Over the past ten years, the Norwegian salmon price has more than doubled to c.NOK57 per kilogram (with peaks of above NOK70 in 2016 and 2017) versus volumes increasing by only 3% per annum. The main reason for the export value growth in 2015-2016 was the reduction in salmon harvest volumes in both Norway and Chile. Volume declines were caused by an algae bloom, a lower smolt release in Chile in 2016 and finally a forced sea lice harvest in Norway during autumn 2015. This led to the biggest negative supply shock ever (supply contraction of c.7%) and therefore to extraordinary price increases for salmon.

While prices appear to have normalised, both supply and demand dynamics could prove supportive to future salmon price development. Moreover, we believe that demand should be supported by the fact the salmon can be easily adapted to local cooking habits and by the fact that until recently, salmon used to be consumed at home or in restaurants but is now increasingly available on the go.

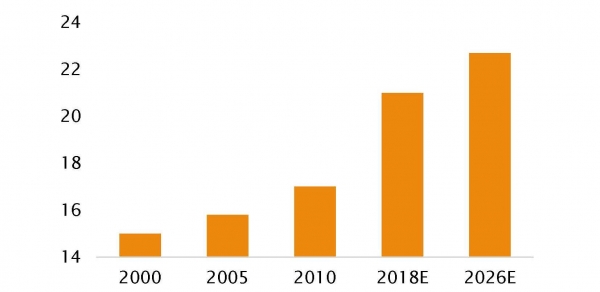

Global population is growing rapidly and while 70% of the Earth’s surface is covered by ocean only 6% of human protein consumption is produced there (pork, poultry and beef account for the bulk of the global protein supply). According to the UN, the world’s population could grow by 30% between 2017-2050, which equates to more than 2 billion new mouths to feed! Therefore, increasing aqua production will be crucial to meet the growing demand.