While there are talks of an acceleration of the "de- dollarization" trend, the DXY dollar index - which measures performance of the greenback against a basket of international currencies - reached its highest level in five years last week.

The dollar at 5-year high

What’s behind the dollars' strength?

Several factors explain the rise of the dollar.

The prospects for normalization of U.S. monetary policy are of course playing a major role. At last Wednesday's FOMC meeting, we got confirmation that the Federal Reserve has started a tightening cycle that should lead to numerous rate hikes but also a reduction in the size of the Fed's balance sheet.

The normalization of U.S. monetary policy is justified by the strong inflationary pressures observed in the U.S. for more than a year. These tensions are due to both cyclical elements (rising commodity prices, shortages of goods due to interruptions in supply chains, etc.) and factors that appear to be more permanent (shortages of labor, real estate, etc.).

With the exception of the Bank of England, the central banks of other developed economies have not yet begun to normalize their monetary policy. The European Central Bank (ECB) is keeping negative interest rates (for the time being) and continues its asset purchase program (QE).

The European continent is also facing strong inflationary pressures. However, these are essentially linked to the rise in energy prices, the magnitude of which has been exacerbated by Russia's invasion of the Ukraine. If Mr Putin cuts off gas supplies, Europe could not only experience accelerating inflation but also fall into recession. These macroeconomic prospects are weighing on the single currency, which is at its lowest level in five years against the dollar.

On the other side of the Channel, the Bank of England was the quickest to raise interest rates, and it did so again last week. But these adjustments are not enough to prevent a depreciation of the pound against the dollar, as the British currency currently trades at its lowest level since September 2020. The main reason for this is the risk of stagflation that the UK is facing.

Even the Swiss franc, a traditional safe haven, has lost ground against the greenback. For some experts, Switzerland's close trading relationship with the rest of Europe and our geographic proximity to Russia takes away some of the safe haven status of the Swiss franc.

But the most dramatic depreciation against the dollar has been seen in the yen. Inflation is also picking up in the Land of the Rising Sun, but at much lower levels than in the US and Europe. The Bank of Japan's monetary policy remains decidedly expansionary, stating that it will keep its main policy rate - which has been at a historic low of -0.1% since January 2016 - at the current rate (or lower) for the time being and that it will continue its asset purchases (quantitative easing), in order to cap the yield on Japanese 10-year government bonds at a maximum of 0.25%. A mechanism known as "Yield Curve Control". This monetary policy is the opposite of the Fed's, and has led to a sharp depreciation of the yen, which is now at a 20-year low against the dollar. The weakness of the Japanese currency has repercussions on the entire Asian continent. Indeed, a weak yen makes Japan's productive apparatus more competitive. Neighboring countries are therefore tempted to let their currency depreciate in order to maintain their competitive position on a global scale. An episode of competitive devaluation is therefore to be feared.

Many developing and emerging countries are also facing a depreciation of their currencies against the dollar. This is especially the case for commodity importing countries.

The sharp rise in commodity prices is worsening their trade balance and weighing on the value of their currency.

As the Bloomberg table below shows, the dollar has appreciated against the vast majority of currencies. Two exceptions: the Brazilian real (which is benefiting from the boom in commodity exports) and... the ruble (see last week’s FOCUS note: « How Russia rescued the ruble? »).

Mixed effects on the US economy

For the United States, the strength of the dollar has at least one advantage: it puts downward pressure on inflation, the Fed's number one problem at this stage. About 15% of the U.S. economy is imported and the strength of the dollar helps mitigate the rising price of goods and services imported from abroad.

On the other hand, the strength of the dollar penalizes American exports due to a loss of competitiveness. The U.S. trade balance is suffering: the gap between what Americans buy and sell abroad has never been so wide, with the monthly deficit reaching $110 billion last month.

American companies that are oriented towards foreign markets are suffering from the increasingly strong dollar. This is bad news for these companies, especially at a time when weakening growth in the global economy potentially means less demand for their products and services. The strength of the dollar is a hotly debated topic during the current quarterly earnings season. Microsoft recently revealed that the rising dollar reduced its sales by about $300 million in the first three months of the year. PepsiCo also complained about the strength of the dollar.

As a reminder, it is historically very difficult for U.S. corporate profits to grow when the dollar is strong (see chart below). The rising dollar could therefore weigh on earnings growth in the U.S. this year.

The appreciation of the dollar: a "headache" for the rest of the world

The rising dollar further complicates the role of the European Central Bank. While the eurozone is facing record inflation rates, the stronger greenback is putting upward pressure on the price of imported goods and services. And the situation could get even worse if there is a boycott on imported energy from Russia. At present, Europeans pay for most of their Russian oil and gas purchases in euros. In the event of a boycott of Russian imports by Brussels or a freeze on Russian exports to Europe, Europe will not only see the price of oil and natural gas skyrocket (due to the drop in world supply), but will also have to pay its bills in dollars. The risk is that the euro will fall below parity, as investors will have to take into account the danger of a severe recession in Europe.

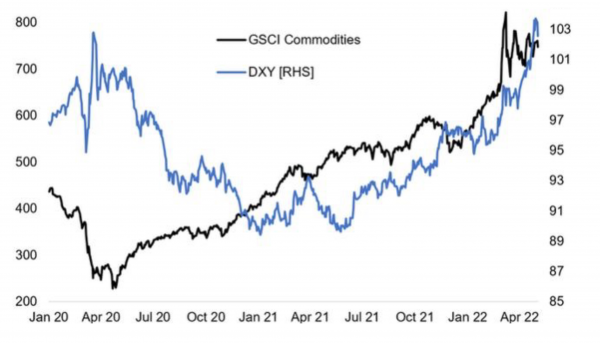

As mentioned above, a strong dollar is also bad news for many developing and emerging countries. It makes raw materials valued in dollars (crude oil, copper, aluminum, etc.) more expensive to import. The most dramatic effect is on agricultural commodities. The planet is already facing a risk of soft commodities shortage since the invasion of Ukraine by Russia, two countries considered as "granaries" for wheat. It should be remembered that the correlation between the dollar and commodities is historically weak, even negative. The rise in commodities is therefore generally offset by the fall in the dollar. The current situation is very different (see chart below).

Another negative impact of the rising dollar on emerging and developed markets is the increased cost of servicing their debt. Many of these countries have denominated much of their debt in dollars. The ability to refinance in their own currencies is relatively limited, as higher U.S. interest rates tend to attract capital from international investors to the United States.

Finally, let's not forget that many currencies are pegged to the dollar, which forces their respective central banks to apply the same rate hikes as in the United States. This is the case, for example, in several Middle Eastern countries. For these countries, the strong rise in oil prices allows them to benefit from abundant fiscal revenues which should allow them to cushion the shock of a monetary tightening. But in the case of other countries, rate hikes are not necessarily appropriate. Take Hong Kong, for example, where the zero- covid policy will weigh on growth this year. Will "forced" rate hikes burst the peninsula's property bubble?

The spectrum of a liquidity crisis

As illustrated in a recent study by Gavekal, the difficulties encountered by many countries in the face of the dollar's appreciation could tip us into a new international liquidity crisis. Indeed, the rise in commodity prices is forcing many of them to dip into their dollar reserves to finance their energy resources purchases.

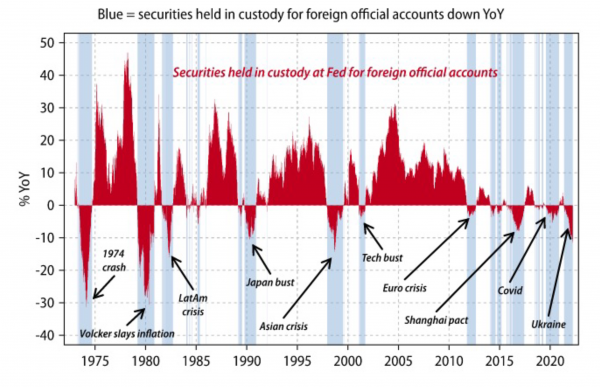

Proof of this shortage of dollars: an item in the accounts of the US Federal Reserve called "securities held on deposit for foreign and international official accounts" shows a sharp drop in the amounts held. These are U.S. dollar assets held at the Fed by non-US central banks as foreign exchange reserves.

Over the past 50 years, most financial crises have occurred when these assets held at the Fed were down year over year (see chart below). The exception to this rule is the great financial crisis of 2008-2009, which was not triggered by an international liquidity crisis, but by a domestic liquidity crisis (bursting of the housing bubble).

Most of these international liquidity crises have involved the failure of a large bank, a very large corporation or a sovereign state. In the past, the Federal Reserve has intervened in every case, usually by lowering rates or flooding the markets with liquidity.

But can the Fed afford to do so this time? Unlike previous crises that took place in a context of deflation or low inflation, the world is currently facing an inflationary crisis even though US interest rates remain relatively low (1%). If such a liquidity crisis were to occur, it would be complicated for the Fed to lower rates or inject more liquidity in the current context.

Conclusion

The current macroeconomic situation is exceptional on several levels: rising commodity prices and simultaneous strengthening of the dollar, difficulty for central banks to intervene as a last resort in the event of a financial crisis due to inflationary pressures, short-term rates still abnormally low, etc.

The simultaneous sharp decline in equity and bond markets already seems to price in the normalization of monetary policy. But the current dollar shortage poses additional threats to the markets. The risk of a liquidity crisis is to be watched very closely.

Disclaimer

Le présent document a été publié par le Groupe Syz (ci-après dénommé «Syz»). Il n’est pas destiné à être distribué ou utilisé par des personnes physiques ou morales ressortissantes ou résidentes d’un Etat, d’un pays ou d’une juridiction dans lesquels les lois et réglementations en vigueur interdisent sa distribution, sa publication, son émission ou son utilisation. Il appartient aux utilisateurs de vérifier si la Loi les autorise à consulter les informations ci-incluses. Le présent document revêt un caractère purement informatif et ne doit pas être interprété comme une sollicitation ou une offre d’achat ou de vente d’instrument financier quel qu’il soit, ou comme un document contractuel. Les informations qu’il contient ne constituent pas un avis juridique, fiscal ou comptable et peuvent ne pas convenir à tous les investisseurs. Les valorisations de marché, les conditions et les calculs contenus dans le présent document sont des estimations et sont susceptibles de changer sans préavis. Les informations fournies sont réputées fiables. Toutefois, le Groupe Syz ne garantit pas l’exhaustivité ou l’exactitude de ces données. Les performances passées ne sont pas un indicateur des résultats futurs.