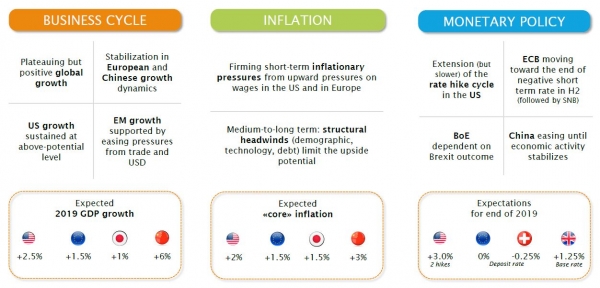

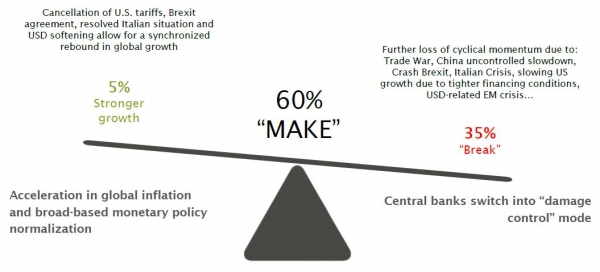

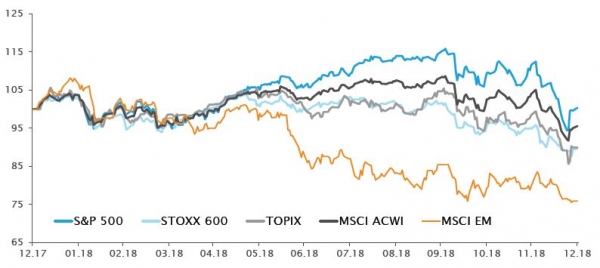

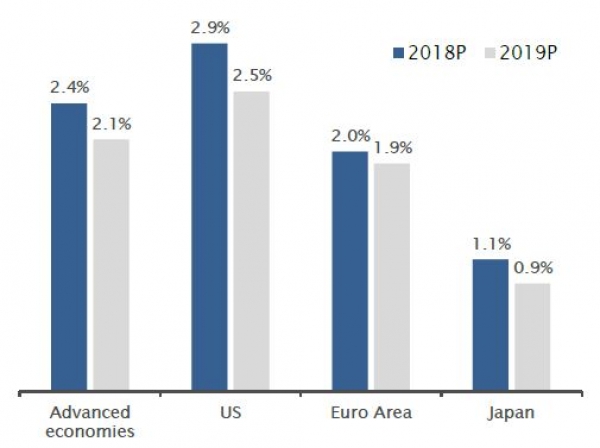

In the current economic context of slowing growth momentum, contained inflationary pressures and tightening US monetary conditions, we recommend to enter 2019 with a cautious stance, favouring liquidity, quality and value. However, in our base case scenario, we expect some opportunities to re-emerge next year as uncertainties recede and/or valuations would have improved enough to withstand them.

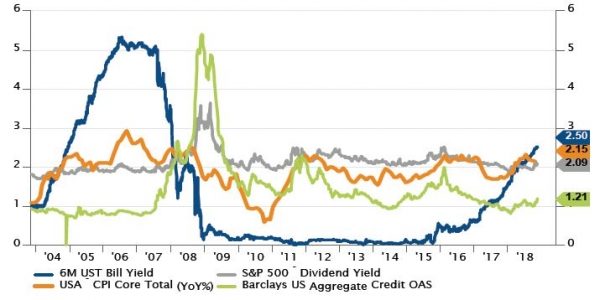

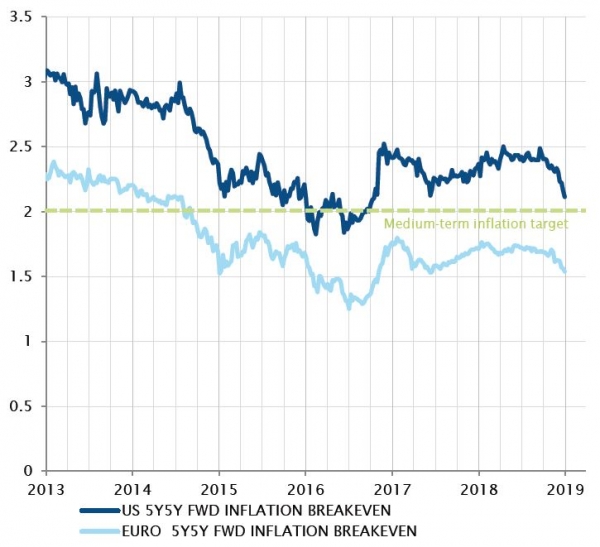

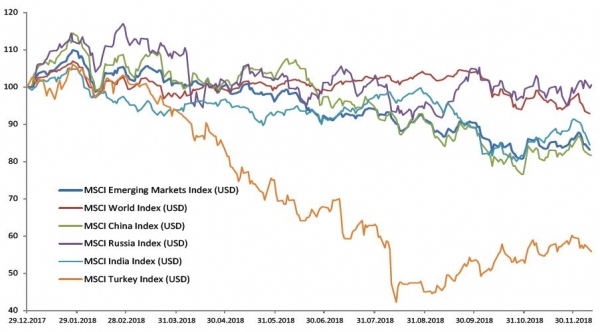

In addition to the legitimate concerns surrounding trade wars, China growth, peak earnings, Brexit or Italy, the real trigger of the recent market’s correction is, according to us, linked to the sudden reappearance of TIARA, aka the acronym for "There Is A Real Alternative" or, the new substitute, after a decade of financial repression, of TINA ("there is no alternative").

In other words, for the first time since the Great Financial Crisis, US Treasury Bills (i.e. USD cash) are yielding more than inflation! US investors no longer need to take additional (and perhaps unwanted) risks in order to preserve the purchasing power of their savings.

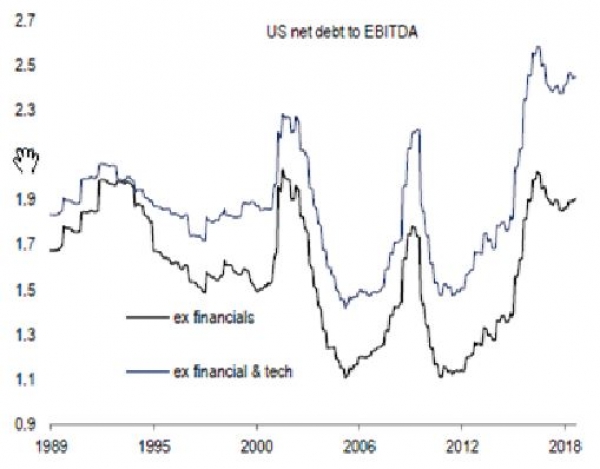

This acts as a powerful magnet that drains cash outside assets that do not offer sufficient expected return compensation versus the return of a liquid deposit account in USD. It could be seen as the latest stage of the US monetary policy normalisation if, as we expect, there won’t be excessive inflationary pressures requiring the Fed to adopt even a tighter policy.