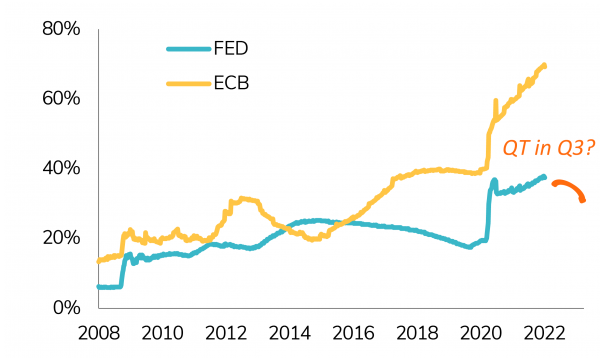

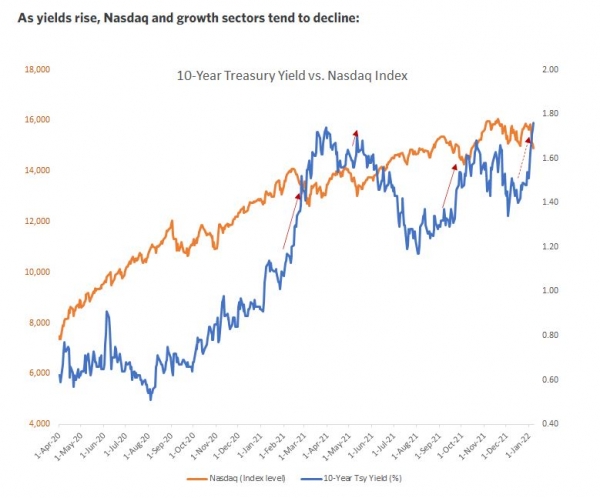

Markets started 2022 with a bit of a bang for investors. Equities and bonds fell in tandem on the back of Fed minutes which turned out to be more hawkish than expected, leading to US 10-year bond yields to break critical levels. These minutes indicated that the Fed was not only considering raising rates and accelerating its balance-sheet tapering process, but also letting the balance sheet rollover and decline sooner than most expected. This potential reduction of liquidity spooked markets, particularly those areas with loftier valuations, as there seemed to be less appetite for speculative assets in the new environment.

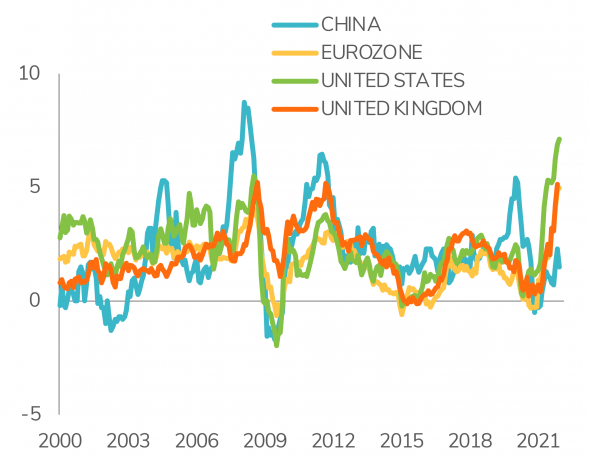

Despite a potentially less supportive liquidity outlook in the months ahead, current signals lead us to maintain a positive stance on risk assets and equity in particular. Global growth remains above potential, financial conditions remain supportive, global earnings growth remains well oriented and some segments of the market remain reasonably valued. Last but not least, our market technical indicators (trend, sentiment, etc.) continue to be positively oriented.

In a nutshell:

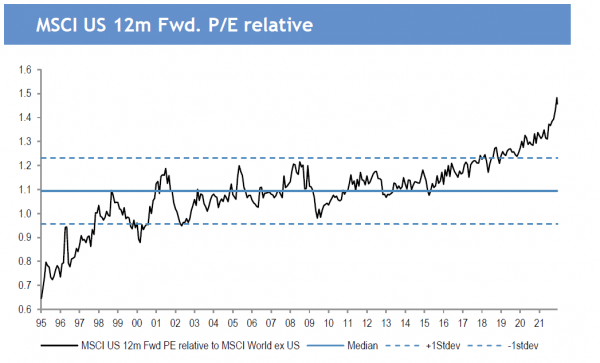

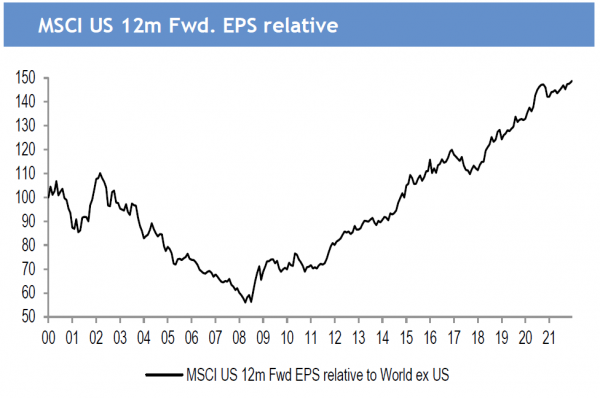

- We maintain a positive view on equity markets coming into 2022. However, we also expect equity returns to be more moderate than last year, and volatility to increase to more normal levels – and we already got a taste of both in the first week of 2022.

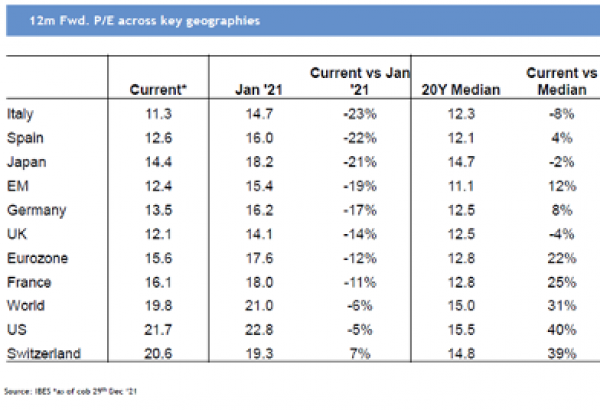

- We continue to favor developed markets over emerging markets. However, we are upgrading China equities from cautious to positive on the back of superior earnings growth expectations, attractive valuations and on improving monetary policy conditions in mainland China.

- From a tactical standpoint, we are turning less negative on aggregate fixed income. Indeed, we decided to reverse last month’s timely move as the upward risk on rates is now less important. We maintain our disinclination on Government bonds due to the Fed’s policy reassessment. However, we believe the scope of further yield curve steepening is limited as the Fed’s normalization is already priced in. We are turning more cautious on the EUR curve given ECB inflation concerns and potential normalization to come.

- While we were bullish on the dollar throughout 2021, we now believe that the greenback is forming a top and that the EUR, GBP and JPY have some upside potential.

- We remain cautious on commodities. Our tactical asset allocation is summarized in the matrix at the end of the article.