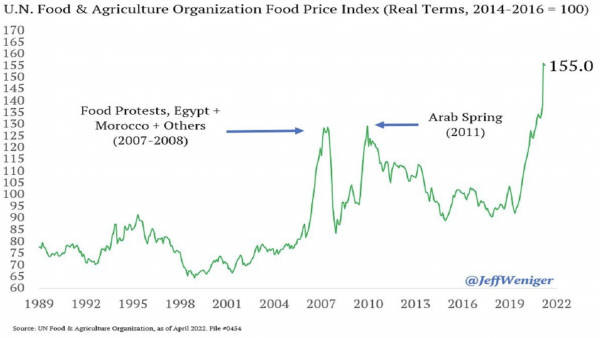

This is, without doubt, the most dramatic and important development of the first half of 2022. Although a Russian incursion into Ukraine appeared plausible at the beginning of the year, Russian President Vladimir Putin's decision to carry out a full-scale war beyond the separatist region of Donbas stunned the world. Beyond the conflict’s human tragedy, sanctions imposed by the West have far-reaching consequences for the global economy and monetary order.

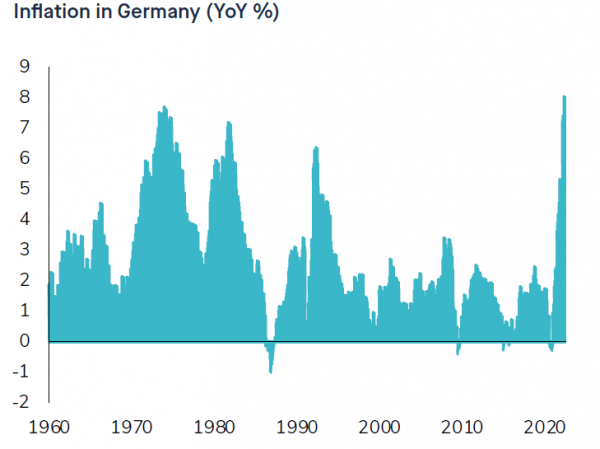

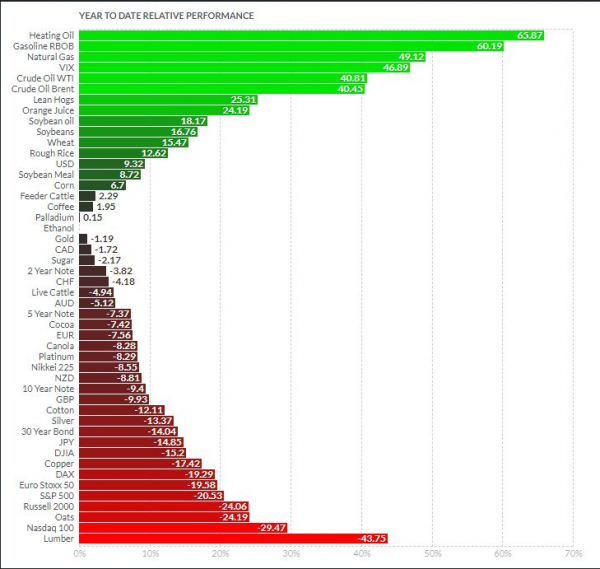

This episode of history comes at a time when the supply of raw materials is already insufficient to meet demand. Meanwhile, Russia produces and exports a vast majority of them: oil, natural gas, industrial metals, precious metals, and agricultural commodities. The global economy, therefore, faces a commodity supply shock, with consequences for both growth (downside risk) and inflation (upside risk). At the time of writing, a rapid end to the war, and therefore to the application of sanctions, seems unlikely. Even if an agreement is reached, the normalization of relations between Russia and the West may take years, for as long as President Putin remains in power.