At the end of October, Mark Zuckerberg announced the change of the name of Facebook’s parent company to “Meta”, referring directly to a gigantic project he intends to develop: the metaverse. Other large groups (Nike, Disney, etc.) also seem to be preparing for what could become the next “big thing”.

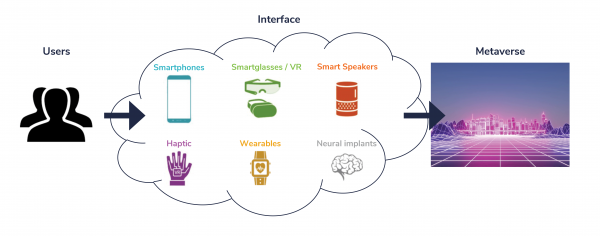

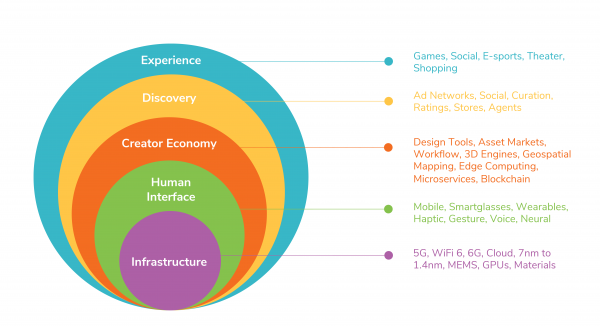

What is it about? The Metaverse is a contraction of the words “meta” and “universe”. For Zuckerberg, it is the “holy grail of social interaction”. The idea is to generate more immersive virtual experiences while remaining connected to reality. Among the types of experience made possible by this three-dimensional universe: buying (real) clothes in virtual stores and picking them up in the real world, attending a (virtual) concert given by a (real) artist, etc. In this type of experience, virtual 3D and the real world are intrinsically linked. To access them, all you have to do is use a virtual reality headset and/or other technological interfaces.

But the metaverse is also a new dimension in the world of games with projects such as Decentraland where users can earn MANA (Decentraland’s native token), buy land or virtual collectibles, vote on economic and governance projects, or create NFT (non-fungible tokens), giving them real interoperability for the value of their time spent in the game.

For the vast majority of people, the metaverse looks like an enhanced version of virtual reality (VR). But for many specialists, the metaverse could well be the future of the Internet.