to their customers. On the positive side, balance sheets also remained solid and companies have room for more share buybacks. Earnings revisions in Europe are holding up much better than purchasing manager indicators would suggest, but for how long?

As a result, we continue to see earnings growth providing a mild tailwind for equities but still believe that some downward earnings growth revisions should act as a slight headwind for equities in the second half of this year.

Indicator #4: Valuations: - Neutral

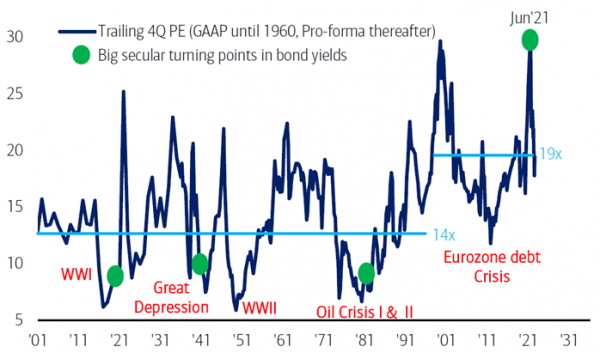

Global equity valuations have de-rated this year. In the US, the S&P 500's 12-month price-to-earnings ratio is 16.7. This is lower than the five-year average (18.6) and the 10-year average (17.0).

On a relative basis, we note that the S&P 500 equity risk premium is below both the last five-year average and the last 15-year average. The equity risk premium (ERP) remains low. European market valuations are improving both form an absolute (P/E) and relative (ERP) angle. This is likely for a reason; defensives (in Europe) are very expensive.

Overall, this indicator remains NEUTRAL. Equity markets are less expensive than in 2021, but nor are they cheap.

Indicator #5 Market Dynamics - Neutral (downgrade)

Our market dynamic indicators have turned neutral, from positive last month. The S&P 500 trend remains negative with the 200-day moving average falling and the price lower. This signal continues to show that the long-term bull trend has been broken and that we remain in a bear market of lower lows and lower highs. While breadth was improving during the first part of the summer, it has been worsening recently. Moreover, the “hi-low” and volatility indicators are back into negative territory. While some sentiment indicators are oversold, they are not in deep oversold territory. From a geographic point of view, indicators are more favorable for US equities than for European stocks.

Asset Class Preferences

Equity allocation: Unattractive (downgrade)

Based on the weight of evidence, we are downgrading our view on equities from “cautious” to “unattractive.” The US economy has moved into a late-cycle “slowdown” phase, after spending the last 18 months in mid-cycle ‘expansion’ period. Late-cycle ‘slowdown’ is consistent with below-average equity market performance, owing to slower earnings growth and multiple compression.

From a regional perspective, we are downgrading US equities from “attractive” to “positive.” The US economy is likely to remain strong in the short-term as it is less affected by the chaos affecting the rest of the world. Consumers’ savings remain solid as employment is strong and wages are rising. However, a hawkish Fed and less favorable technical factors lead us to be less constructive on US equities from a tactical standpoint.

We keep our “unattractive” view on the eurozone. The European economy has been much impacted by the shocks created by the war in Ukraine, particularly the energy crisis created by its dependency to Russia. The ECB is tightening aggressively with the economy on the brink of recession. We keep a cautious stance on Japan, LatAm, China and emerging markets. The Covid lockdowns in China are lasting longer, and there is a lack of visibility that warrants caution. We keep a positive stance on Swiss equities where we find defensive stocks. We are downgrading UK equities from “cautious” to “unattractive”. New Prime Minister Liz Truss is advocating for “reverse Thatcherian” economics, in other words fiscal stimulus coupled with hawkish monetary policy. This stance doesn’t seem to have convinced markets for now. An intensifying energy crisis also weighs on UK assets. Our least-favoured market remains Eastern Europe equities (“very unattractive”).

From a sector perspective, we remain overweight on information technology and neutral on consumer discretionary and consumer staples.

Fixed income allocation: Cautious

We keep a “cautious” stance on fixed income. Rates are rising across the board, with a sharp repricing of the EUR curve. Inflation expectations are stabilizing, as the Fed and the ECB appear credible in their anti-inflation stance. EUR rates (and sovereign spreads) have increased amid energy-driven inflation and the start of the ECB’s rate cycle. In credit, investment grade offers attractive absolute yields in USD and already prices much bad news in EUR. High yield credit offers attractive yields but spreads are not at extreme levels of cheapness. ECB hikes should support banks’ fundamentals and thus benefit EUR subordinated. emerging market debt in USD has been resilient recently. EM debt in local currency is not far from attractive levels.

We remain cautious on rates. Some steepening has materialized, but the US yield curve remains deeply inverted, while absolute levels are at 2022 highs. The bright spot may become the long end of the curve, but we wait for more evidence. Within government bonds, we keep our preference for USD rates over EUR as the ECB needs to catch up. Peripheral yields should benefit from the ECB's new tool (Transmission Protection Instrument) but Italian yields will remain under pressure until the elections.

As for credit, we keep our cautious stance. Credit spreads have started to widen again, adding value to the segment; absolute levels are attractive, but rising interest rates are the main factor. European high yield is more attractive than US high yield due to heightened fears of recession in Europe. Low liquidity and the withdrawal of central bank support should continue to weigh on spreads. The bright spot is on the 0-2-year segment in investment grade / high yield.

We remain cautious on emerging market bonds. Overall, valuations are attractive and we note a resumption of positive flows. EM companies are used to dealing with high inflation and a strong dollar (2013 experience). EM local debt has become more attractive as emerging central banks tighten their monetary policy. Their aggressive strategy is starting to pay off, with for example, lower inflation in Brazil.

We remain positive on subordinated debt. This matured and resilient asset class is still offering premiums despite solid capital position. Valuations remain cheap due to growth concerns, which should be offset by fundamentals. Rising interest rates will have a strong positive impact on net interest income while the ECB's decision not to talk about reverse tiering for TLTROs (targeted longer-term refinancing operations) will continue to contribute positively to European banks’ profits.

Commodities: Positive overall. Keep a preference stance on Gold

Over the last few months, commodities have moved from being overbought to oversold as recession fears now dominate all markets. We remain positive on the asset class and see commodities as an attractive macro hedge. After years of underinvestment in capital expenditure, many commodities are facing a supply shortage while demand is firm. Russia’s invasion of Ukraine and sanctions are worsening the situation. Energy and commodities are needed for virtually everything, and Russia massively exports both. Unlike in 1973, it’s not just the price of oil, but the price of everything that is surging. Furthermore, the supply shock may be long-lasting. Indeed, despite ongoing negotiations between Russia and Ukraine, a stalemate with prolonged economic impacts looks likely. We are therefore positive on broad commodities. We keep our preference for gold. The yellow metal is one of the few portfolio diversifiers remaining. It benefits from lower real bond yields, geopolitical uncertainty, elevated inflation and tight supply.

Hedge Funds: Very attractive

Alternative strategies are grabbing their opportunity to deliver value. After the pandemic, economies are adapting to the changing cost of capital. Investors need a more selective and active approach to investing and as interest rates rise, hedge funds are providing positive returns. Alternative strategies are benefiting from lower liquidity and higher interest rates.

In terms of hedge funds strategies, we are positive on equity hedges with low net exposure and a trading approach. We are also positive on macro and CTA.

Forex: The US dollar remains supported by yield differentials

In foreign exchange markets, we believe all currencies are unattractive against the US dollar. On the EUR/USD, downward pressures on the euro are amplified by the ongoing energy crisis in Europe. The surge in energy prices and concerns around winter supply weighs on prospects for the EUR from several angles: macroeconomic growth, inflation, interest rate differentials, external balance, and flows of funds. The ECB is between a rock and a hard place, and even fast rate hikes may not be enough.

The Swiss franc is temporary overwhelmed by the USD strength, but downside is limited. Fundamental drivers plead for a firm CHF over the medium term. Flight to safety from European assets offers powerful support, but faster Fed rate hikes than the SNB are supporting the USD in the short-run.

For the GBP/USD, we see more downside risk as inflation surges and the UK’s fiscal deficit widens. The surge in energy prices and concerns around winter supply weighs on GBP prospects from several angles: macroeconomic growth prospects, inflation, interest rate differentials, external balance, flows of funds. The Bank of England's recent hawkish stance is more than offset by new Prime Minister Truss’s programme of huge fiscal support to households and businesses.

There is limited additional downside for the Japanese yen but the currency needs the Bank of Japan to regain some ground. Growth momentum and monetary policy differentials continue to weigh on the yen against the US dollar, but peak “rate differential” may be near.

Cross-asset correlations and volatility

The bond/equity correlation is in positive territory, implying no diversification in multi-asset portfolios. Volatility remains contained to equities, even when indices decline. Volatility remains high on bond markets.

Disclaimer

Le présent document a été publié par le Groupe Syz (ci-après dénommé «Syz»). Il n’est pas destiné à être distribué ou utilisé par des personnes physiques ou morales ressortissantes ou résidentes d’un Etat, d’un pays ou d’une juridiction dans lesquels les lois et réglementations en vigueur interdisent sa distribution, sa publication, son émission ou son utilisation. Il appartient aux utilisateurs de vérifier si la Loi les autorise à consulter les informations ci-incluses. Le présent document revêt un caractère purement informatif et ne doit pas être interprété comme une sollicitation ou une offre d’achat ou de vente d’instrument financier quel qu’il soit, ou comme un document contractuel. Les informations qu’il contient ne constituent pas un avis juridique, fiscal ou comptable et peuvent ne pas convenir à tous les investisseurs. Les valorisations de marché, les conditions et les calculs contenus dans le présent document sont des estimations et sont susceptibles de changer sans préavis. Les informations fournies sont réputées fiables. Toutefois, le Groupe Syz ne garantit pas l’exhaustivité ou l’exactitude de ces données. Les performances passées ne sont pas un indicateur des résultats futurs.