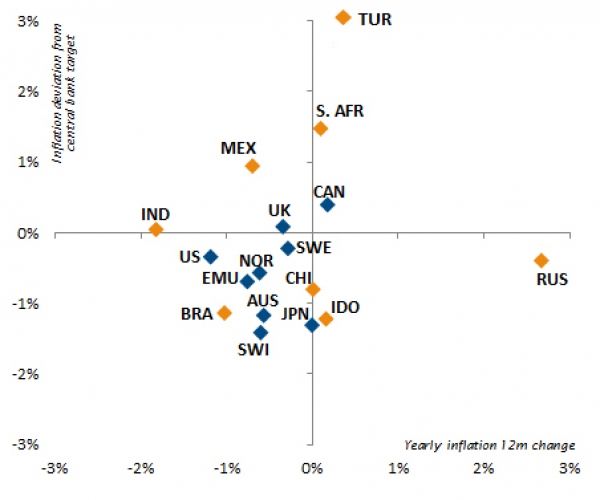

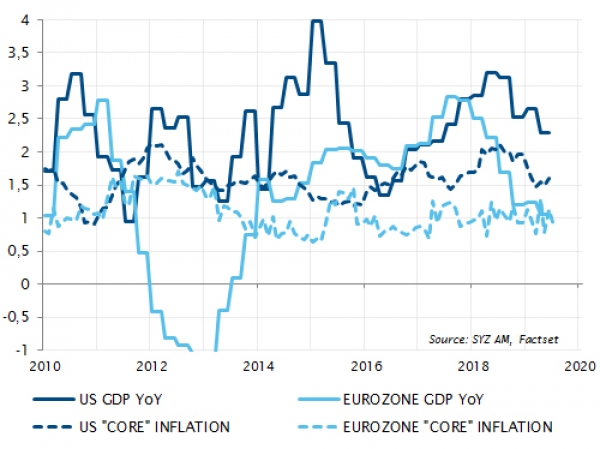

Financial markets have been spurred by the Federal Reserve and the ECB clearly signalling more monetary policy accommodation is in the cards for the second half of the year. The cocktail of low inflation and positive economic growth is a powerful incentive for investors to take more risk in their portfolios – by hunting for positive yield, as a growing share of the fixed income market now offers negative yield, and by sticking to equities as the method of choice for generating performance.

Admittedly, the combination of lower rates and reassuring economic data, especially in the US, is a clear positive for equities, credit and EM assets. However, price action over the past few weeks has been quite fast and furious, especially in fixed income.

This has left little safety margin for unexpected developments – as if a sustained rate cut cycle by the Fed was 100% guaranteed, along with ECB rate cuts and a resumption of asset purchases. As if the Trump-Xi truce in trade tensions displayed at the G20 would last and eventually lead to a resolution. As if central bank intervention would prevent a recession. And as if an improvement in economic growth and inflation, likely to temper Fed and ECB dovishness, could be ruled out.

None of these are guaranteed in our opinion. This leaves us in a situation where we do not want to fight the incoming liquidity wave unleashed by central banks, but where we also do not want to be in the front row during the ride. Valuations appear quite stretched across the board, and the potential for further upside seems limited within the current macroeconomic environment.

We have therefore taken some profits on our credit exposure raised in the previous month. On the other hand, we acknowledge the negative or declining yield of ‘safe’ investments de facto creates powerful support for risky assets – and positive economic developments cannot be ruled out. Therefore, we maintain our existing allocation to equities and EMs, along with some high-quality duration, gold and yen to balance potential negative risks to the macro outlook.

Until we can tell whether monetary policy easing will manage to propel economic momentum, or on the contrary whether it will come too late to reverse the downward macro trend, remaining ‘cautiously neutral’ in terms of asset allocation and sectors is the best way to navigate markets.

_Fabrizio Quirighetti