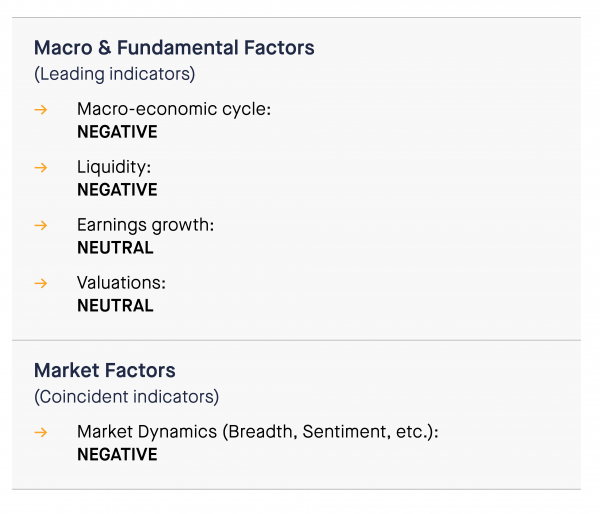

On an aggregated basis, our indicators are pointing towards an “UNATTRACTIVE” view on risk assets.

A soft landing with scary turbulence

Mercredi, 05/11/2022Global equity markets are nearing bear market territory, being down nearly 20% from their recent peak. The acceleration of the market pullback seems to indicate that investors are starting to anticipate a “hard-landing” of the global economy. In other words, they fear that central banks will fail to tame inflation without triggering a recession or sharp economic downturn.

This risk shouldn’t be dismissed. However, we believe that the “soft landing” scenario has merit.

- This risk of a "hard landing" shouldn’t be dismissed. First because history shows that the Fed doesn’t have a very good track-record in engineering “soft landings”. Second because aggressive monetary tightening might not be very effective in lowering inflation triggered by persisting supply-side issues. Third because hiking rates and lowering the size of the Fed’s balance sheet often carries the risk of triggering financial accidents (liquidity or credit event, failure of a bank or large corporate bankruptcy, etc.).

- However, we believe that the “soft landing” scenario has merit. The monetary policy tightening starts at a time when the economy benefits from substantial shock absorbers. The US consumer can still tap into savings accumulated during the pandemic. The job market is very strong: never has a rate hike cycle started at a time when there were 5 million more job offers than unemployed people. Corporate America is also in a very decent shape. Balance sheets are strong and earnings continue to grow, with high single digit EPS growth expected for the S&P 500 companies in 2022E. Last but not least, high nominal growth on both sides of the Atlantic implies that governments have the capacity (and incentive) to provide support to the economy while monetary policy stimulus dwindles.

- From a macroeconomic perspective, a “soft-landing” is thus our core scenario. But we also believe that it will come with a scary dose of turbulence during the journey. This is not the best macroeconomic outcome for risk assets but it drives us to rule out the scenario of a full-blown recessionary bear market. On the monetary policy side, central banks are not investors’ friends anymore. The Fed has firmly entered into a rate hike cycle (+75 bps since March 2022) and the ECB might soon follow. Overall, the global liquidity context acts as headwind for risk assets. Equity markets are becoming more attractive on an absolute basis as the current correction has been driven by valuation multiples compression, rather than an earnings downgrade. While we still expect positive earnings growth this year, we believe that some downward revisions might take place later this year as companies will struggle to maintain their profit margins because of inflationary pressure and a dollar that is becoming too strong for its own good.

- Our coincident indicators (market dynamics) have been deteriorating recently. Trend indicators and market breadth give negative signals while sentiment is oversold but not extreme enough to trigger a contrarian call.

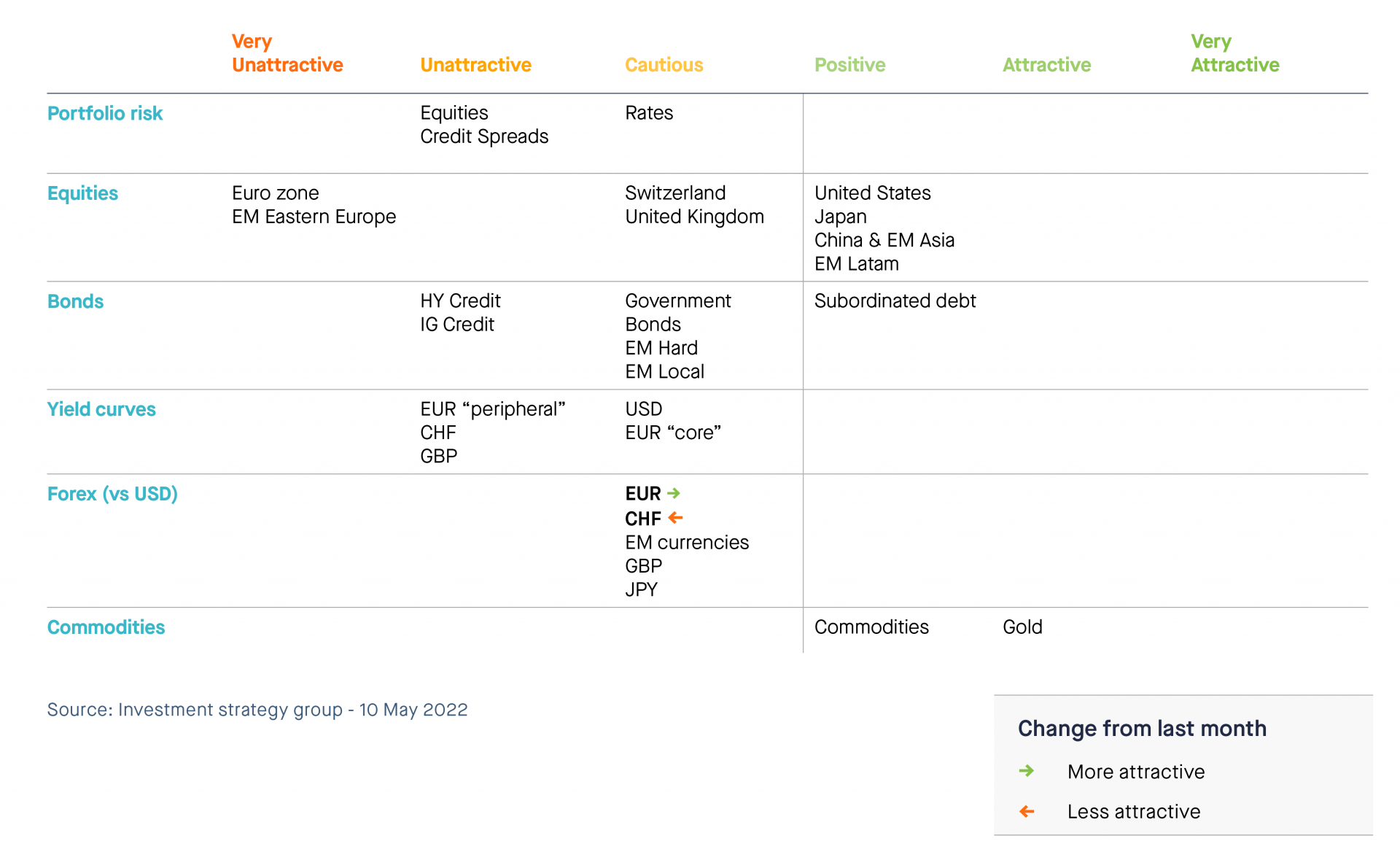

- Overall, the weight of the evidence (i.e. the aggregation of our fundamental and market indicators) remains negative. As such, we maintain an “unattractive” view on equity markets in general. We do a have a positive stance on US and Japan equities. Our least favored market remains Eurozone equities (very unattractive) and we maintain a cautious view on the UK and Switzerland.

- In Fixed Income, we remain cautious on rates and keep an “unattractive” stance on credit spreads. In Forex, we are cautious on the euro, Swiss franc and the Japanese Yen against dollar. We keep a positive view on Commodities and a “preference” stance on Gold.

Indicators review summary

Indicator #1

Macro-economic cycle: Negative

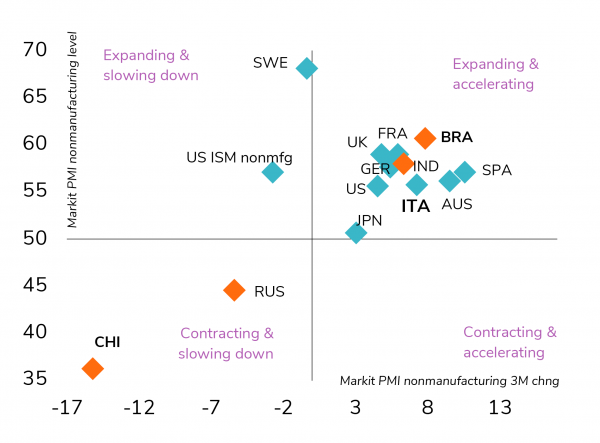

Global growth is slowing but remains positive for the time being in all large economic regions except China. In the manufacturing sector, the cyclical momentum is slowing but remains positive with the exception of China (and Russia for obvious reasons). The service sector is still in strong expansion in the US and Europe. We however observe a severe slowdown in Russia (sanctions) and in China (Covid) as their zero-Covid policy choking the economy. Economic surprises are still positive across large economies but are declining in Europe and the US.

Europe and the US are facing an inflationary shock like no other in the past 40 years. The shock on prices is such that an inflationary loop is gaining momentum. Fast-rising prices erode households’ purchasing power and sentiment and force central banks to act (see next indicator). A more restrictive monetary policy is likely to dent demand and weigh on future economic growth. A key question mark for investors and economists is whether the Fed will be able to engineer a soft landing or inversely trigger a hard landing – aka a recession – as they did in the vast majority of instances. From our point of view, fiscal policy could help offset part of the negative impact stemming from a more restrictive monetary policy. In a world of higher nominal GDP growth, higher public deficits may be less of an issue than they used to be during the last 2 decades.

We note that while inflation is picking up in many regions, it remains muted in China and Japan.

We believe that 2022 will be a year of slowing global growth on the back of global trade disruptions, elevated inflation and tighter credit conditions. As such, our macro indicator is NEGATIVE. Our core scenario is a “soft-landing” of the global economy but the risk of a “hard landing” cannot be ruled out in a context of elevated uncertainties.

Indicator #2

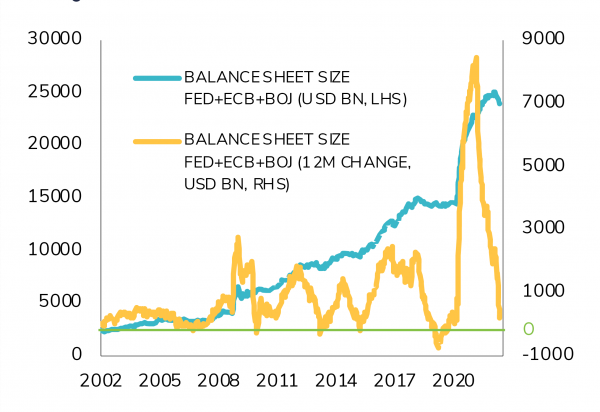

Liquidity: Negative (downgrade)

As mentioned above, central banks are focused on catching up with inflation, restoring their credibility and seizing a window of opportunity to exit ZIRP (zero interest rate policy) / NIRP (Negative Interest Rate Policy). In the US, Monetary policy is unlikely to provide much support to the economy and financial markets. On the back of a strong job market and the highest inflation numbers over the last 40 years, the Fed will stick to its plan to hike rates and tighten liquidity despite Russia’s war in Ukraine. As we learned at the May FOMC, the plan for the Fed is to deliver on the expected monetary policy tightening as long as the economy remains on its firm growth trajectory. Interestingly, there was no strong commitment beyond the next “couple of meetings” for which additional 50 bps rate hikes have clearly been signaled by Mr Powell, in line with market expectations.

Beyond that, and as it should always be, the continuation of the rate hike cycle will depend on growth and inflation data. The evolution of the US economy during the second half of the year will dictate whether the Fed has to turn more “dovish” or more “hawkish”. But at least, and at last, Fed decision-makers can now look at the situation from a more comfortable and balanced point of view.

In Europe, the ECB may be more cautious than expected regarding rate hikes and QE tapering. In Japan, the BoJ's monetary policy remains decidedly expansionary, stating that it will keep its main policy rate - which has been at a historic low of -0.1% since January 2016 - at the current rate (or lower) for the time being and that it will continue its asset purchases (quantitative easing), in order to cap the yield on Japanese 10-year government bonds at a maximum of 0.25%. A mechanism known as "Yield Curve Control". This monetary policy is the opposite of the Fed's, and has led to a sharp depreciation of the yen, which is now at a 20-year low against the dollar.

Should the geopolitical and financial crisis deepen, fiscal and/or monetary policy should come as a support not only in Europe but also in the US.

Overall, liquidity conditions have been progressively tightening and we now see this indicator as a NEGATIVE (vs Neutral).

Indicator #3

Earnings growth: Neutral

To the surprise of many, we continue to see analysts revising earnings upwards for 2022E. Expectations for S&P 500 earnings growth are now at 10.2% for this year, up from 7.0% at the end of December 2021. For 2023E, consensus expects S&P 500 earnings to grow by 7.9%. 1Q earnings season has been rather strong with 69% of companies beating consensus on revenues and 76% beating it on net income. However, we note that market reaction has been severe for those missing estimates (-3.0% median performance the day after they published results) while the reward for those beating them has been meagre (+1.1%).

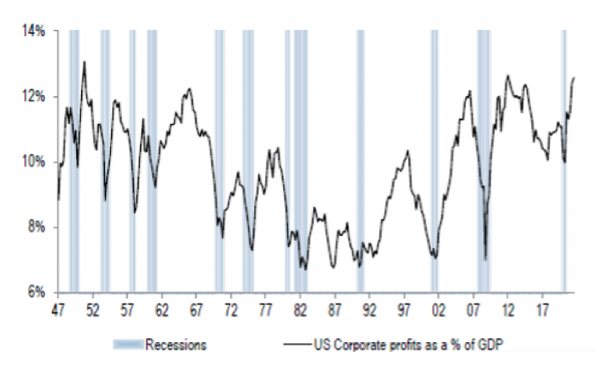

Note that US corporate margins currently stand at a record high (see chart below), which means that companies have so far been able to pass input cost increases onto consumers. Balance sheets remain solid as well and companies have room for more share buybacks. As such, we continue to see earnings growth as being a tailwind for US equities but still believe that some downward earnings growth revisions could happen later this year. Indeed, after a very strong earnings rebound in 2021, base effects are no longer as favorable. While profit margins have been resilient until now, high input cost pressures can hurt individual companies and some specific sectors. That said, we still expect high single digit earnings growth. Share buybacks provide strong support while value / cyclicals sectors benefit from rising commodity prices.

In Europe, we expect low to mid-single digit growth for European earnings this year.

Indicator #4

Valuations: Neutral

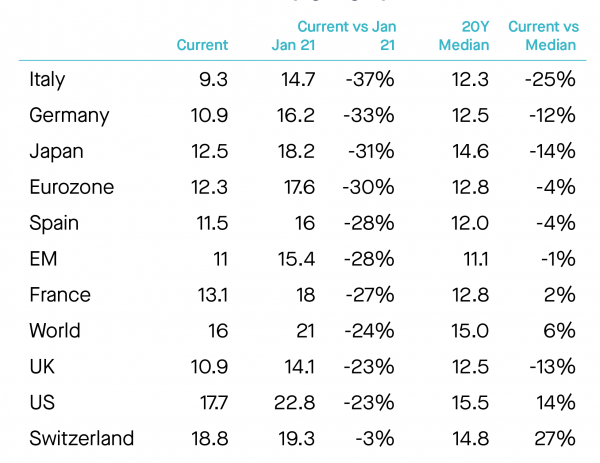

Global equity valuations have eased but are now below the 20-year median in the vast majority of countries except in the US and Switzerland (see table below). Indeed, the current equity market drawdown has been driven by valuation multiples compression rather than earnings revision.

Looking across geographies, the US and Switzerland continue to trade at a premium vs. MSCI World while Japan, the UK, Emerging Markets and the Eurozone are trading at a steep discount.

Compared to bonds, global equity markets remain attractive versus bonds but the gap is starting to close as bond yields rise. For instance, the US dividend yield minus Bond yield is -1.3%, in-line with the historical average. In Japan, the Eurozone and the UK, the differential remains clearly in favor of equity markets. Thus, investors remain incentivized to keep investing into risk assets.

We also note that with the return of inflation, investors consider stocks as being a much better hedge against inflation than bonds. As such, asset allocators are rotating from fixed income funds into equity funds. This can push equity valuations higher. On a more cautious note, we feel that increased geopolitical risk, growing economic sanctions against Russia and downgrades in earnings are not fully priced yet. As such, this indicator remains NEUTRAL.

Indicator #5

Market dynamics: Negative (downgrade)

Our market indicators have been deteriorating recently. The low frequency / long-term indicators show that the long- term bull trend (price above 200 days moving average) has been broken and is starting to exhibit the characteristics of a bear market (lower lows and lower highs). The momentum (rate of change) has turned negative on a 12-month rolling basis. We also note that market breadth keeps deteriorating.

Indicators such as MACD and Mean Reversion show that the market is oversold but without hitting extreme levels. Likewise, the put-to-call ratio reached an elevated level but is not extreme. The Bull-to-bear ratio is the only indicator hitting extreme levels (which is a positive from a contrarian perspective).

Asset Class Preferences

Equity allocation: Unattractive

Based on the weight of the evidence, we keep an unattractive stance on equities. The U.S. economy has moved into the late cycle ‘slowdown’ phase, after spending the last 18 Months in Mid-Cycle ‘Expansion’. Late-cycle ‘slowdown’ is consistent with below-average equity market performance, owing to slower earnings growth and multiple compression. Earnings growth remains a tailwind but we expect macro uncertainty and volatility to weigh on valuation multiples. From a regional perspective, we have a positive stance on US and Japan equities – which are cheap and getting cheaper. Our least favored equity market remains the Eurozone(strong disinclination). There is significant geopolitical risk and energy dependency. Outside the Eurozone, we maintain a cautious view on the UK and Switzerland.

From a sector perspective, cyclicals and value have been leading over the last few months but defensives have been doing better more recently, which is consistent with where we stand in terms of the macroeconomic cycle.

Fixed income allocation: Unattractive

On the fixed income side, we remain cautious on rates. Long-term USD and EUR rates continue to rise (nominal & real) and steepen yield curves. Medium and long-term inflation expectations are at multi-year highs due to the surge of energy and commodity prices, as well as rising wages. In the Eurozone, the rates curve acknowledges a coming exit of the ECB Negative Interest Rate Policy, with sovereign spreads amplifying the move. Overall, we see some divergence across government bond markets. US short rates are now set on a very aggressive path while the EUR rates still have work to do. We thus find some value in the short-end of the US Government curve. We still find the EUR Peripheral curve unattractive due to a potential PEPP/ APP early exit (July).

We keep an “unattractive” stance on credit. The recent revaluation of credit spreads has added some value to the segment, especially in the short duration bucket. However, Investment Grade and High Yield are still not cheap compared to current volatility, poor liquidity and the lack of support from central banks. A bright spot is the 0-2 year segment in Investment Grade / High Yield. Emerging markets debt recorded its worst ever start of the year (-14%). We remain cautious on this segment. While valuations are attractive overall, EM capital flows have declined sharply in the last days. We stay positive on subordinated debt. This matured and resilient asset.

Commodities: Positive overall. Keeping a preference stance on Gold

We believe that commodities might be overbought short- term but remain under-owned long-term. After years of capex underinvestment, many commodities are facing a supply shortage while demand is firm. The invasion of Ukraine by Russia and the sanctions are worsening the situation. Energy and commodities are needed for virtually everything, and Russia exports both massively. And unlike in 1973, it’s not just the price of oil, but the price of everything that is surging. Furthermore, the supply shock might be a long lasting one. Indeed, despite ongoing negotiations between Russia and Ukraine, a stalemate with prolonged economic impacts looks likely. We are thus positive on broad commodities. We keep our preference stance on Gold. The yellow metal is one of the few portfolio diversifier remaining. It benefits from lower real bond yields, geopolitical uncertainty and tight supply.

Forex: Positive on the dollar against all currencies

In Forex, we find all currencies unattractive against the dollar. The Ukrainian War weighs on EUR and GBP prospects from several angles: macroeconomic growth prospects, interest rate differentials and flows of funds. However, normalization by the ECB could support the EUR in the coming months. Fundamental drivers support the CHF over the medium term but short-term drivers support the USD, especially widening the rate differential. Growth momentum and monetary policy differentials are weighing on the yen.

Tactical positioning: our asset allocation matrix

Disclaimer

Le présent document a été publié par le Groupe Syz (ci-après dénommé «Syz»). Il n’est pas destiné à être distribué ou utilisé par des personnes physiques ou morales ressortissantes ou résidentes d’un Etat, d’un pays ou d’une juridiction dans lesquels les lois et réglementations en vigueur interdisent sa distribution, sa publication, son émission ou son utilisation. Il appartient aux utilisateurs de vérifier si la Loi les autorise à consulter les informations ci-incluses. Le présent document revêt un caractère purement informatif et ne doit pas être interprété comme une sollicitation ou une offre d’achat ou de vente d’instrument financier quel qu’il soit, ou comme un document contractuel. Les informations qu’il contient ne constituent pas un avis juridique, fiscal ou comptable et peuvent ne pas convenir à tous les investisseurs. Les valorisations de marché, les conditions et les calculs contenus dans le présent document sont des estimations et sont susceptibles de changer sans préavis. Les informations fournies sont réputées fiables. Toutefois, le Groupe Syz ne garantit pas l’exhaustivité ou l’exactitude de ces données. Les performances passées ne sont pas un indicateur des résultats futurs.