Surprisingly for many, Poland became the first country to issue a green bond in December 2016, winning the race ahead of France, which had already announced in April 2016 that it would launch a green-linked instrument in the capital markets.

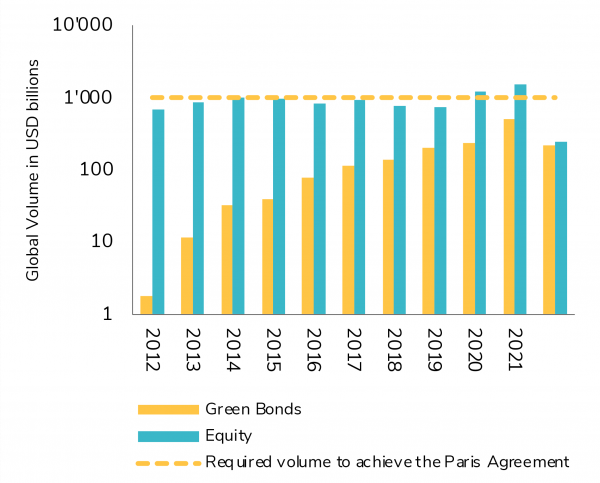

In the capital markets, states, local authorities and companies raise billions every year to finance projects, mainly through institutional investors.

Poland is not your normal green crusader. The EU member state is known for coal mining and poor air quality. It also regularly reaches Earth Overshoot Day1 in May. As Mathis Wackernagel, inventor of the concept of the carbon footprint, says - post-May Poland is living on credit. Translated to finances, from May it runs a budget deficit.