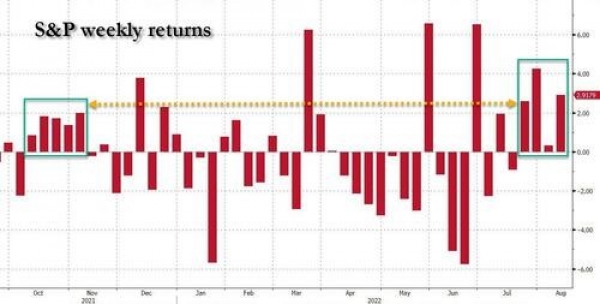

US equities are extending their rebound that began in mid-June. The week's pleasant surprise came from US inflation figures, which are finally showing signs of inflection (see point #5). The S&P 500 index rose by over 3%, marking the fourth consecutive week of gains and the longest period of positive weekly performance since November. The S&P has now erased 50% of the decline it suffered between its all-time high in January and its low point in June. Since the beginning of the year, however, the main US index remains clearly in the red (-10.2%).

The week in 7 charts

Lundi, 08/15/2022The summer rally continues

Non profitable stocks and cryptos coming back to life, as US inflation finally gives investors some breathing space. Each week, the Syz investment team takes you through the last seven days in seven charts.

Chart#1 - The summer rally continues

Chart#2 - The come-back of speculative stocks

The Nasdaq also had a good week, with the rebound from its lows now over 20%. The segment that suffered the most during the bear market was the one that outperformed last week: the so-called "non-profitables", i.e. companies at a stage of growth whose investments and current expenses exceed their turnover. This segment - which had shone during the "covid years" and which is largely represented in Ark Invest's funds - had recorded four consecutive quarters of sharp decline. But in the last few weeks, these speculative stocks have made spectacular gains. There are two explanations for this: 1) the return to the market of small holders (retail investors), who are eager to buy this type of stock; 2) the obligation for certain hedge funds to cover their short positions because of the rise.

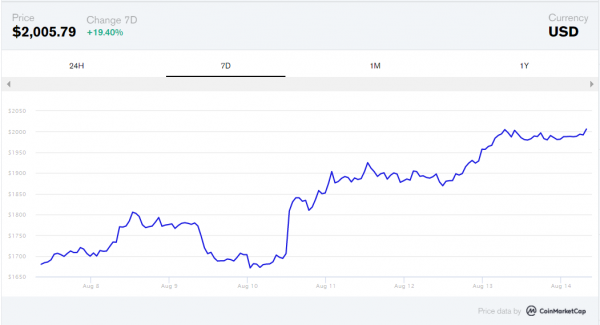

Chart#3 - Cryptocurrencies are also recovering

The rebound in crypto-currencies also continues. Bitcoin ($BTC) is testing $25,000 while Ether ($ETH) reclaimed the $2,000 level late Friday night for the first time since May, according to data from CoinMarketCap.

Ether, the second-largest crypto-currency by market capitalisation is up 17% over the week and has almost doubled in the past month. More than $152 million of "short" positions in ETH were liquidated in the past 24 hours, according to Coinglass data. Many investors are anticipating the positive impact of the upcoming Ethereum update ("The Merge"). The level of staking on the Ethereum blockchain has just reached a record high of 13.2 million ETH, according to data from Beaconscan.

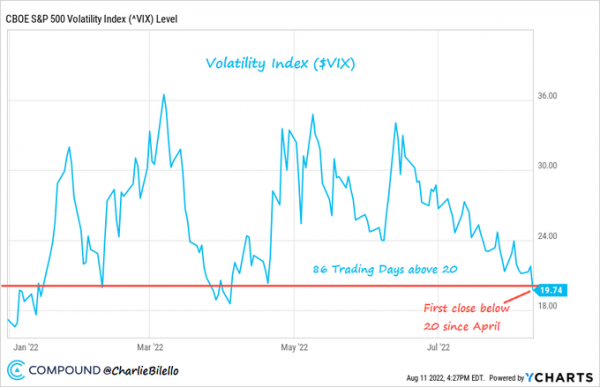

Chart#4 - Are investors too complacent?

Of course, some credit must be given to the very good market reaction to the inflation figures (see next point). Much of the bad news seems to be "priced in" and too many investors remain too defensively positioned, especially hedge funds with net short positions. They are therefore forced to cover their positions as the rally progresses, further fuelling it.

Yet many observers are probably surprised to see the VIX implied volatility index ("fear index") fall below 20 (the complacent level) for the first time since April, despite the following headwinds:

- US inflation remains near a record high (8.5%);

- A Fed monetary policy that remains restrictive;

- Downward revisions to earnings growth expectations;

- A P/E multiple for the S&P 500 that cannot be described as cheap (18x expected earnings for the next 12 months);

- The decline in ISM/PMI economic indicators;

- An energy crisis in Europe (see point #7);

- Numerous geopolitical risks: Russia/Ukraine war, China/Taiwan/USA, Brazilian elections, US mid-term elections, rising covid cases in China, etc.

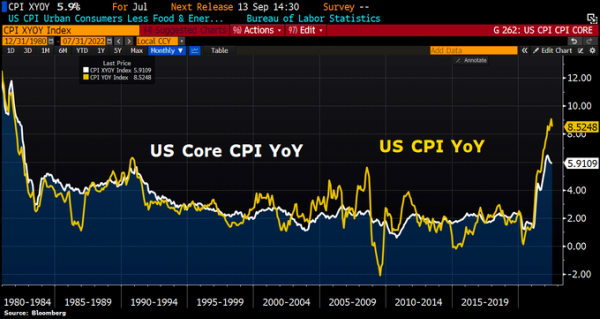

Chart#5 - First sign of inflection in 18 months for US inflation

This is THE good surprise of last week. In July, US consumer prices rose by 8.5% year-on-year and remained stable on a monthly basis. Economists were expecting increases of 8.7% and 0.2%, respectively. The Core CPI was unchanged from June at +5.9%, but lower than the +6.1% forecast.

Another positive development on the US inflation front is that the producer price index also appears to be weakening. For the month of July, it is up 9.8% year-on-year against 10.4% expected and 11.3% the previous month.

Returning to the consumer price index, it was the fall in commodity and energy prices that made this (relative) positive surprise possible. Note that the median inflation figure (i.e. the median price increase of the basket of goods and services considered for the calculation of the index) reached 6.3% year-on-year, which is higher than last month. This would suggest that inflationary pressures remain widespread, which should keep the central bank particularly vigilant.

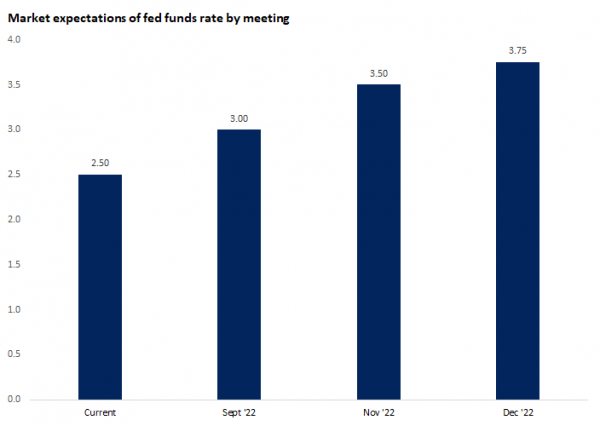

Chart#6 - Peak inflation does not necessarily mean the end of monetary tightening

Following the release of the inflation figures, the market revised the rate hike expectations downwards for the next Fed meeting. Traders are now giving a higher probability of a 50 basis point hike (instead of 75 basis points) at the September meeting. Markets expect the Fed funds rate to reach a range of 3.50% to 3.75% in 2022, before pausing in 2023.

It is worth noting that some Fed members wanted to calm the market. Thus, Mary Daly, the president of the San Francisco Fed, warns that it is "far too early to 'claim victory' in its fight against high inflation after new data showed a respite in consumer price pressures." She is not the only Fed official to do so, reflecting concerns about premature easing of financial conditions.

It is worth noting that the Fed's pace of balance sheet reduction will double in September, with the size of Quantitative Tightening (QT) increasing to $95 billion per month.

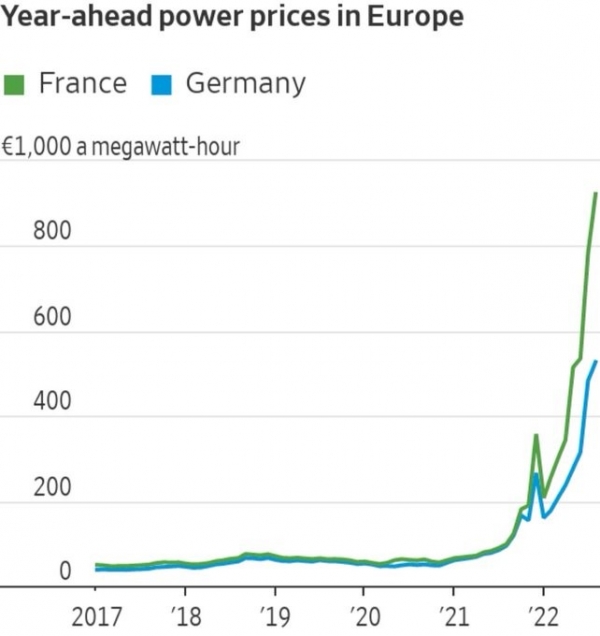

Chart#7 - The energy crisis continues in Europe

While US consumers and businesses benefited from lower energy prices in July, Europe continues to face a severe energy crisis. Electricity prices continue to rise unabated, particularly in France and Germany, increasing the risk of "stagflation" in the economy.

As Germany tries to build up its gas reserves ahead of winter, the regulator warns that Germany needs to reduce gas consumption by 20% to avoid winter rationing. Klaus Müller, head of the federal network agency, warned that the long-term cost of ending Germany's dependence on Russia would be a "very high gas price" that could have serious consequences.

Disclaimer

Le présent document a été publié par le Groupe Syz (ci-après dénommé «Syz»). Il n’est pas destiné à être distribué ou utilisé par des personnes physiques ou morales ressortissantes ou résidentes d’un Etat, d’un pays ou d’une juridiction dans lesquels les lois et réglementations en vigueur interdisent sa distribution, sa publication, son émission ou son utilisation. Il appartient aux utilisateurs de vérifier si la Loi les autorise à consulter les informations ci-incluses. Le présent document revêt un caractère purement informatif et ne doit pas être interprété comme une sollicitation ou une offre d’achat ou de vente d’instrument financier quel qu’il soit, ou comme un document contractuel. Les informations qu’il contient ne constituent pas un avis juridique, fiscal ou comptable et peuvent ne pas convenir à tous les investisseurs. Les valorisations de marché, les conditions et les calculs contenus dans le présent document sont des estimations et sont susceptibles de changer sans préavis. Les informations fournies sont réputées fiables. Toutefois, le Groupe Syz ne garantit pas l’exhaustivité ou l’exactitude de ces données. Les performances passées ne sont pas un indicateur des résultats futurs.